Historical and real-time

tick data

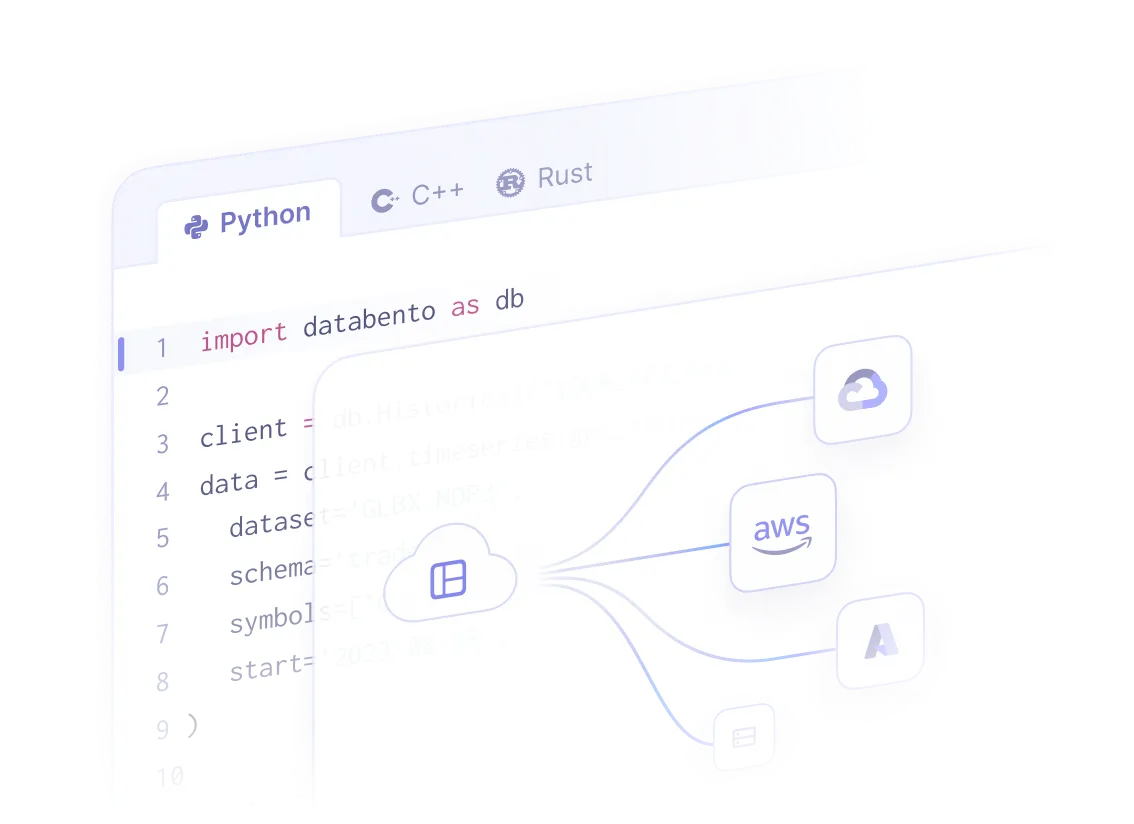

Databento provides cloud-based solutions for intraday and

real-time tick data. Simple, fast access in Python, C++, and Rust.

Databento tick data

Tick data and tick history are commonly-used terms for the most granular types of market data: L1, L2, and L3. Definitions can vary by vendor, so we use our own naming conventions.

Tick data solutions

The industry’s fastest tick data platform. First to deliver full L3 (MBO) over internet. Cloud-compatible and accessible from everywhere.

Four asset classes in one integration

Equities

Access equities data sourced from direct feeds—with more information than SIP data.

Futures

Equity indices, interest rates, energies, agriculture, metals, and FX futures.

Options

Explore options data from all 18 US equity options exchanges, plus options on futures.

Spot FX

Over 100 currency pairs, including majors & cross-rates, from 40+ liquidity providers.

KEY FEATURES

Official distributor for over 40 exchanges

Our data is sourced from the same direct feeds used by the largest trading firms, hedge funds, and banks.

KEY FEATURES

L2 and L3 data

L3 (MBO) provides every buy and sell order at every price level, tick-by-tick.

L2 (MBP-10) aggregates book depth by price and includes every order across the top ten price levels.

