Corporate actions data and APIs

Get upcoming and historical company events— dividends, splits, M&A, listings, and more.

215

Venues worldwide

310,000+

Stocks, ETFs, bonds, and more

61

Event types supported

6 years

Point-in-time history

Over 60 event types covered

Upcoming and historical corporate action events that affect security prices and listing statuses. See all events ->

Dividends

Upcoming and past dividends, declaration, ex-dividend, record, and payment dates.

Forward and reverse splits

Capital changes like forward splits and reverse splits with effective dates.

Adjustment factors

To back-adjust end-of-day prices, EPS, P/E and other prices for all corporate actions.

Mergers and acquisitions

Ticker changes caused by mergers, acquisitions, demergers, spinoffs, and more.

IPOs and new listings

Upcoming and historical listings like initial public offerings (IPOs), with listing dates.

Listing continuity

Listing continuity events like name changes, delistings, and description changes.

Capital changes

Such as share buybacks, redemptions, bonus issues, and rights issues.

Legal actions

Legal issues like bankruptcy and class action lawsuits, with filing and notice dates.

Announcements

Coming soon

Machine-readable announcements from over 400 sources, timestamped to the second.

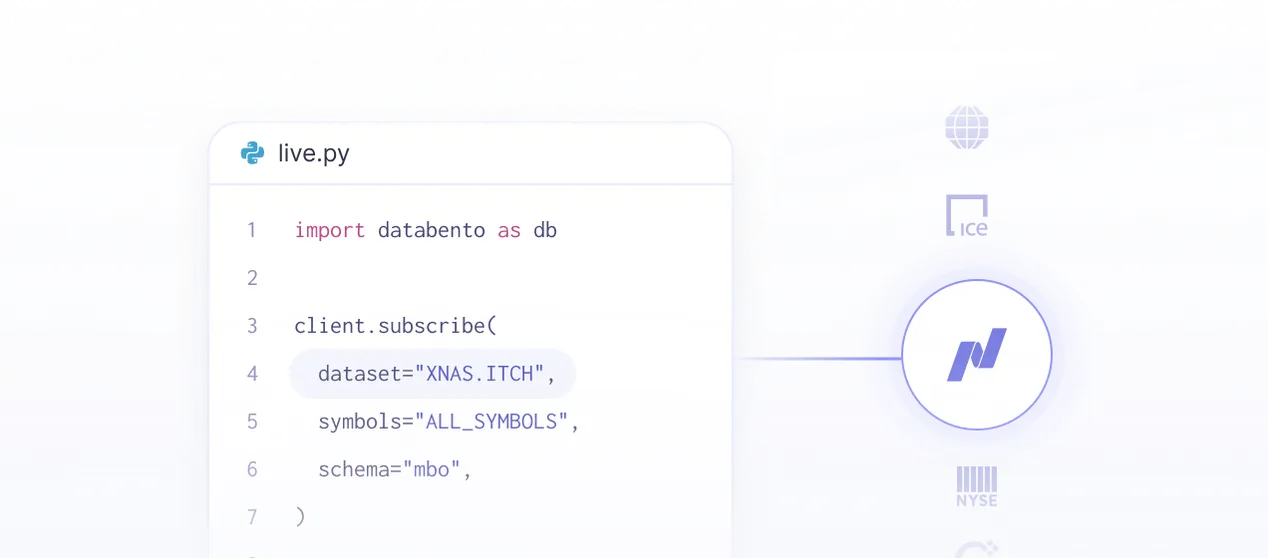

Everything in one modern API

Databento’s reference data API works with any language. We also provide official client library support in Python.

Optimized for Pandas dataframes

Works natively with Pandas dataframes on our official Python client library.

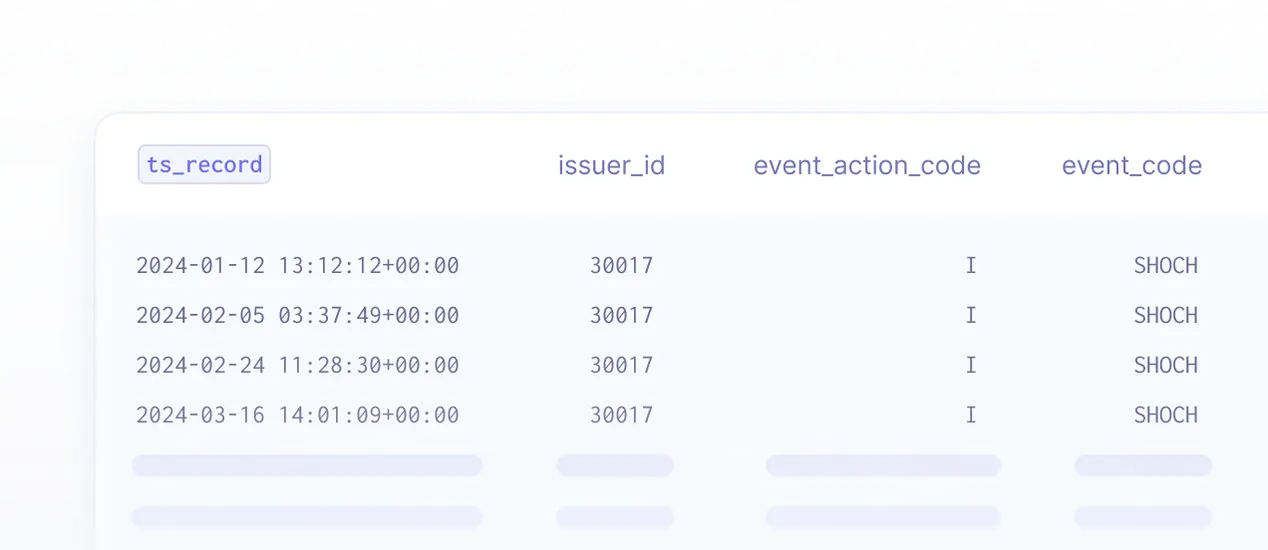

Point-in-time format

Get corporate events timestamped as if you were live. Backtest accurately without survivorship or lookahead bias.

