Real-time Cboe EDGX Depth now available on Databento US Equities

We're excited to announce the addition of real-time Cboe EDGX Depth data to Databento US Equities. This follows our earlier release of historical full-depth data for all Cboe equities venues in May.

Sourced directly from Cboe's most active equities exchange, this dataset provides full order book coverage and is now available to all users on Plus and Unlimited plans with the required exchange licensing.

Cboe EDGX Depth is a proprietary full order book feed from the most active of Cboe’s four equities venues. It delivers every quote and order at each price level, along with any event that updates the order book after an order is placed, including trade executions, modifications, or cancellations. With L3 granularity, it provides data not found in SIP feeds—such as explicit trade aggressor side and odd lots—for accurate modeling of quote lifetimes and queue composition.

EDGX is one of the few US equities venues to open early at 4:00 AM ET, making it particularly valuable for firms active in the pre-market session and for price discovery ahead of the broader market.

This dataset covers all securities traded or routed through the EDGX exchange, including those listed on the Nasdaq, NYSE, NYSE American, NYSE Arca, and other Cboe exchanges under Reg NMS. As of July 2025, Cboe EDGX represented 4.88% of the average daily volume (ADV) across all exchange-listed US equities.

Relative to its exchange license fees for real-time data, Cboe EDGX Depth is the most cost-effective full order book feed after Nasdaq TotalView-ITCH. It's an ideal supplement for teams already using TotalView to expand their MBO coverage across high-volume venues.

Real-time Cboe EDGX data is included with a Plus or Unlimited subscription through our Databento US Equities service. Visit our pricing page for more details or to upgrade your plan.

Once your license is active, you can begin streaming live data using the dataset ID EDGX.PITCH. The example below demonstrates how to request MBO data for two symbols with our Python client library.

import databento as db

client = db.Live("YOUR_API_KEY")

client.subscribe(

dataset="EDGX.PITCH",

schema="mbo",

symbols=["NVDA", "AAPL"],

)

client.add_callback(print)

client.start()

client.block_for_close(timeout=10)We're adding live auction imbalance data for the NYSE, NYSE Arca, and NYSE American in early August. These feeds will be included with all Plus and Unlimited plans for Databento US Equities.

As part of this upcoming release, the price of our Plus plan will increase to $1,500/month. Current Plus subscribers won't be affected by this pricing change and will have access to the new imbalance feeds at no additional charge.

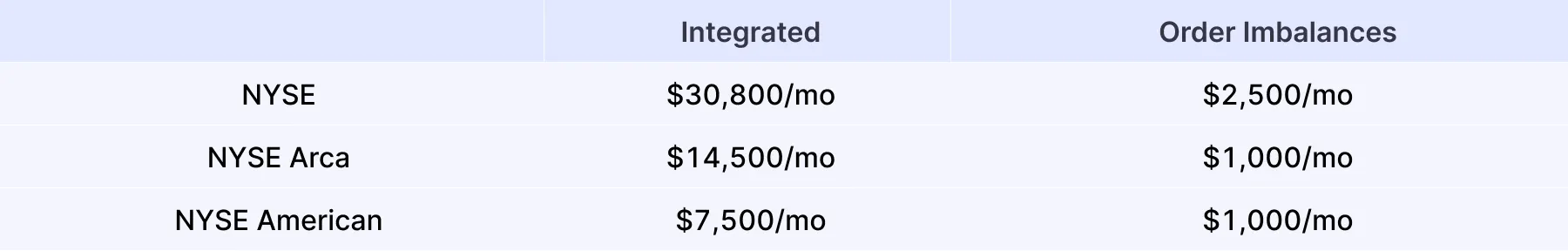

While real-time imbalance data can be licensed as part of the full Integrated feeds for NYSE, NYSE Arca, and NYSE American, this costs upwards of $7,500/month in non-display fees. The Order Imbalances feeds start at $1,000/month and offer a more cost-effective option to license this data.

A comparison of license fees for each venue is shown below: