Futures data

Get real-time and historical futures data.

It only takes 3 minutes with our APIs.

60+ trading venues

Easy access through a single API and official client libraries (Python, C++, Rust).

Over 3 million symbols

Futures, spreads, and options from all CME, ICE, EEX, and Eurex exchanges.

19 PB of coverage

Tick data, full order book, market depth, OHLCV, reference data, and more.

Flexible pricing

Only pay for what you use, or get unlimited access with a subscription plan.

Direct from source

Sourced from direct exchange feeds at our Aurora I and Equinix FR2 colos.

Self-service onboarding

Skip the sales call. Access your first dataset in as little as 3 minutes.

List of supported venues

Databento is a licensed distributor and direct provider of market data for 60+ trading venues. See all supported venues ->

CME Globex MDP 3.0

Futures · Options on futures

All futures and options on CME, CBOT, NYMEX, and COMEX. Includes full book, stats, reference data, and more.

Since 2010

650,000+ symbols

Historical

Live

EEX

Futures · Options on futures

Most liquid power market in Europe and a major exchange for natural gas and emissions derivatives.

Since 2018

50,000+ symbols

Historical

Live

Eurex

Futures · Options on futures

Europe's largest derivatives exchange. Covers equity index and fixed income products, as well as single stock options.

Since 2025

600,000+ symbols

Historical

Live

ICE Europe Commodities

Futures · Options on futures

Covers over 50% of global crude and refined oil futures trading. From ICE's iMpact feed.

Since 2018

115,000+ symbols

Historical

Live

ICE Europe Financials

Futures · Options on futures

Covers European equity and interest rate derivatives. From ICE's iMpact data feed.

Since 2018

349,000+ symbols

Historical

Live

ICE Endex

Futures · Options on futures

Leading European energy exchange for gas, power, and emissions. From ICE's iMpact data feed.

Since 2018

115,000+ symbols

Historical

Live

ICE Futures US

Futures · Options on futures

Major softs, metals, MSCI indices, and the US Dollar Index. From ICE's iMpact data feed.

