Equities data

Get real-time and historical stock and ETF data.

It only takes 3 minutes.

See API docs ->

60+ trading venues

Easy access through a single API and official client libraries (Python, C++, Rust).

Over 3 million symbols

20,000+ stocks and ETFs since inception across all US exchanges and ATSs.

19 PB of coverage

Tick data, full order book, CBBO, OHLCV, imbalance, reference data, and more.

Flexible pricing

Only pay for what you use, or get unlimited access with a subscription plan.

Direct from source

Raw and normalized market data sourced from prop feeds at our Equinix NY4 colo.

Self-service onboarding

Skip the sales call. Access your first dataset in as little as 3 minutes.

Comprehensive market coverage

Databento is a licensed distributor and direct provider of market data for 60+ trading venues. See full venue list ->

Databento US Equities

Equities

Data from 15 US equities exchanges and 30 ATSs under a single pricing plan.

Since 2018

20,000+ symbols

Historical

Live

| Exchange | Dataset | Definitions | L1 | L2 | L3 |

|---|---|---|---|---|---|

| Nasdaq | Nasdaq TotalView-ITCH | | | | |

| Nasdaq BX | Nasdaq BX TotalView-ITCH | | | | |

| Nasdaq PSX | Nasdaq PSX TotalView-ITCH | | | | |

| NYSE | NYSE Integrated | | | | |

| NYSE American | NYSE American Integrated | | | | |

| NYSE Arca | NYSE Arca Integrated | | | | |

| NYSE National | NYSE National Trades and BBO | | | | |

| NYSE Texas | NYSE Texas Integrated | | | | |

| Cboe BZX | Cboe BZX Depth | | | | |

| Cboe BYX | Cboe BYX Depth | | | | |

| Cboe EDGA | Cboe EDGA Depth | | | | |

| Cboe EDGX | Cboe EDGX Depth | | | | |

| MEMX | MEMX Memoir Depth | | | | |

| MIAX | MIAX Pearl DoM | | | | |

| IEX | IEX TOPS | | | | |

| FINRA/Nasdaq TRF Carteret | Nasdaq Basic with NLS Plus | | | | |

| FINRA/Nasdaq TRF Chicago | Nasdaq Basic with NLS Plus | | | | |

| FINRA/NYSE TRF | Coming soon NYSE Trades | | | | |

Modern stock data APIs built for top financial institutions

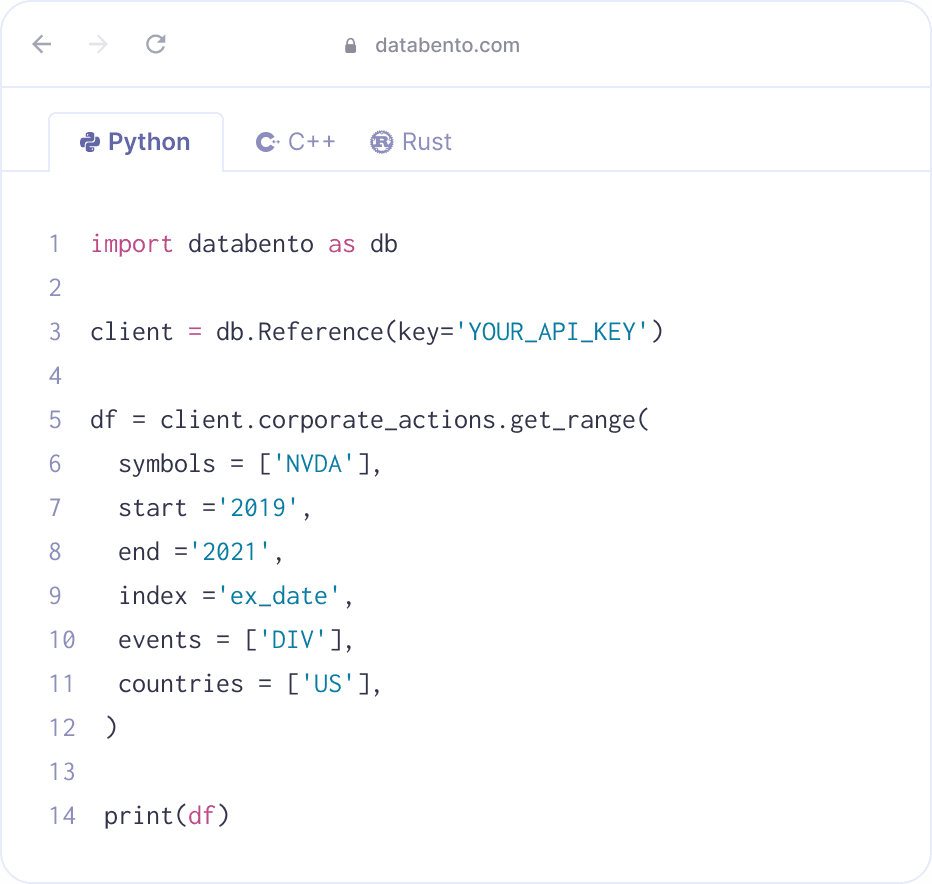

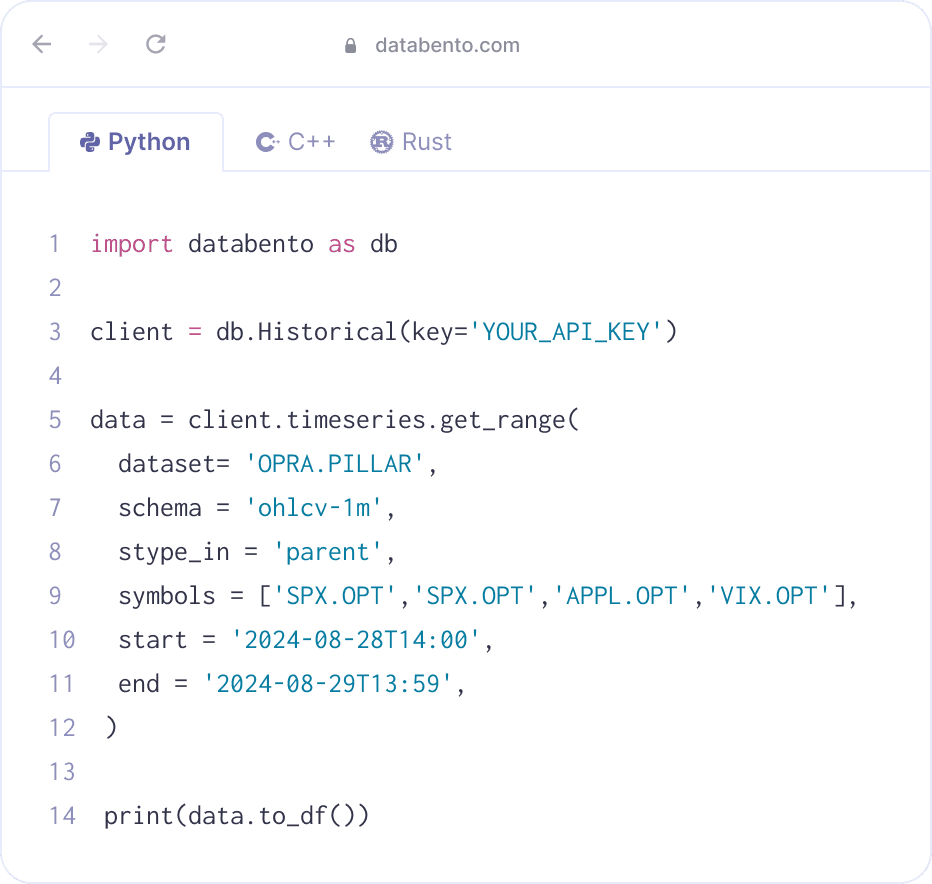

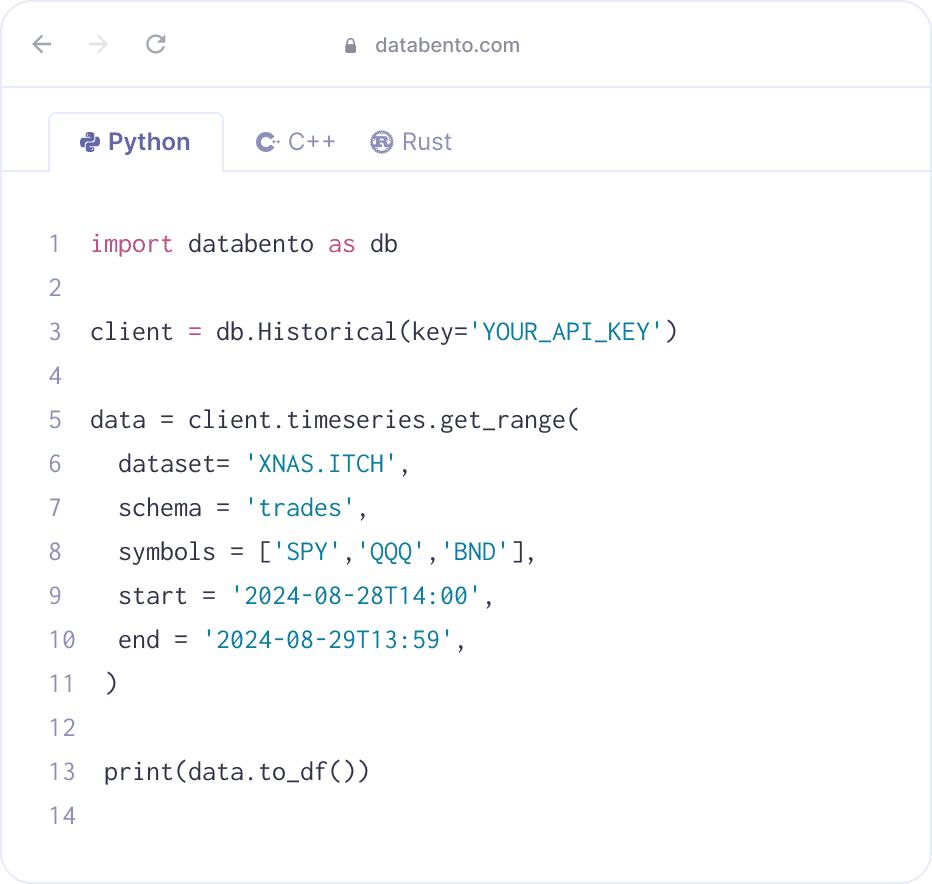

Databento works with any language through our APIs. We also provide client libraries for Python, Rust, and C++.