Easy setup on any platform

Open source library and standard HTTP API. Works on Linux, macOS and Windows out of the box.

Merge corporate actions with price data easily

Based on the same conventions, symbology, and timestamp formats as Databento’s historical and live APIs, making it easy to join with market data.

Fast, cloud-neutral API

Blazingly fast from any public cloud or your own premises.

4 updates per day

Get latest intraday data before market open, after end of day, and more.

Multiple formats

Read directly in your application or write files to disk in CSV, JSON, or Parquet.

Global coverage of 215 markets

310,000+ listed and delisted stocks, ETPs, DRs, bonds, and more from 85,000+ issuers and companies. See all supported venues ->

182 countries

215 venues

Supported exchanges in North America

United States

Cboe BZX

FINRA OTCBB

FINRA TRACE

Investors Exchange

Nasdaq

NYSE National

New York Stock Exchange

NYSE American

NYSE Arca

OTC Markets Group

Canada

Canadian Securities Exchange

Cboe Canada

Toronto Stock Exchange

TSX Venture Exchange

Mexico

Institutional Stock Exchange

Bolsa Mexicana de Valores

Other

Bahamas International Securities Exchange

Barbados Stock Exchange

Bermuda Stock Exchange

Cayman Islands Stock Exchange

Bolsa Nacional de Valores

Dutch Caribbean Securities Exchange

Dominican Republic Stock Exchange

El Salvador Stock Exchange

Guatemala National Stock Exchange

Central American Securities Exchange

Jamaica Stock Exchange

Nicaragua Stock Exchange

Latin American Stock Exchange

Eastern Caribbean Securities Exchange

Trinidad & Tobago Stock Exchange

API Documentation

Corporate actions in 5 lines of Python

1 2 3 4 5 6 7 8 9 10 11 12

import databento as db

client = db.Historical('YOUR_API_KEY')

data = client.timeseries.get_range(

dataset='GLBX.MDP3',

schema='mbo',

start='2023-01-09T00:00',

end='2023-01-09T20:00',

limit=100,

)

data.replay(print)Sample Data

Download sample data in one click

You can also start with our flexible Starter Plan, which includes 1,000 symbols and each additional symbol for $1 per month.

Flexible plans for every use case

Pair with Databento’s market data and security master

Live data

Real-time, delayed, and intraday streaming price and book feeds. Official source for over 70 venues.

Learn more ->Historical data

Up to 15 years of normalized data, 19 PB of coverage, and over 3 million active tickers.

Learn more ->Security master

External symbology mappings since 2005. Includes CUSIP, Bloomberg FIGI, ISIN, CFI, FISN, and CIK.

Learn more ->Frequently asked questions

How do I choose the symbols for my Standard plan?

We keep track and count any new symbols when they're requested on our API.

You won't have to decide on these symbols upfront. We reset this each time your subscription renews.

How can I check which symbols have been used and how many are remaining on my Starter plan?

Just ask our support team. We'll give you the list of symbols that you've consumed. We count your symbol use by unique ISIN.

We're in the midst of adding a feature to our portal to show your allocated symbols.

Can I get more than 1,000 symbols on the Starter plan?

Yes, if you need more symbols, contact our support team and we can add more symbols to your plan at $1 per month for each additional symbol.

What happens if I exceed the symbol limit on the Starter plan?

Any API request exceeding the symbol limit will return an authorization error. You can contact our support team and we'll be happy to add more symbols to your plan at $1 per month for each additional symbol. This will be considered a plan upgrade and we'll reset you on a new 12-month term.

Can I upgrade from Starter to Unlimited before my annual subscription has ended?

Yes. You can upgrade from Starter to Unlimited at any time. The remainder of your term on the Starter plan gets terminated and we'll start you on a new 12-month term.

When is data updated or published?

New data and upcoming events are appended 4 times per day, between 4 to 5 AM, 9 to 10 AM, 2 to 3 PM, and 7 to 8 PM London time.

Are there restrictions on the use of the data?

Personal and commercial users can use the data for any internal purpose, including for display and non-display applications. The pricing is the same regardless of the size of your organization or the number of devices using the data. However, external redistribution in files or over API is not allowed.

How is the data sourced?

The data is sourced from our partner EDI and a variety of exchanges like Nasdaq. EDI's technology helps to aggregate over 400 primary sources and exchange data is used as a source of truth on symbol directory, ticker information, and more. We collaborated with our sources to implement a system of point-in-time updates specific to our API. Our data pipelines normalize these sources and implement Databento's symbology system over the data. The data is served directly from Databento's servers.

How does this compare to other sources of corporate actions data?

A few data vendors also use similar sources for raw data to implement their corporate actions offerings. The main differences are: (i) We have a proprietary, point-in-time update system that's tailored to our institutional users and API design patterns. (ii) The API uses Databento's symbology and conventions and is built into our Python client library, which makes it easy to fetch the corporate actions and merge with our price data. (iii) Using Databento means you'll be getting a much larger set of convenience features and receiving support solely from us instead of multiple parties.

It's possible to buy the raw data in flat files at a slightly lower cost and then normalize it yourself, but implementing an API layer over it is usually a significant undertaking, and you'll lose the convenience features that come with Databento.