Since 2018

419,000+ symbols

Historical

Live

-

CME

-

CBOT

-

NYMEX

-

COMEX

-

ICE Europe Commodities

-

ICE Europe Financials

-

ICE Endex

-

ICE US

-

ICE Canada

-

ICE Abu Dhabi

-

EEX

-

Eurex

Modern futures data APIs built for top financial institutions

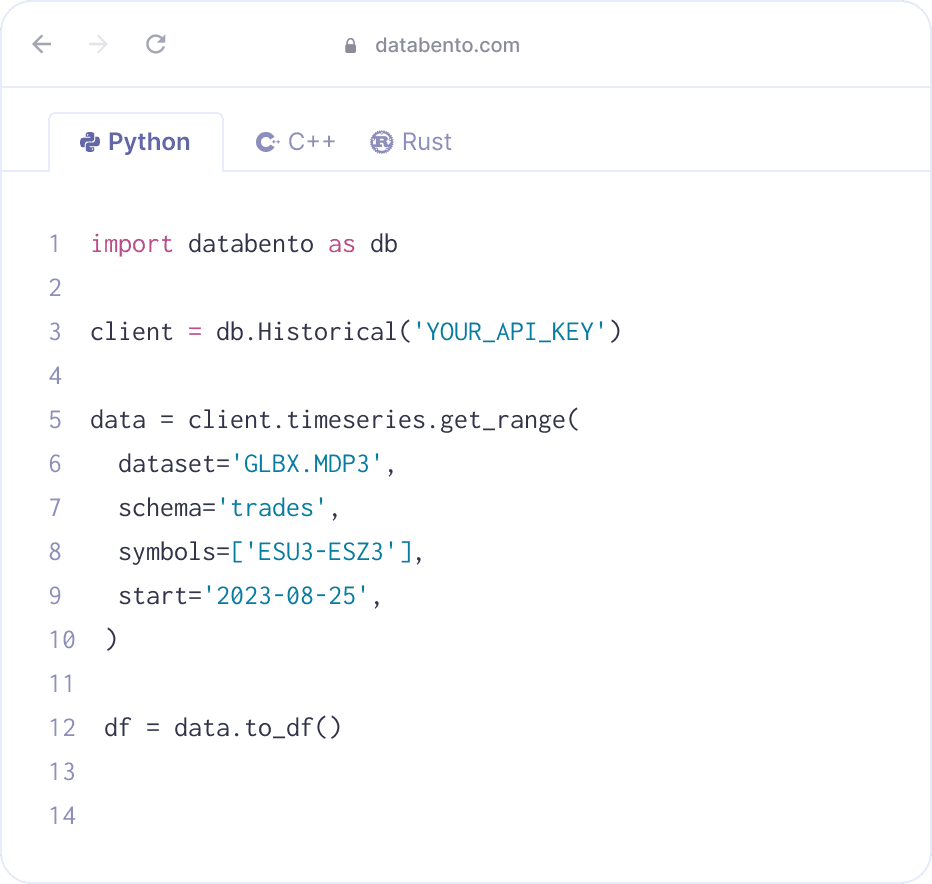