API

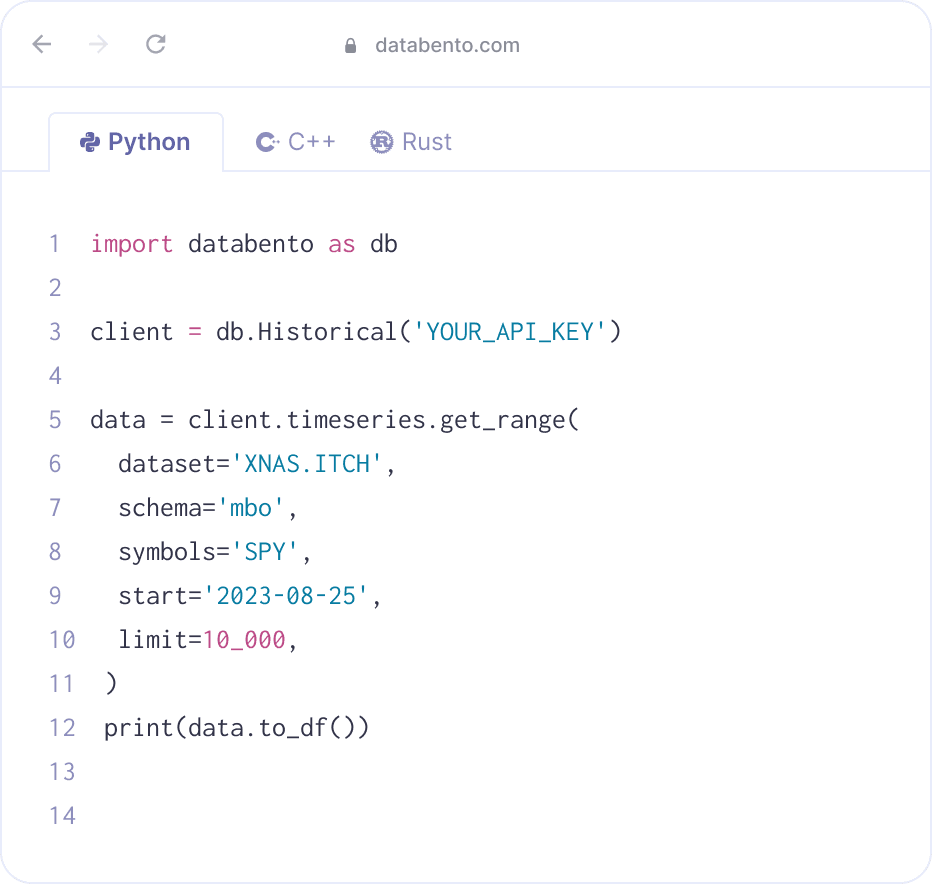

Build your first application in 4 lines of code

Examples

Simple workflows for equities trading

Nanosecond timestamps

The only normalized market data solution to provide up to four timestamps for every event, with sub-microsecond accuracy across venues.

Full order book

All buy and sell orders at every price level. Get each trade tick-by-tick and order queue composition at all prices.

Entire venue in one API call

Subscribe to every update of every symbol on the venue, in a single API call—like a direct feed—be it over internet or cross-connect.

Direct prop feeds only

Databento’s equities data is sourced directly from each exchange.

Direct feedsDatabento | SIPsMost data providers | |

|---|---|---|

Feeds included | 18 proprietary feeds | CTS, CQS, UTDF, UQDF only |

Price levels | All levels | Top of book only |

Trade aggressor sideThe SIPs don’t tell you whether a trade is buyer or seller-initiated, so you have to infer from the quote prices and participant timestamps. This can be as inaccurate on as much as 45% of trades. Using direct prop feeds gives you 100% accuracy. | ||

Full order bookThe SIPs only consolidate top-of-book quotes from each market center, leaving out valuable information that happens in subsequent levels. Moreover, the SIPs are depth feeds, and do not provide order IDs which let you determine queue composition of each price level. | ||

Odd lotsOdd lots are not reported to the SIPs. However, odd lots make up nearly 50% of US equities trading activity and this trend continues to increase. Databento’s equity bundles report all trades regardless of size. | ||

Auction imbalanceSignificant price discovery takes place during the opening and closing auctions, with closing auction volume now over 12% of US daily volume. Institutional traders use auction imbalance data, only available on the prop feeds and not the SIPs, to identify actionable opportunities and participate in the opening and closing auctions. | ||

Low latencyThe CTA and UTP SIPs are based in Mahwah and Carteret respectively. For example, this means that trades in NYSE-listed stocks that occur on Nasdaq in Carteret have to be reported to CTA in Mahwah, incurring unnecessary latency. We consolidate the prop feeds in Secaucus NY4, which gives us the least average distance to all of the equities matching engines. |

