Options data

Get real-time and historical options data.

It only takes 3 minutes with our APIs.

60+ trading venues

Easy access through a single API and official client libraries (Python, C++, Rust).

Over 3 million symbols

Includes 1.4+ million US equity options contracts and 600k+ options on futures.

19 PB of coverage

Tick data, full order book, market depth, NBBO, OHLCV, reference data, and more.

Flexible pricing

Only pay for what you use, or get unlimited access with a subscription plan.

Direct from source

Sourced from direct exchange feeds at our Equinix NY4 and Aurora I colos.

Self-service onboarding

Skip the sales call. Access your first dataset in as little as 3 minutes.

List of supported venues

Databento is a licensed distributor and direct provider of market data for 60+ trading venues. See all supported venues ->

OPRA

Equity options

Consolidated last sale and national BBO across all US equity options exchanges.

Since 2013

1,600,000+ symbols

Historical

Live

CME Globex MDP 3.0

Futures · Options on futures

All futures and options on CME, CBOT, NYMEX, and COMEX. Includes full book, stats, reference data, and more.

Since 2010

650,000+ symbols

Historical

Live

EEX

Futures · Options on futures

Most liquid power market in Europe and a major exchange for natural gas and emissions derivatives.

Since 2018

50,000+ symbols

Historical

Live

Eurex

Futures · Options on futures

Europe's largest derivatives exchange. Covers equity index and fixed income products, as well as single stock options.

Since 2025

600,000+ symbols

Historical

Live

ICE Europe Commodities

Futures · Options on futures

Covers over 50% of global crude and refined oil futures trading. From ICE's iMpact feed.

Since 2018

115,000+ symbols

Historical

Live

ICE Europe Financials

Futures · Options on futures

Covers European equity and interest rate derivatives. From ICE's iMpact data feed.

Since 2018

349,000+ symbols

Historical

Live

ICE Endex

Futures · Options on futures

Leading European energy exchange for gas, power, and emissions. From ICE's iMpact data feed.

Since 2018

115,000+ symbols

Historical

Live

ICE Futures US

Futures · Options on futures

Major softs, metals, MSCI indices, and the US Dollar Index. From ICE's iMpact data feed.