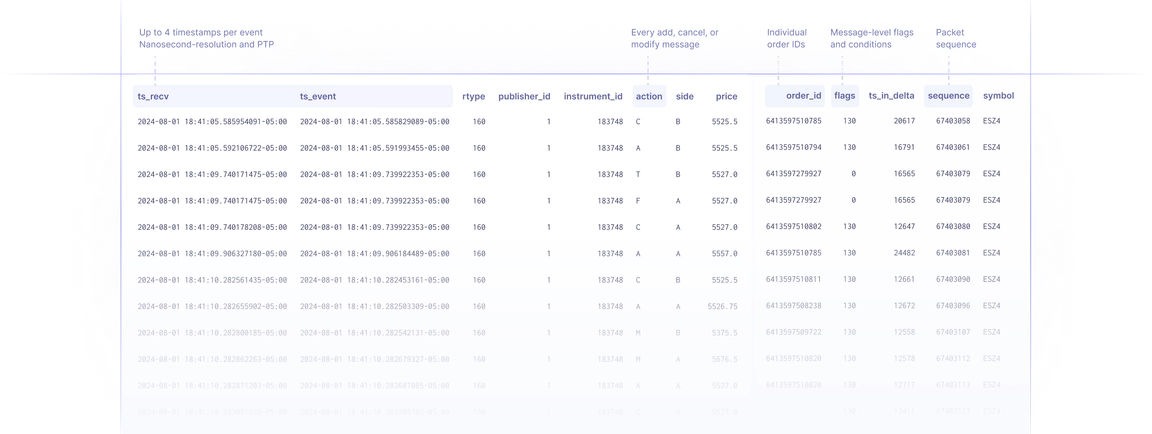

Nanosecond-resolution

The only normalized market data solution with sub-microsecond accuracy for every dataset.

Multiple formats

15 normalized schemas derived from raw PCAPs and delivered in binary, CSV, JSON, and Parquet.

Auction imbalance data

Data like paired quantity, total quantity, and auction status that’s only available from prop feeds.

Instrument definitions

Point-in-time definitions, updated intraday to reflect new listings like IPOs and derivative strikes.

Tick data for every use case

See real-world applications using Databento’s L2 and L3 tick data.

View all customer stories ->Backtesting and simulation

Machine learning

High-frequency trading

Transaction cost analysis

Latency modeling

QuestDB

Create a real-time dashboard in Grafana and enable SQL analysis with the fastest open-source database for time series data

“The new infrastructure stack for financial services is emerging, starting with [Databento’s] high-fidelity, real-time market data APIs.”

Nicolas Hourcard, CFA

GitHub

hftbacktest

Backtesting a market making model based on stochastic optimal control

“Databento enables individual traders to access the finest market data which was previously accessible only to institutional traders.”

nkaz001

VectorBT

Python-based backtesting platform that pushes 3,000,000+ simulations per minute

“It’s been refreshing to work with a data provider that truly understands the needs of modern developers and offers solutions optimized for Python. We were up and running the same day.”

Head of Systematic Trading

Machine learning

Build high-frequency trading signals and model-based alphas in Python with sklearn

"The quality was better than some of the standalone exchange data we'd accessed in the past."

Nelson Griffiths

High-frequency trading

Implement an algorithmic trading strategy with paper trading and live data

“You have a true top of the line offering and your engineers are among the most experienced in the biz. Some would call this overkill, except those who run HFT prop and market making books.”

Paul Aston

Transaction cost analysis

Plot markout curves to measure execution quality and slippage for TCA

“Wonderful—the platform is amazing. Documentation and API [are] first class.”

Balraj Bassi

Latency modeling

Calculate feed and round-trip internal latencies of CME’s matching engine

“Databento is a leader in financial market innovation. Any investment manager that cares about latency and market data quality should become a customer!”

Adrian Bialonczyk

Award-winning technology

Brought to you by the same engineers behind market data infrastructure at top HFT firms.

FIA Expo 2021 People’s Choice Award

“Databento tackles the challenges of obtaining market data, a key pain point for many market participants.”

Fintech clients seek data alternatives

“Databento's APIs are designed for institutional and commercial use cases, but available to all.”

World Economic Forum 2022 Technology Pioneer

“Databento resolves the price, speed, and quality issues that users face with incumbent data providers.”

2023 Inc. Magazine Best Workplaces Honoree

“Proving to the world that you're a magnet for talent... is a truly remarkable achievement.”

