What are venues and publishers?

Our FAQs blog series aims to address user inquiries about the Databento portal, registration process, datasets, data formats, and more. In this article, we'll answer a common question: What are venues and publishers?

Trading venues (venues) are marketplaces where the buying and selling of securities and financial instruments take place. While other data sources often use the term "exchange" to encompass all trading venues, this is not always accurate.

If you're only interested in specific venues that operate under a centralized exchange model, like NASDAQ, this naming convention is usually acceptable. However, with Databento, you'll likely encounter different venue models while exploring asset classes or markets, such as ECNs (Electronic Communication Networks) and ATSes (Alternative Trading Systems). Since terms like "exchange," "ATS," and "ECN" have certain regulatory definitions, we refrain from conflating exchanges with other trading venues.

At Databento, we use the terms "trading venue" and "venue" interchangeably, and we use the term "publisher" to refer to any data provider on Databento. A publisher may also be a venue.

A vast majority of US equities data that consumers are receiving is disseminated by the Securities Information Processors (SIPs) —namely the Consolidated Tape Association (CTA) and the UTP Plan. The SIPs provide a consolidated view of all protected bid/ask quotes and trades from US equities trading venues. On Databento, we refer to the SIPs as publishers, but not market operators.

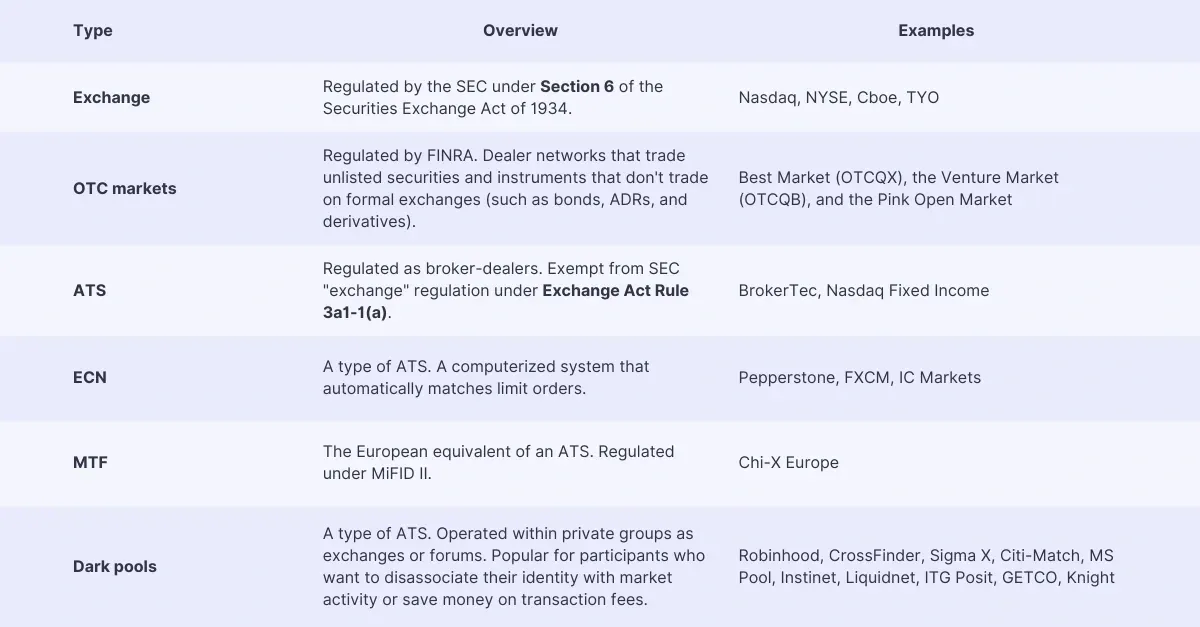

An exchange is a venue registered with the SEC under Section 6 of the Securities Exchange Act of 1934. The SEC lists all registered exchanges.

OTC markets are dealer networks that trade securities that don't meet exchange listing requirements (such as "unlisted" securities) and instruments that don't trade on a formal exchange (such as bonds, ADRs, and derivatives). The Financial Industry Regulatory Authority (FINRA) regulates broker-dealers that operate in the over-the-counter (OTC) market. OTC markets are sometimes referred to by the older term "pink sheets."

An ATS is a non-exchange trading venue that matches buyers and sellers to counterparties for transactions. It is also referred to as "off-exchange."

Although ATSes are usually regulated as broker-dealers instead of exchanges, they do meet the definition of an exchange under federal securities law. They aren't required to register as a national securities exchange as long as the ATS operates under the exemption provided by Exchange Act Rule 3a1-1(a). Since ATSes are non-exchanges, ATS transactions don't appear on national exchange order books. Some traders use this advantage to conceal trading from public view and reduce the effect of large trades.

An ATS must be approved by the United States Securities and Exchange Commission (SEC). For a current list of SEC-recognized ATSes, see here. The equivalent term under European legislation is a multilateral trading facility (MTF). ATSes are inclusive of ECNs, cross networks, call networks, and dark pools.

ECNs are a type of ATS that trade listed stocks and other exchange-traded products outside of traditional exchanges. They must register with the SEC as broker-dealers and as members of FINRA.

ECNs use computerized systems to match limit orders, charging fees per transaction. These venues attempt to eliminate the third party's role in executing orders entered by an exchange market maker or an over-the-counter market maker. They permit such orders to be executed against in whole or in part.

Dark pools are a type of ATS that operate within private groups. They are private exchanges or forums for securities trading. While their legal standing may vary based on local regulations, they're favored by participants seeking to dissociate their identity from market activity and those looking to reduce transaction fees. Although the term "dark pools" has acquired a negative connotation, they're also referred to as "unlit markets."