Since 2018

419,000+ symbols

Historical

Live

Equity options

-

BOX Options

-

Cboe BZX Options

-

Cboe C2 Options

-

Cboe EDGX Options

-

Cboe Options

-

MEMX Options

-

MIAX Emerald

-

MIAX Options

-

MIAX Pearl

-

MIAX Sapphire

-

Nasdaq BX Options

-

Nasdaq GEMX

-

Nasdaq ISE

-

Nasdaq MRX

-

Nasdaq Options

-

Nasdaq PHLX

-

NYSE American Options

-

NYSE Arca Options

-

BOX Options

-

MIAX Sapphire

-

Cboe BZX Options

-

Nasdaq BX Options

-

Cboe C2 Options

-

Nasdaq GEMX

-

Cboe EDGX Options

-

Nasdaq ISE

-

Cboe Options

-

Nasdaq MRX

-

MEMX Options

-

Nasdaq Options

-

MIAX Emerald

-

Nasdaq PHLX

-

MIAX Options

-

NYSE American Options

-

MIAX Pearl

-

NYSE Arca Options

-

BOX Options

-

MIAX Emerald

-

Nasdaq ISE

-

Cboe BZX Options

-

MIAX Options

-

Nasdaq MRX

-

Cboe C2 Options

-

MIAX Pearl

-

Nasdaq Options

-

Cboe EDGX Options

-

MIAX Sapphire

-

Nasdaq PHLX

-

Cboe Options

-

Nasdaq BX Options

-

NYSE American Options

-

MEMX Options

-

Nasdaq GEMX

-

NYSE Arca Options

Options on futures

-

CME

-

ICE Europe Commodities

-

CBOT

-

ICE Europe Financials

-

NYMEX

-

ICE Canada

-

COMEX

-

ICE Abu Dhabi

-

ICE Endex

-

EEX

-

ICE Futures US

-

Eurex

-

CME

-

CBOT

-

NYMEX

-

COMEX

-

ICE Endex

-

ICE Futures US

-

ICE Europe Commodities

-

ICE Europe Financials

-

ICE Canada

-

ICE Abu Dhabi

-

EEX

-

Eurex

Modern options data APIs built for top financial institutions

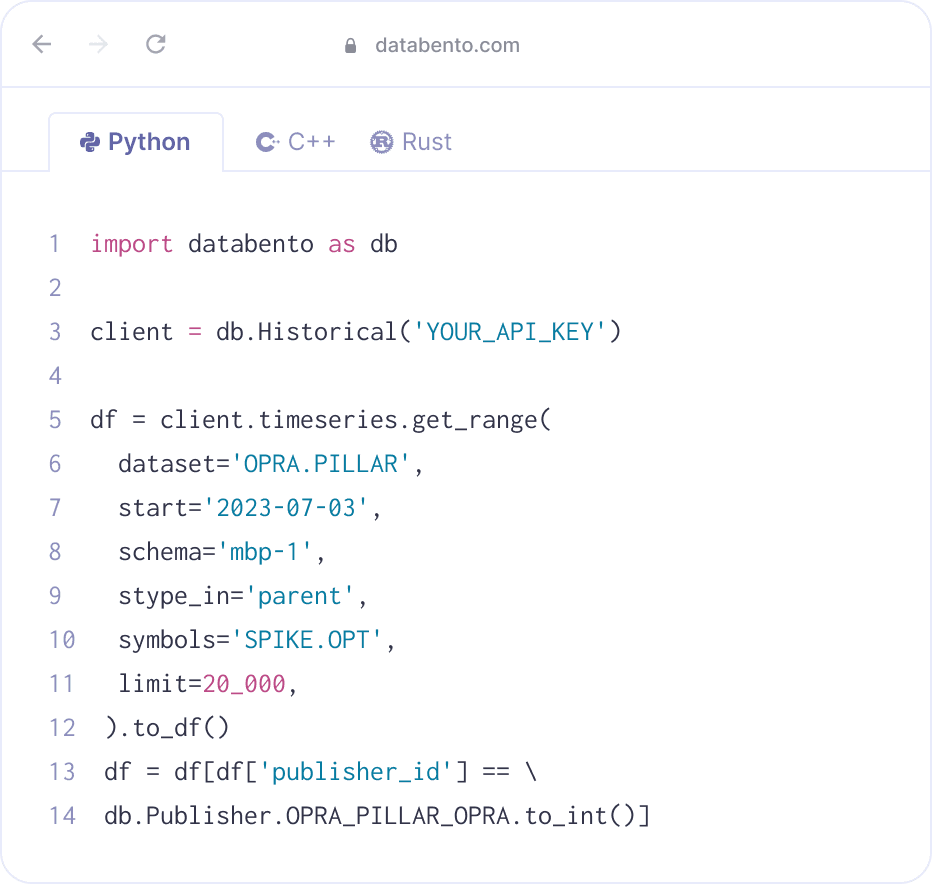

Databento works with any language through our APIs. We also provide client libraries for Python, Rust, and C++.