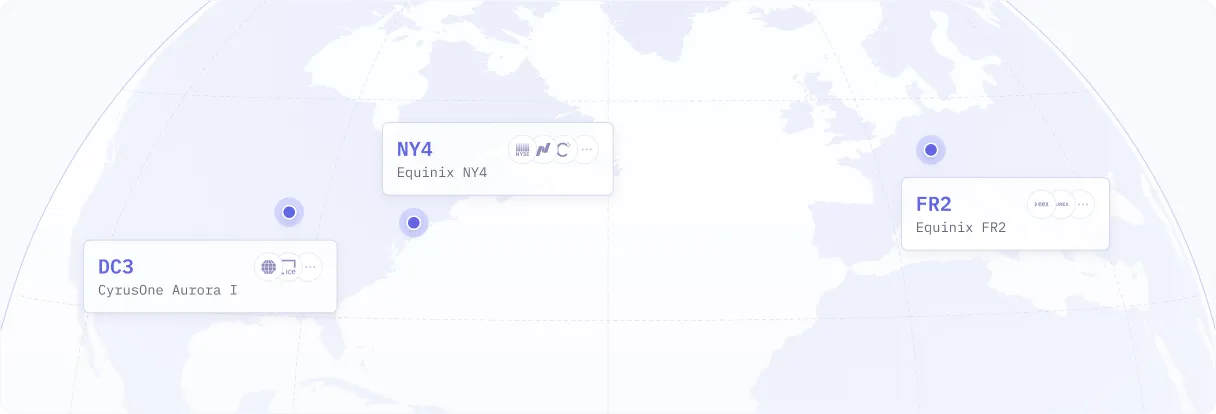

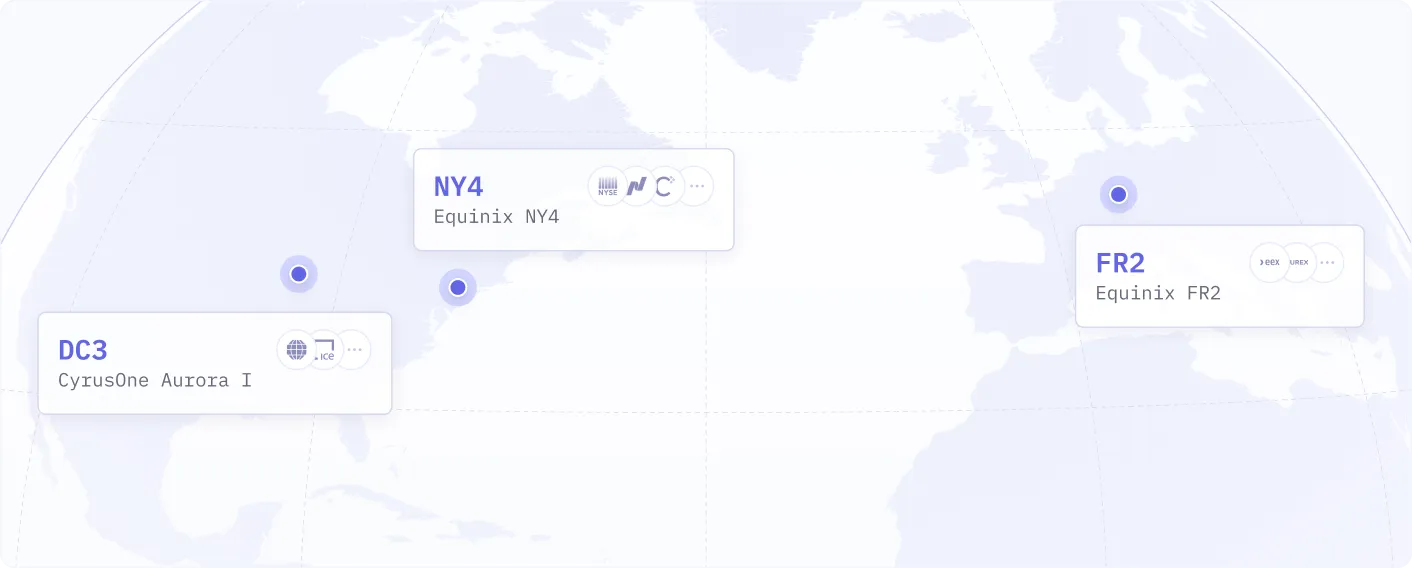

Direct from colocation facilities

All data is sourced directly from raw feeds at our Equinix NY4 and Aurora I colocation sites, with no third-party data providers in between.