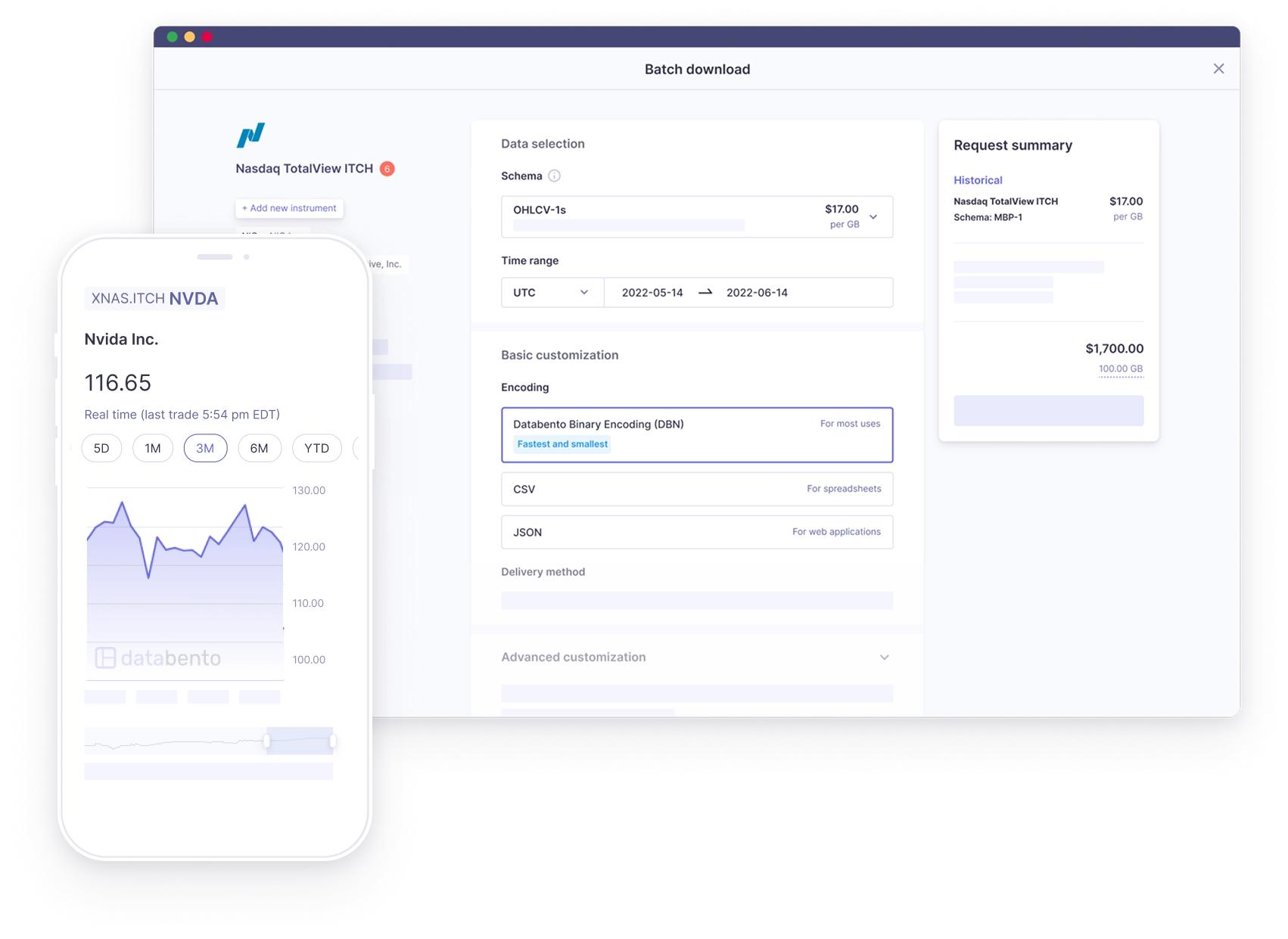

Customize your data

Select symbols, format, encoding, and delivery. Get any range by the nanosecond.

Read our API reference and user guides

Documentation

Schemas

Our datasets support multiple formats, including order book, tick data, bar aggregates, and more. View all supported schemas ->

-

mbo

Market by order

Market by order, full order book, L3.

-

mbp-10

Market by price

Market by price, market depth, L2.

-

mbp-1

Market by price

Top of book, trades and quotes, L1.

-

tbbo

Top of book

Top of book, sampled in trade space.

-

trades

Trades

Tick-by-tick trades, last sale.

-

ohlcv-t

Market bars per second

Aggregates per second, minute, hour, or day.

-

definition

Definitions

Point-in-time instrument definitions.