API

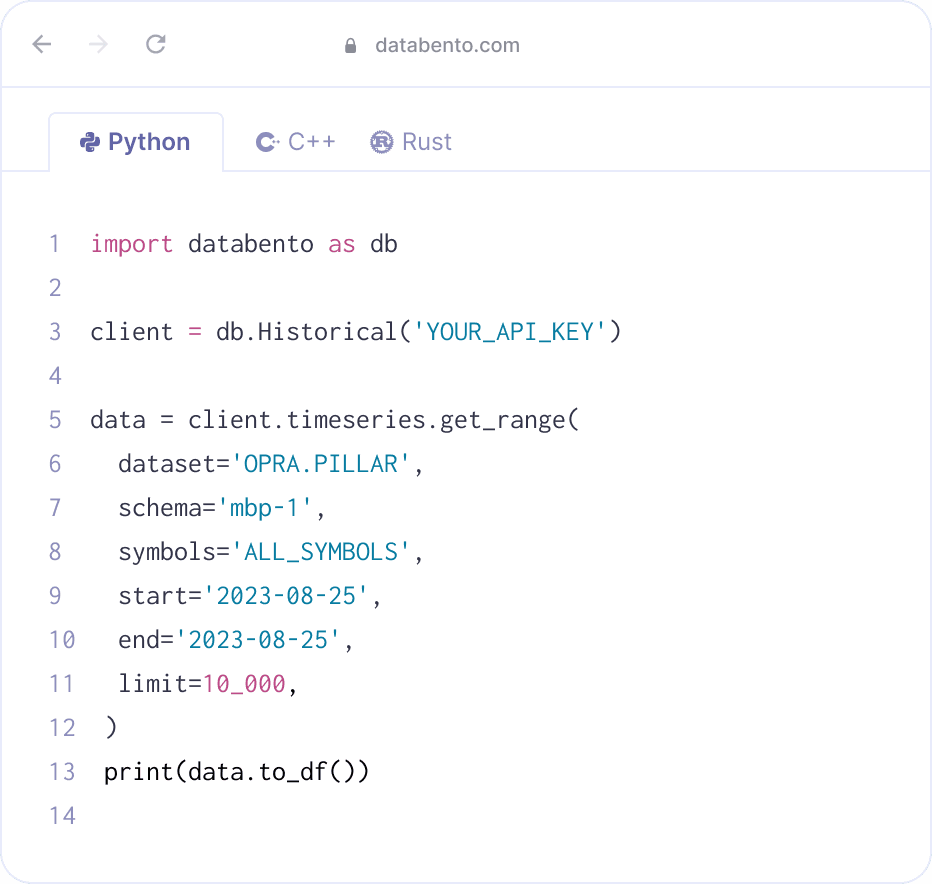

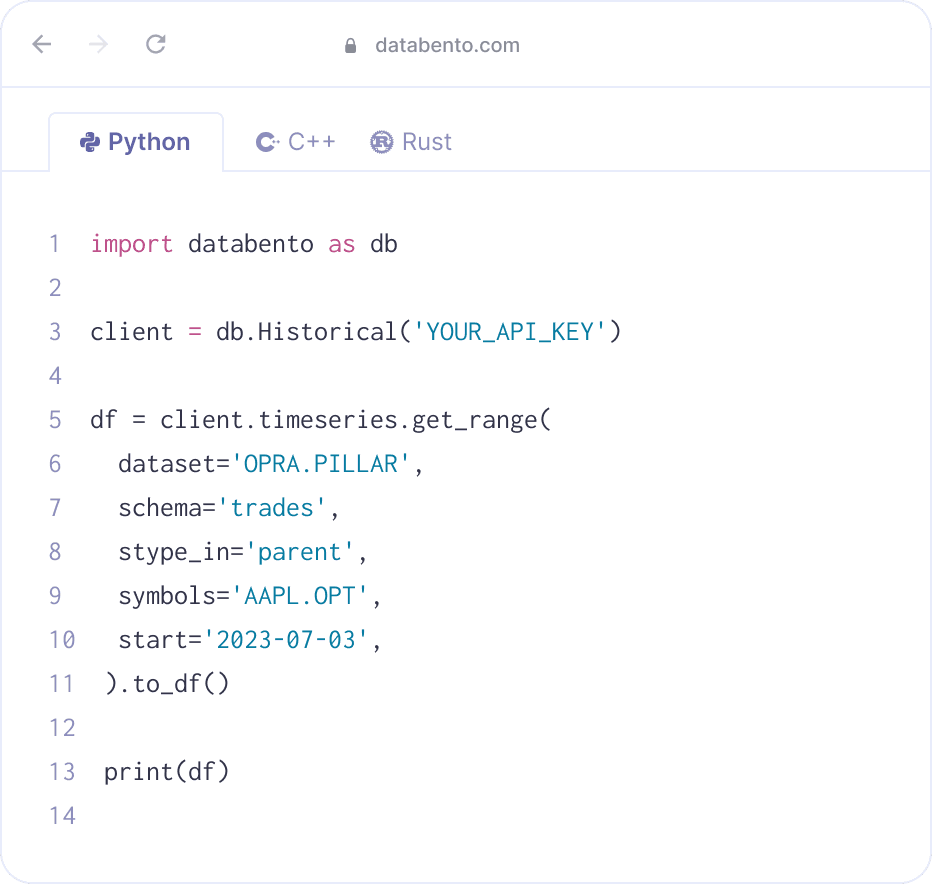

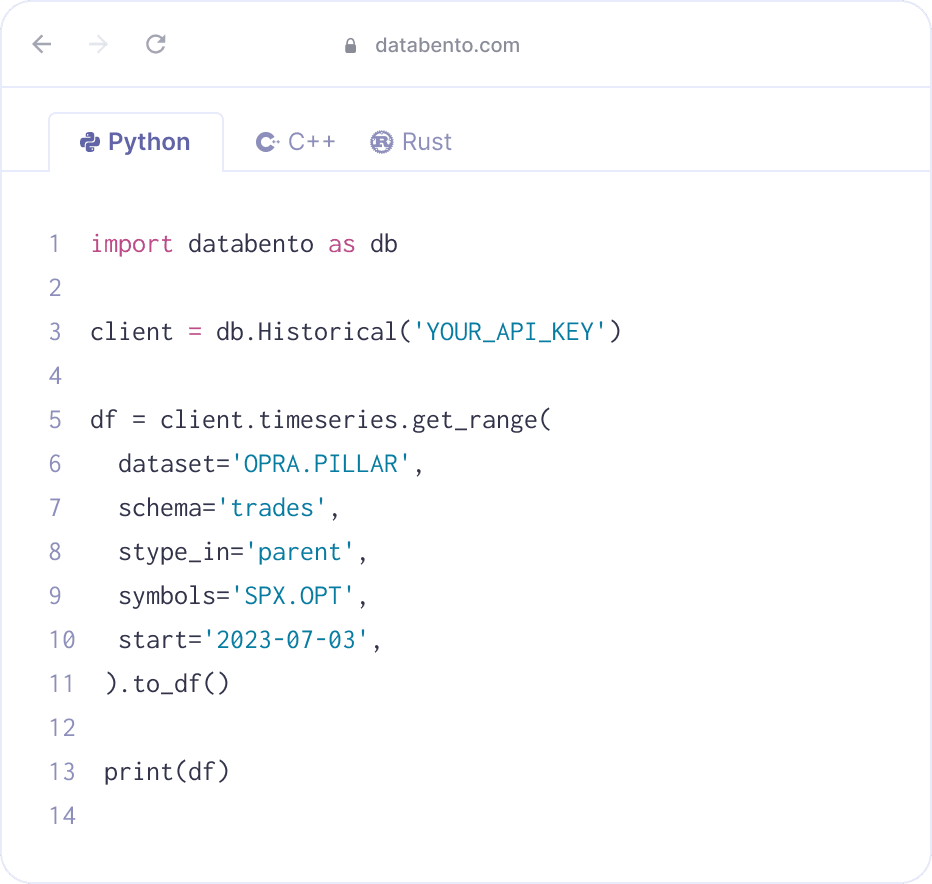

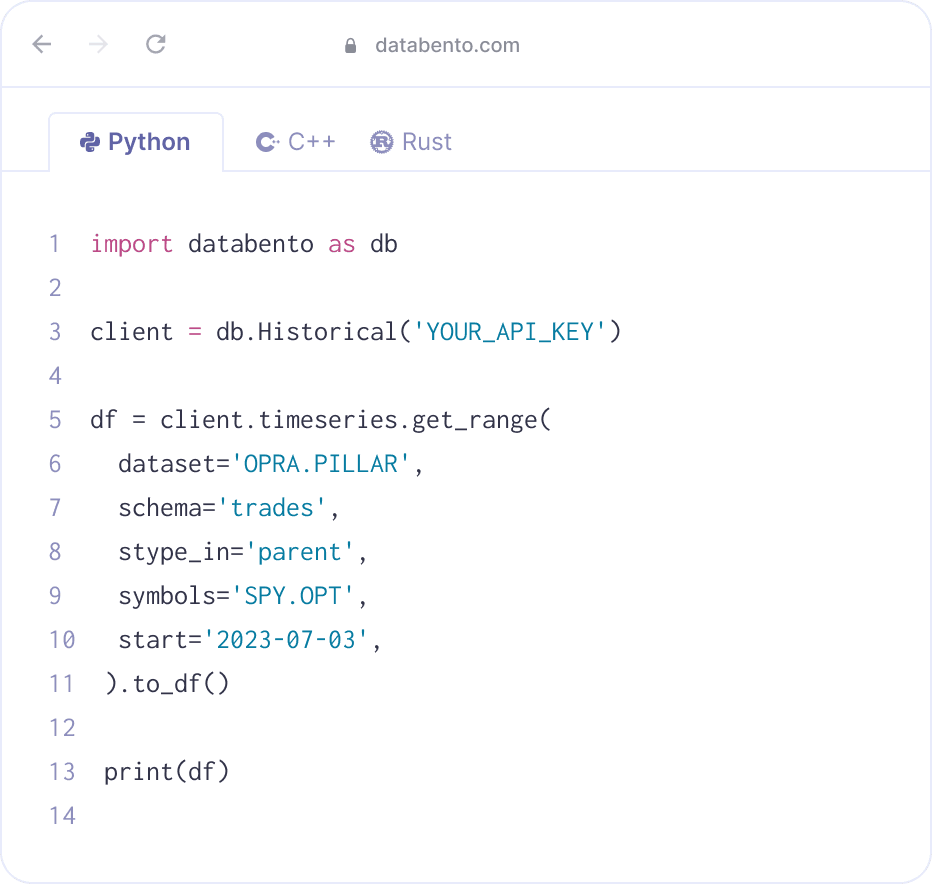

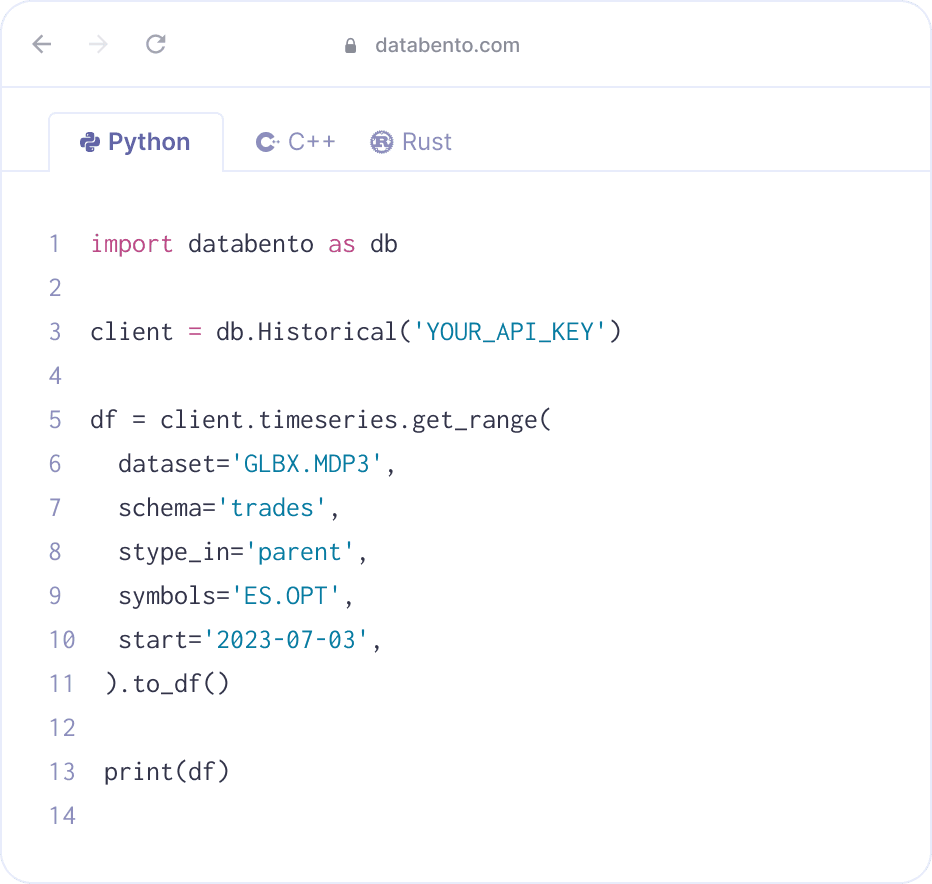

Build your first application in 4 lines of code

Examples