Our datasets support multiple formats, such as order book, tick data, bar aggregates, and more. View all supported schemas ->

Market by order

Market by order, full order book, L3.

Market by price

Market by price, market depth, L2.

Market by price

Top of book, trades and quotes, L1.

Trades

Tick-by-tick trades, last sale.

Top of book

Top of book, sampled in trade space.

Market bars per second

Aggregates per second, minute, hour,or day.

Statistics

Intraday and end-of-day trading statistics, static data.

Definitions

Point-in-time instrument definitions.

Imbalance

Auction imbalance, order imbalance.

Download sample data

Databento subscribes to the most granular feed of each trading venue. Most of our datasets support L1, L2, and L3 data.

Nasdaq TotalView ITCH

Equities

CME Globex MDP 3.0

Futures · Options

ICE Europe Commodities

Futures · Options

L1 (MBP-1)

Top-of-book

CSV

L2 (MBP-10)

Market depth

CSV

L3 (MBO)

Full order book

CSV

Nasdaq TotalView ITCH

Equities

CME Globex MDP 3.0

Futures · Options

ICE Europe Commodities

Futures · Options

L1 (MBP-1)

Top-of-book

L2 (MBP-10)

Market depth

L3 (MBO)

Full order book

Frequently asked questions

What timestamps are included in your tick data?

We provide up to four timestamps per event, each in nanosecond resolution.

Exchange timestamp: A lossless capture of the primary timestamp from the trading venue—typically tag 60 (TransactTime), but sometimes tag 52 (SendingTime), depending on the venue. Used to sequence and correlate matching engine events.

Sending timestamp: If both tags are available, we include both. Useful for estimating matching engine latency.

Wire capture timestamp: A high-precision timestamp taken at the exchange boundary when the packet is pulled off the wire. Synchronized to a GPS clock using PTP, it enables accurate backtesting and simulation of the matching engine round-trip delay. Also useful on venues that provide only millisecond-resolution timestamps that are sometimes out-of-order. This is the same as packet receive timestamp found in our PCAP data, and can be used to validate our normalized data against raw market data.

Databento sending timestamp: Available via our real-time gateway, this shows when Databento sent the data, useful for measuring internal latency and data staleness.

Learn more in our timestamping guide.

What asset classes does Databento provide tick data for?

Databento offers tick data across futures, options, and equities, covering 70+ global trading venues.

What's the difference between raw and normalized tick data?

Raw tick data is captured in its original wire format, encoded in the native protocol used by the exchange or trading venue. Normalized tick data derived from raw tick data into a consistent format that unifies fields across different wire protocols for easier use.

Some vendors label their normalized data as “raw,” but this can be misleading—normalization is usually lossy, potentially discarding details like original packet order.

We offer raw tick data through our PCAP service, and normalized tick data via our API and browser GUI.

Is your tick data considered L1, L2, or L3?

There's no industry convention on what's considered "tick data". Many market data providers pass off a feed or dataset with each individual trade (a subset of L1 market data) as "tick data". In many cases, what they call "tick data" isn't even the most granular form of data available—which is usually either in PCAP or raw MBO format. In our case, we provide all three levels of granularity in our "tick data" offering.

What delivery methods are supported for your tick data?

We offer both historical and real-time tick data in normalized form.

Historical tick data is accessible via API or our no-code browser GUI. You can stream it into application memory or download it in batch as binary or CSV flat files over HTTP or FTP.

Real-time tick data is delivered through our streaming API.

Can intraday tick data improve backtesting accuracy if I trade at low frequencies?

Yes, usually.

Even for low-frequency strategies, most large price moves and trade opportunities occur within sub-second bursts. OHLCV data often obscures when your trade would’ve actually executed within a bar—making it hard to model slippage or fill timing accurately. Market makers also widen spreads during volatile moments, so constant spread assumptions often underestimate true slippage. It’s generally easier to model these effects directly with tick data than to rely on parametric approximations.

Also, since low-frequency strategies are especially sensitive to execution and market impact, sophisticated practitioners still often rely on tick data for transaction cost analysis as they develop their low- to mid-frequency strategies.