-

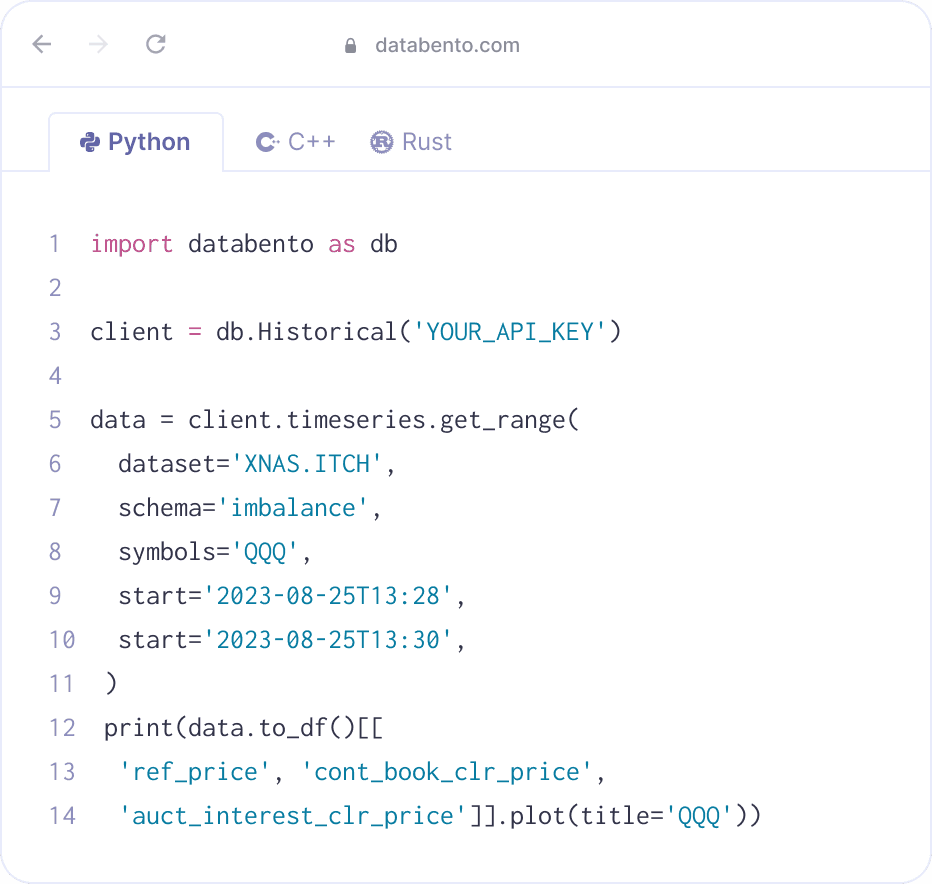

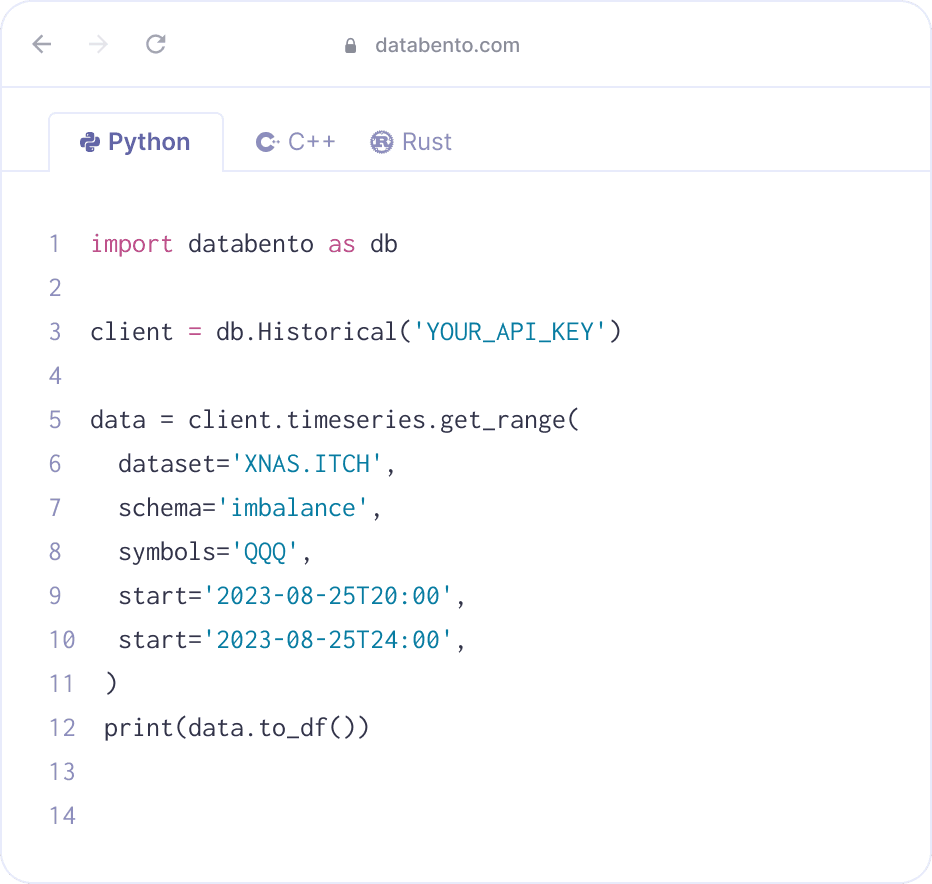

imbalance

Imbalance

Auction imbalance, order imbalance.

-

statistics

Statistics

Intraday and end-of-day trading statistics, static data.

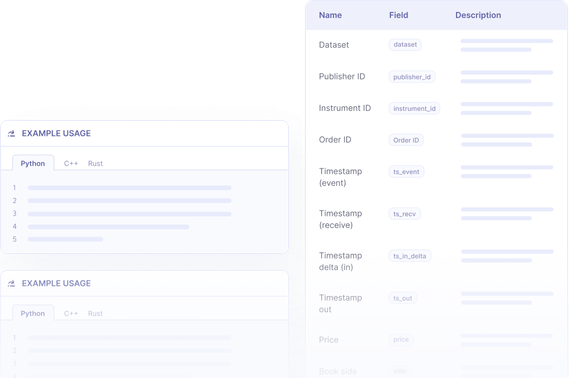

Fields

Examples of frequently used data fields. Each schema is represented as a collection of fields. View all supported fields by schema ->

-

publisher_id

Publisher ID

The publisher ID assigned by Databento, which denotes the dataset and venue.

-

instrument_id

Instrument ID

The numeric instrument ID.

-

order_id

Order ID

The order ID assigned at the venue.