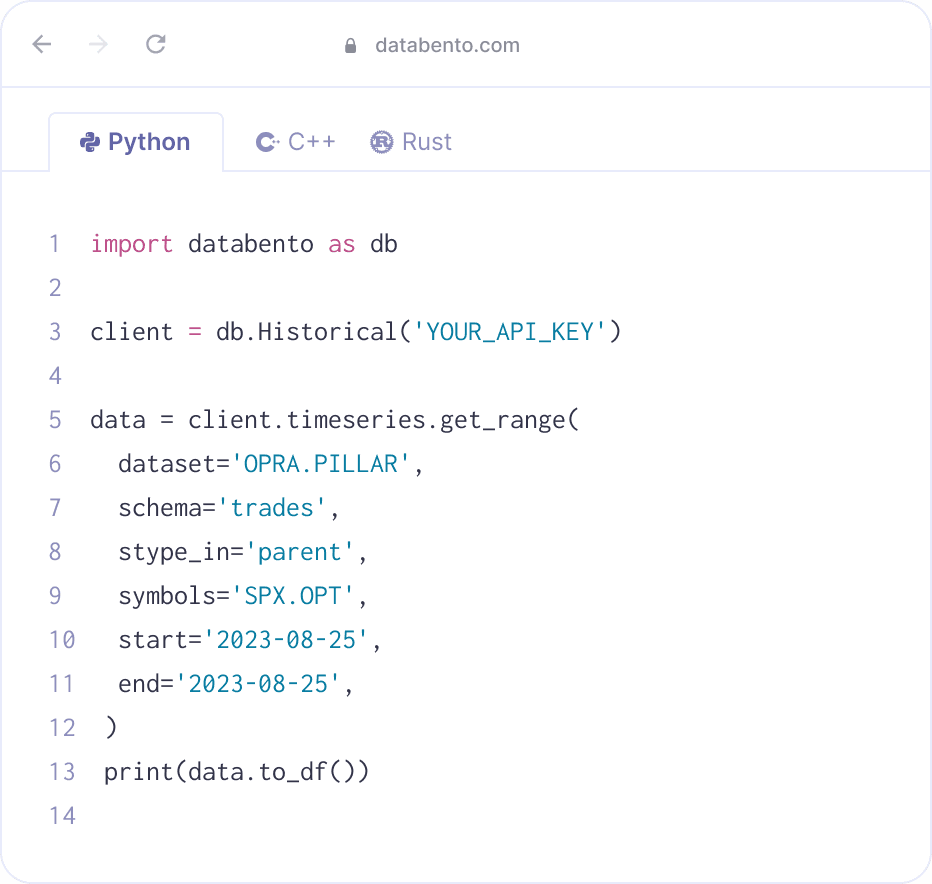

Simple workflows for options trading

Nanosecond timestamps

The only normalized market data solution to provide up to four timestamps for every event, with sub-microsecond accuracy across venues.

Multiple venues in one

Identify the trading venue behind each quote and get the consolidated NBBO.

Smart symbology

Easy ways to fetch options chains and handle multiple expirations and rollovers.

Customize your data

Select symbols, format, encoding, and delivery. Get any range by the nanosecond.

Read our API reference and user guides

Documentation

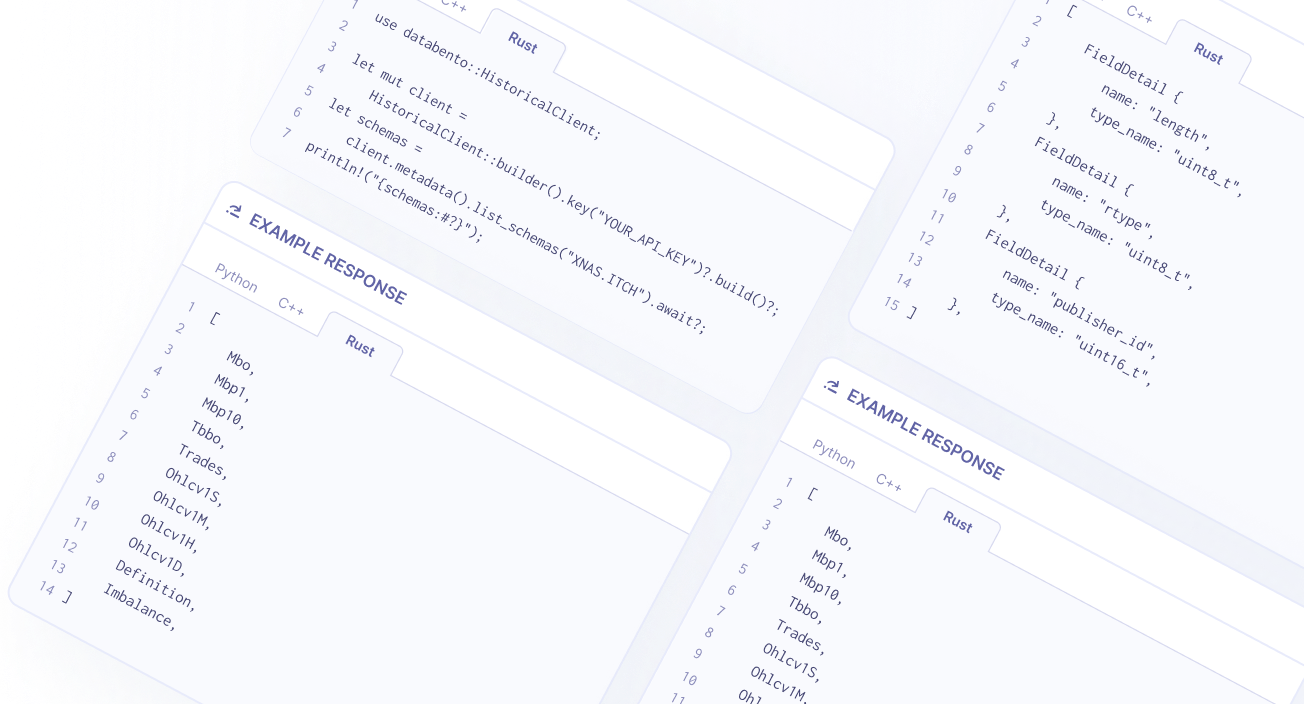

Schemas

Our datasets support multiple formats, including order book, tick data, bar aggregates, and more. View all supported schemas ->

-

mbo

Market by order

Market by order, full order book, L3.

-

mbp-10

Market by price

Market by price, market depth, L2.

-

mbp-1

Market by price

Top of book, trades and quotes, L1.

-

tbbo

Top of book

Top of book, sampled in trade space.

-

trades

Trades

Tick-by-tick trades, last sale.

-

ohlcv-t

Market bars per second

Aggregates per second, minute, hour, or day.

-

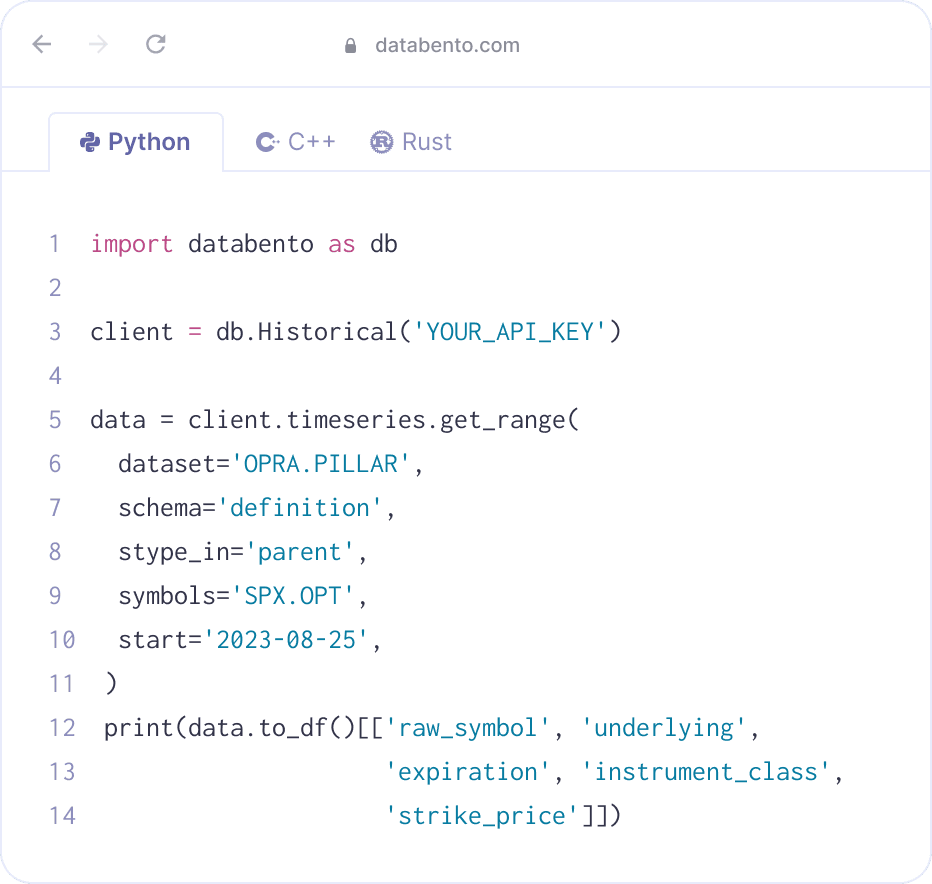

definition

Definitions

Point-in-time instrument definitions.