-

ts_event

Timestamp (event)

The matching-engine-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_recv

Timestamp (receive)

The capture-server-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_in_delta

Timestamp (sending)

The matching-engine-sending timestamp expressed as the number of nanoseconds before

ts_recv. -

price

Price

The order price where every 1 unit corresponds to 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

-

action

Action

The event action. Can be Add, Cancel, Modify, cleaR book, Trade, or Fill.

-

size

Size

The order quantity.

-

flags

Flags

A combination of packet end with matching engine status.

-

expiration

Expiration

The last eligible trade time expressed as a number of nanoseconds since the UNIX epoch.

-

strike_price

Strike price

The exercise price if the instrument is an option. Converted to units of 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

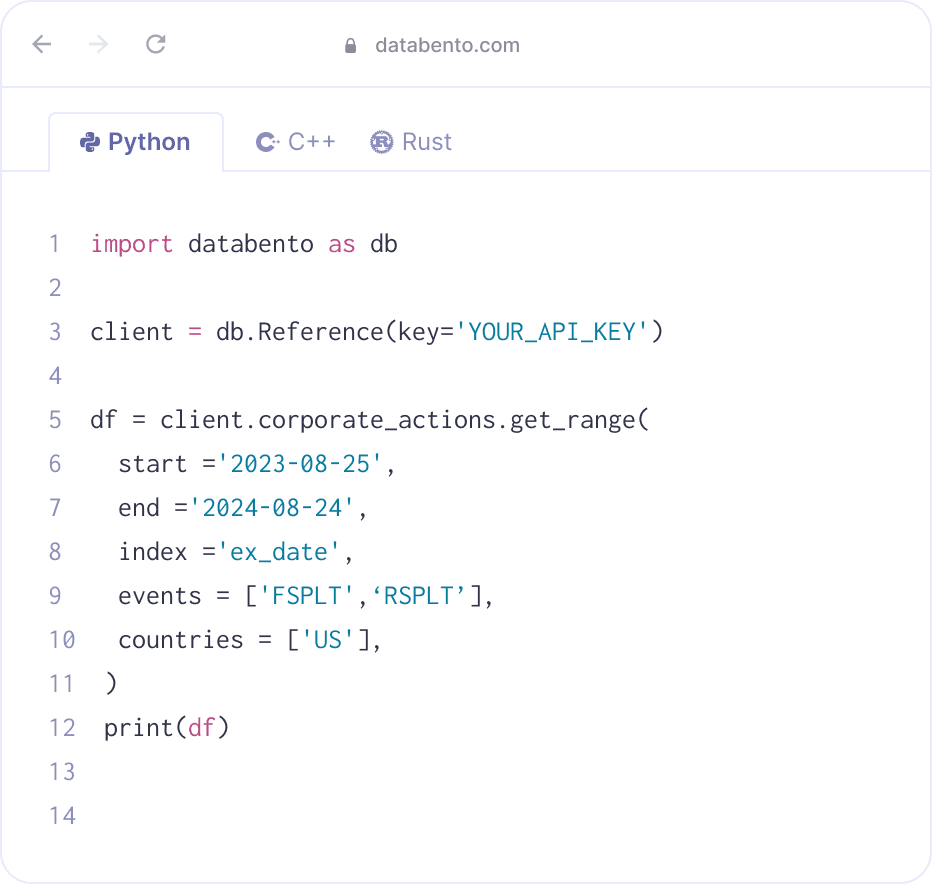

API methods

Examples of popular API methods. Our APIs are organized into four categories: metadata, timeseries, symbology, and batch download. View all supported API methods ->

-

timeseries

Get range

Stream time series data using our Historical API.

-

batch

Submit job

Submit a batch job to extract historical data files in bulk.

-

batch

Download

Download a completed batch job.

-

symbology

Resolve

Resolve a list of symbols into their exchange specific identifier.

-

metadata

List publishers

List all our dataset publishers.

-

metadata

List datasets

List all our available dataset names.

-

metadata

Get cost

Get the cost in US dollars for a historical streaming or batch download request.

-

metadata

Get dataset range

Get the available date range for a dataset.