-

imbalance

Imbalance

Auction imbalance, order imbalance.

-

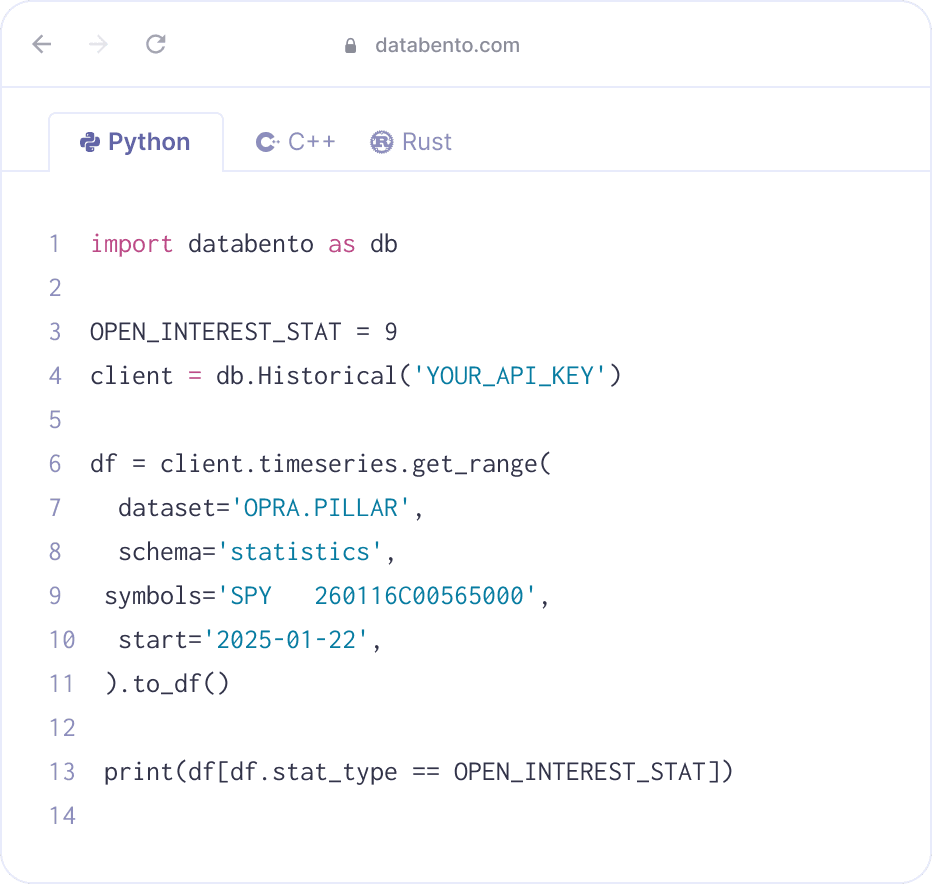

statistics

Statistics

Intraday and end-of-day trading statistics, static data.

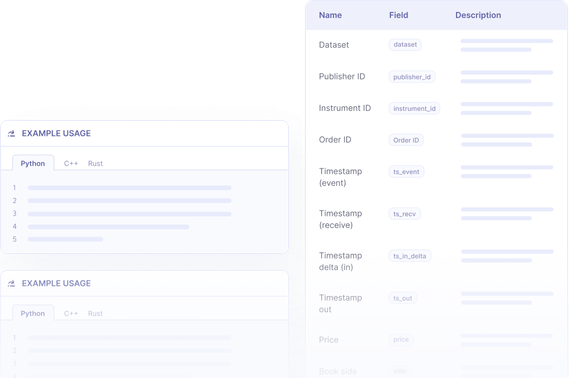

Fields

Examples of frequently used data fields. Each schema is represented as a collection of fields. View all supported fields by schema ->

-

publisher_id

Publisher ID

The publisher ID assigned by Databento, which denotes the dataset and venue.

-

instrument_id

Instrument ID

The numeric instrument ID.

-

order_id

Order ID

The order ID assigned at the venue.

-

ts_event

Timestamp (event)

The matching-engine-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_recv

Timestamp (receive)

The capture-server-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_in_delta

Timestamp (sending)

The matching-engine-sending timestamp expressed as the number of nanoseconds before

ts_recv. -

price

Price

The order price where every 1 unit corresponds to 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

-

action

Action

The event action. Can be Add, Cancel, Modify, cleaR book, Trade, or Fill.

-

size

Size

The order quantity.

-

flags

Flags

A combination of packet end with matching engine status.

-

expiration

Expiration

The last eligible trade time expressed as a number of nanoseconds since the UNIX epoch.