-

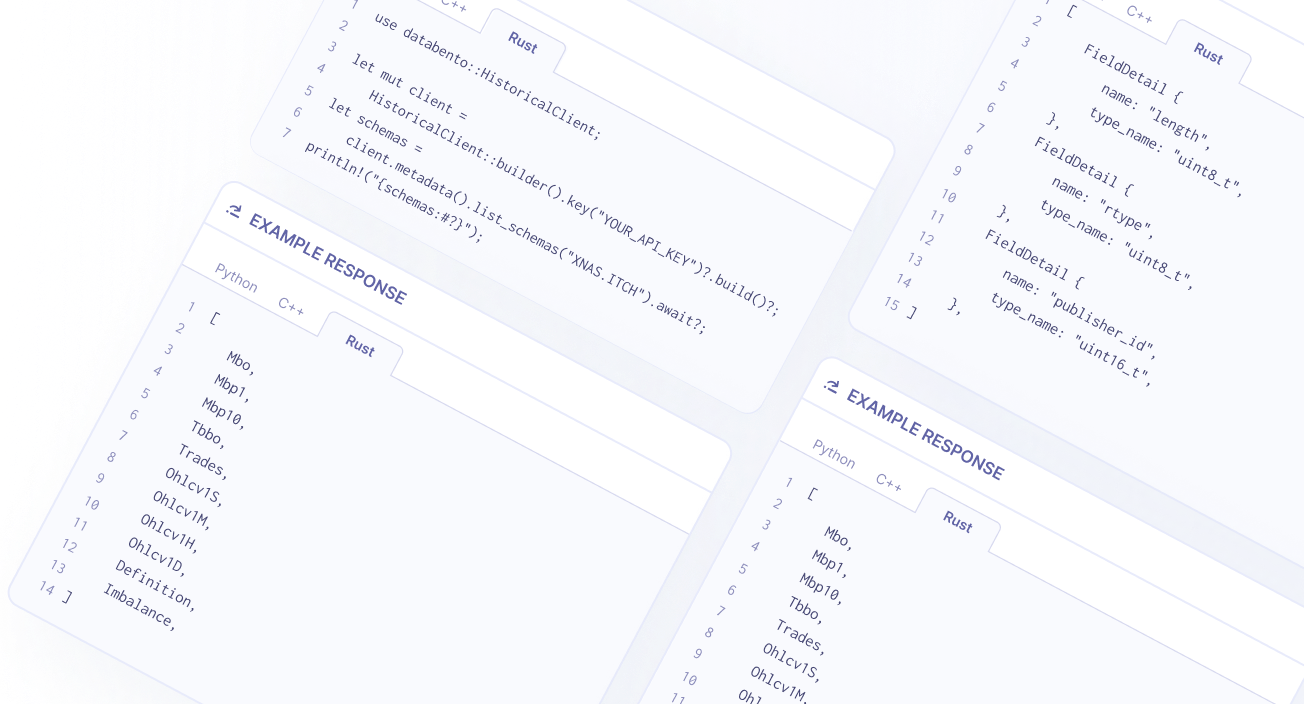

metadata

List schemas

List all available market data schemas for a dataset.

Sampling frequencies

All datasets provide full flexibility and the ability to customize sampling resolution.

-

Every book update

Every order execution, add, cancel, replace, book snapshot, and more. By the nanosecond.

-

Tick-by-tick

Every trade and quote. By the nanosecond.

-

1 second

Subsampled BBO, last sale, and OHLCV aggregates by the second.

-

1 minute

Subsampled BBO, last sale, and OHLCV aggregates by the minute.

-

Hourly

OHLCV aggregates by the hour.

-

Daily

Daily market statistics, indicative opening and closing prices, OHLCV aggregates, and more.

What our users are saying

Michael Tung, Investments Lead

Rick Zhan, VP Quant Research

Paul Aston, Founder

Brett Harrison, Founder

Nikita Ostroverkhov, Algo Trading

V. Chen, Equity Research Associate

Chris Pento, Co-founder and CEO

Matt Papakipos

C. Garcia, Senior Quant Researcher

Pricing

Frequently asked questions

Do I need 100% average daily volume (ADV) and all venues?

Regulation NMS ensures that orders are executed at the best available prices across the 16 equities exchanges, so trades reported on any venue execute at the best available prices at the time and are still suitable for most use cases. Many of our users opt against subscribing to all venues to lower their license fees.

Are all symbols covered? For example, are Nasdaq-listed securities traded on IEX?

Yes, each of our equities datasets covers all exchange-listed US stocks ("NMS stocks"), as these stocks are traded across all venues. For example, a Nasdaq-listed stock like AAPL is also traded on IEX.

What's a TRF?

The three FINRA Trade Reporting Facilities (TRFs) record all off-exchange trades in exchange-listed stocks, as required by regulation. This includes over-the-counter (OTC) transactions in NMS stocks, such as trades executed on Alternative Trading Systems (ATSs) or by FINRA broker-dealers. Collectively, TRFs account for approximately 52% of the average daily volume (ADV) in NMS stocks as of 2024.

For more information, see FINRA's FAQ page or our microstructure guide on the TRFs. Data from the two Nasdaq-operated TRFs is included in our Nasdaq Basic with NLS Plus dataset, while the NYSE-operated TRF is available in our NYSE Trades dataset.

Why do you break up your offerings into separate venues? Don't SIPs offer all venues at once?

Databento is the only market data distributor to source all of our US equities from the direct prop feeds only and to consolidate these feeds ourselves. This is a common practice among the leading electronic market making firms, but uncommon among vendors because the direct prop feeds are significantly more expensive to license (about $60,000/month) than the SIPs ($10,500/month).

The direct prop feeds offer significant informational advantages over the SIPs, such as 100% accurate trade signs, odd lot quotations, full order book, auction imbalance, and lower latency from one less hop to Tape A/B/C. In actual applications, we've found that the SIPs are usually only more useful to FINRA broker-dealers that require a snap quote to meet the Vendor Display Rule.

Since we're licensing all of the direct prop feeds individually, it also gives us the flexibility to provide different blends of prop feeds that may be cheaper to license than the SIPs and more cost-effective for real-time use cases. Exchange operators offer similar solutions, such as Cboe One, Nasdaq Basic, and NYSE BQT, but they're limited to their own exchanges. Databento is venue-neutral, so we can blend a more effective set of feeds across exchange groups.

What is Databento US Equities Mini? Is it approved for distribution and compliant with exchange licensing policies?