-

strike_price

Strike price

The exercise price if the instrument is an option. Converted to units of 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

API methods

Examples of popular API methods. Our APIs are organized into four categories: metadata, timeseries, symbology, and batch download. View all supported API methods ->

-

timeseries

Get range

Stream time series data using our Historical API.

-

batch

Submit job

Submit a batch job to extract historical data files in bulk.

-

batch

Download

Download a completed batch job.

-

symbology

Resolve

Resolve a list of symbols into their exchange specific identifier.

-

metadata

List publishers

List all our dataset publishers.

-

metadata

List datasets

List all our available dataset names.

-

metadata

Get cost

Get the cost in US dollars for a historical streaming or batch download request.

-

metadata

Get dataset range

Get the available date range for a dataset.

-

metadata

List schemas

List all available market data schemas for a dataset.

Sampling frequencies

All datasets provide full flexibility and the ability to customize sampling resolution.

-

Every book update

Every order execution, add, cancel, replace, book snapshot, and more. By the nanosecond.

-

Tick-by-tick

Every trade and quote. By the nanosecond.

-

1 second

Subsampled BBO, last sale, and OHLCV aggregates by the second.

-

1 minute

Subsampled BBO, last sale, and OHLCV aggregates by the minute.

-

Hourly

OHLCV aggregates by the hour.

-

Daily

Daily market statistics, indicative opening and closing prices, OHLCV aggregates, and more.

What our users are saying

Michael Tung, Investments Lead

Rick Zhan, VP Quant Research

Paul Aston, Founder

Brett Harrison, Founder

Nikita Ostroverkhov, Algo Trading

V. Chen, Equity Research Associate

Chris Pento, Co-founder and CEO

Matt Papakipos

C. Garcia, Senior Quant Researcher

Underlying prices and reference data for options

Corporate actions

Upcoming and historical dividends, splits, and adjustment factors since 2018.

Learn more ->Databento US Equities

Stock and ETF data from 15 US equities exchanges and 30 ATSs. Up to L3 granularity since 2018.

Learn more ->Security master

External symbology mappings since 2005. Includes CUSIP, Bloomberg FIGI, ISIN, CFI, FISN, and CIK.

Learn more ->Frequently asked questions

What types of options contracts do you cover?

We cover all US equity options and options on futures. This includes index options, ETF options, single name stock options, and exchange-traded multi-legged options (combinations) like butterfly spreads, straddles, condors, bundles, strips, etc.

Since we source our data from the full direct feeds, we cover every instrument on each exchange and trading venue—every strike and expiration.

Across US equity options (OPRA), CME, and ICE, we currently cover almost 2 million options tickers that are actively listed on any given day.

Do you cover index options?

Yes. For US equity options, we cover index options (e.g., SPX, VIX), ETF options (e.g., SPY, QQQ), and single name stock options (e.g., AAPL, TSLA, NVDA).

Do you cover options on futures?

Yes, we currently cover options on futures on CME and ICE, two of the largest futures exchanges in the world. This includes all exchange-traded multi-legged options, i.e., combinations and spreads.

Does your options API support fetching multiple option chains, strikes, or expirations at the same time?

Yes, you can use parent symbology to fetch all strikes and expirations for a root symbol. Likewise, you can specify multiple parent symbols in a single API request.

Does Databento publish pre-calculated implied volatility and greeks?

We don't currently provide pre-calculated implied volatility (IV) or greeks.

You can IV calculate and greeks from our options prices with an options pricing model. An example of calculating IV of index futures with the Black-76 model is shown in our documentation.

Our API design prioritizes transparency by avoiding vendor-calculated or derived data, such as IV and greeks, which are highly sensitive to the choice of model parameters and inputs. Instead, we usually prefer to provide tutorials and code samples so that you can do this on your end.

Do you provide reference data like expiration dates and open interest?

Yes, these are available on our instrument definitions and statistics schemas, respectively.

What is OPRA?

The Options Price Reporting Authority (OPRA) consolidates and disseminates last sale, NBBO, local exchange quotes, and other regulatory market data across all US equity options exchanges. This is the primary source of US equity options data for most firms and vendors.

The OPRA feed covers all index options, ETF options, and single name stock options on US equity options exchanges.

To find out more, see our microstructure guide.

What symbology system do you use for individual tickers?

Our raw symbols for equity options are based on OCC symbology, also known as Options Symbology Initiative (OSI) symbology. The OPRA dataset specification provides an overview of this symbology format.

Do you provide proprietary feeds from individual equity options exchanges like Cboe Depth of Book (PITCH)?

It's less typical for vendors and trading participants to employ US options data sourced from proprietary feeds due to its large size. While we currently provide US stock and ETF data from proprietary direct feeds, we currently don't provide this for equity options.

If you're interested in US equity options data from proprietary feeds, you can create a ticket on our public roadmap.

How fast is your real-time options data? Can it keep up with the full OPRA feed during market open and close?

You can see it in action for yourself on our live latency dashboard, which shows latency percentiles at specific times of the day.