Databento US Equities Mini our most cost-effective solution for real-time, top-of-book US equities data. It combines multiple trading venues into one composite dataset that provides accurate best bid and offer (BBO) quotes, liquidity, and trade volume data—all without exchange license fees. As its name suggests, it delivers a synthetic "mini" NBBO and eliminates the need for users to manually aggregate BBOs from individual venues.

It's constructed from a proprietary blend of direct feeds sourced from several NMS exchanges and ATSs that have approved its use under derived data licensing terms with Databento. Databento US Equities Mini is optimized for a variety of real-time use cases, including display platforms, redistribution, brokerages, and analytics tools that need real-time BBO or last sale data without incurring additional licensing costs like per-user fees. Its entry-level pricing makes it an ideal starting point for equities data and an excellent choice for those integrating Databento's services for the first time.

Based on our internal testing, we've found that it is very close to NBBO like other exchange-provided "mini-NBBO" feeds (like NYSE BQT, Cboe One, and Nasdaq Basic), at a much more cost-effective price point. It's the only exchange-neutral "mini-NBBO" of its kind; prior to Databento US Equities Mini, no similar commercial solution existed since very few vendor firms have the infrastructure or access to aggregate multiple proprietary feeds and the major exchange operators only blend their own proprietary feeds.

Databento has a derived use license in place with these venues specifically for its redistribution and in turn our end users are allowed to use and redistribute the feed without further licensing or exchange fee requirements. This is based on specific exceptions on these venues for feeds like this so long as they cannot be reverse-engineered to their original feeds and do not serve as a direct substitute of the original prop feeds.

Which real-time feed do you recommend? Databento US Equities Mini, Nasdaq Basic with NLS Plus, Nasdaq TotalView-ITCH, or NYSE Trades?

Here are some common use cases which can help you determine which real-time feed to use:

Investment firms. Most of our buy-side trading customers prefer to use Nasdaq TotalView-ITCH or Nasdaq Basic with NLS Plus.

Brokerage. Our brokerage customers use our feeds to provide an indicative BBO and save substantially on SIP user fees. Both Nasdaq Basic with NLS Plus and Databento US Equities Mini are a great fit for this use case. Firms that have already used Nasdaq Basic in the past often prefer to retain it for legacy purposes. Firms that don't have any legacy requirements often prefer Databento US Equities Mini due to the lighter reporting requirements.

Fintech and analytics. Most of these customers use Databento US Equities Mini as it provides an accurate BBO and permissive distribution terms for web applications, and these firms often don't require L2 or L3 granularity. All plans include our Databento US Equities Summary dataset which provide official EOD prices and 100% delayed volume, which tends to cover their remaining needs. A small portion of customers in this category consume the Nasdaq feeds instead.

Individuals and professional traders. Most of our individual users use Databento US Equities Mini due to its low cost.

You may also consider these factors:

Cost. Databento US Equities Mini is our most cost-effective solution, followed by Nasdaq Basic with NLS Plus. If you're constrained by budget, we recommend using Databento US Equities Mini.

Accuracy, liquidity, and volume. Nasdaq Basic with NLS Plus is by far the single direct feed that provides the most accuracy, liquidity, and volume since it covers the most active venues, including Nasdaq, BX, PSX, and the Nasdaq TRFs which report over 95% of off-exchange trades in NMS stocks.

Licensing terms, compliance burden, and reporting requirements. Databento US Equities Mini is by far the most convenient since it has no license fees on distribution and does not require exchange reporting. You're instantly approved to use it once you subscribe to a plan.

Granularity. If you need L2 (MBP-10) or L3 (MBO) data, Nasdaq TotalView-ITCH is our only real-time feed that offers this at the moment.

Intraday historical simulation. Our history is most complete for Nasdaq TotalView-ITCH and if agreement between backtest and production trading at the intraday level is important to you, we'd recommend using it.

Auction imbalance. Auction imbalance data is available on Nasdaq TotalView-ITCH as well as NYSE, NYSE Arca, and NYSE American. If you have need for auction imbalance on other venues, contact our sales team.

NYSE Trades. In most cases, you should only consider adding NYSE Trades as a supplemental feed to one of the Nasdaq feeds. Licensing fees for NYSE Trades are significantly higher than Nasdaq Basic and Nasdaq TotalView-ITCH, which cover significantly more ADV. Moreover, NYSE Trades alone does not include the BBO on NYSE.

NYSE National Trades and BBO and NYSE Chicago Integrated. The advantage of these two feeds is that they have no licensing fees. However, due to the low ADV, wider spreads, and paperwork requirement on these two feeds, most of our commercial users only consider adding them alongside with NYSE Trades. Non-professional users, however, will be able to add these feeds with instant approval without papering with NYSE, and often will activate these feeds as it's a convenient way to improve their coverage over Databento US Equities Mini.

Do you offer other specific feeds, like NYSE Arca Integrated and NYSE Order Imbalances, for real-time use? Are these only available as historical data?

Databento consumes all of the listed feeds in real-time and has the real-time distribution licenses for most of them, so we can arrange to distribute any feed to you in real-time even if we do not currently advertise it as part of our live coverage.

Most of the other feeds have very high license fees for real-time non-display use, hence we don't actively market them. You may contact our sales team to arrange receipt of any of the other real-time feeds.

A common reason for this is if you have specific needs for NYSE Arca Integrated (e.g. for ETF/ETP liquidity) or any of the L3 (MBO) feeds that include auction imbalances.