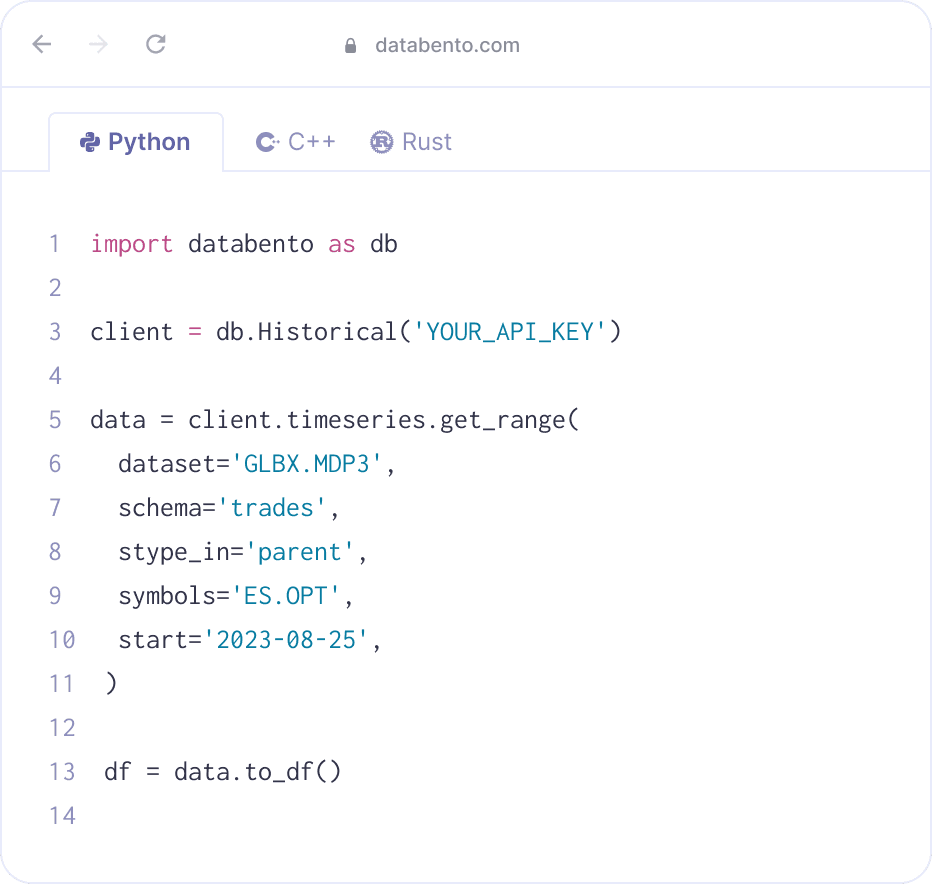

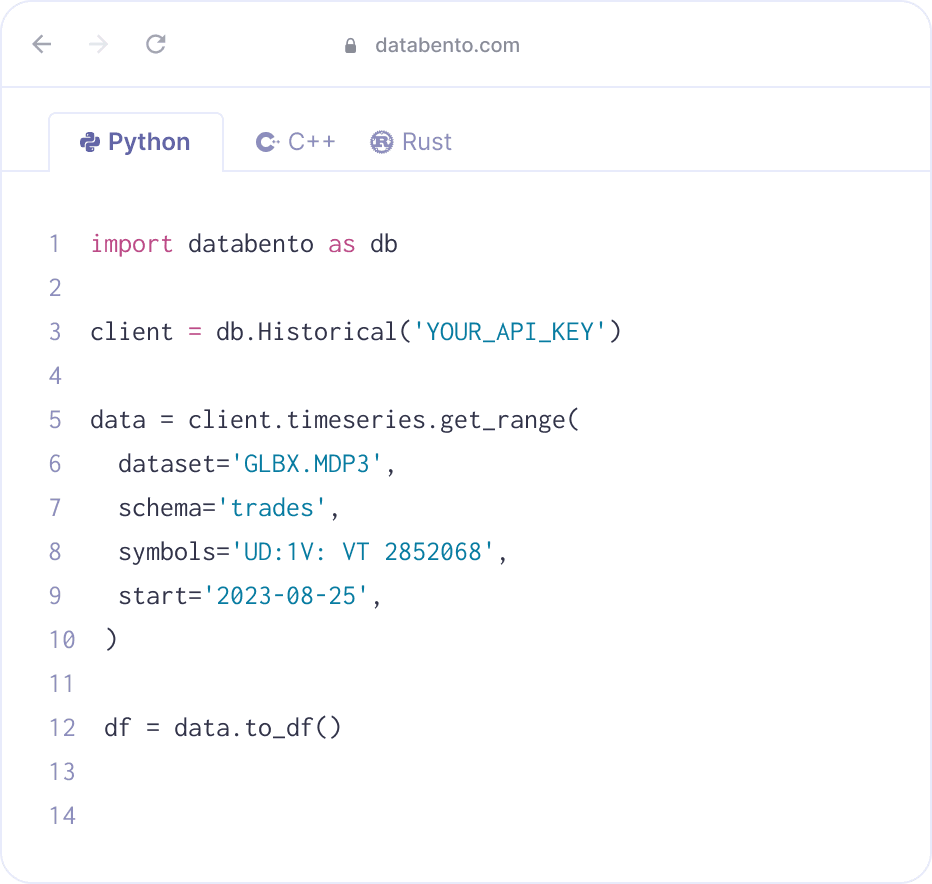

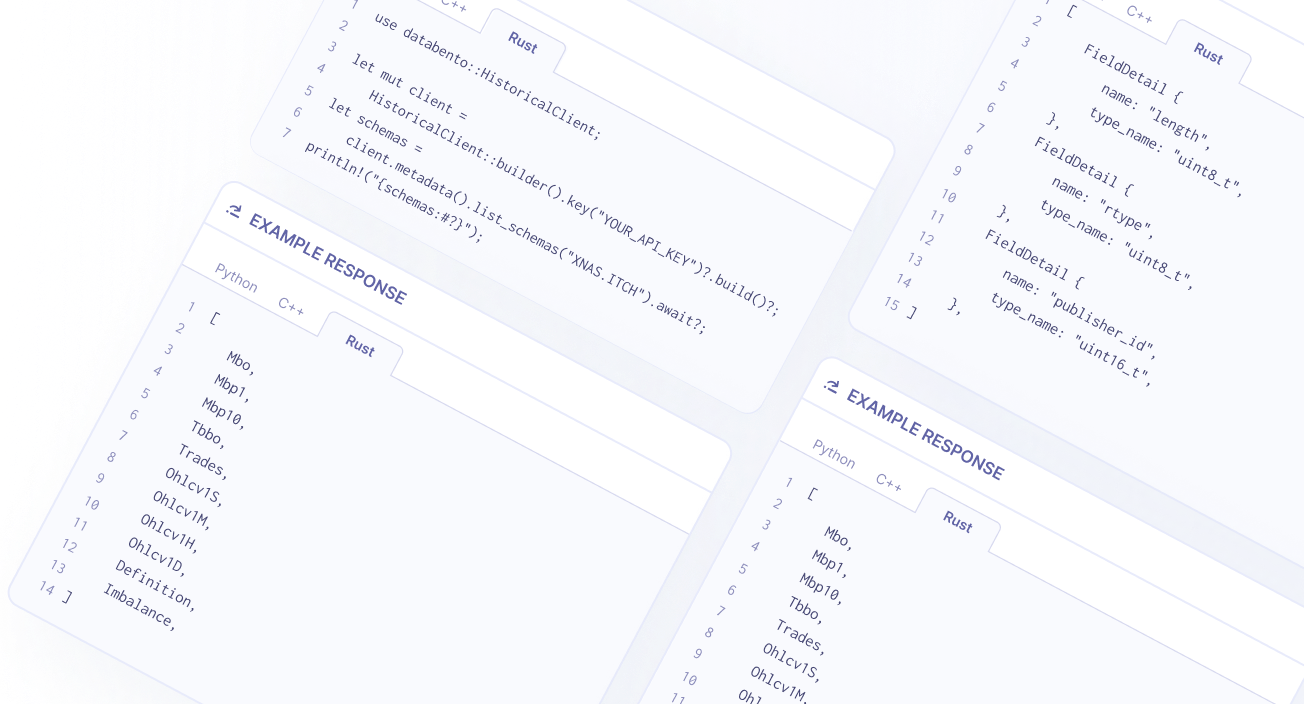

Databento works with any language through our APIs. We also provide client libraries for Python, Rust, and C++.

API

Build your first application in 4 lines of code

Examples

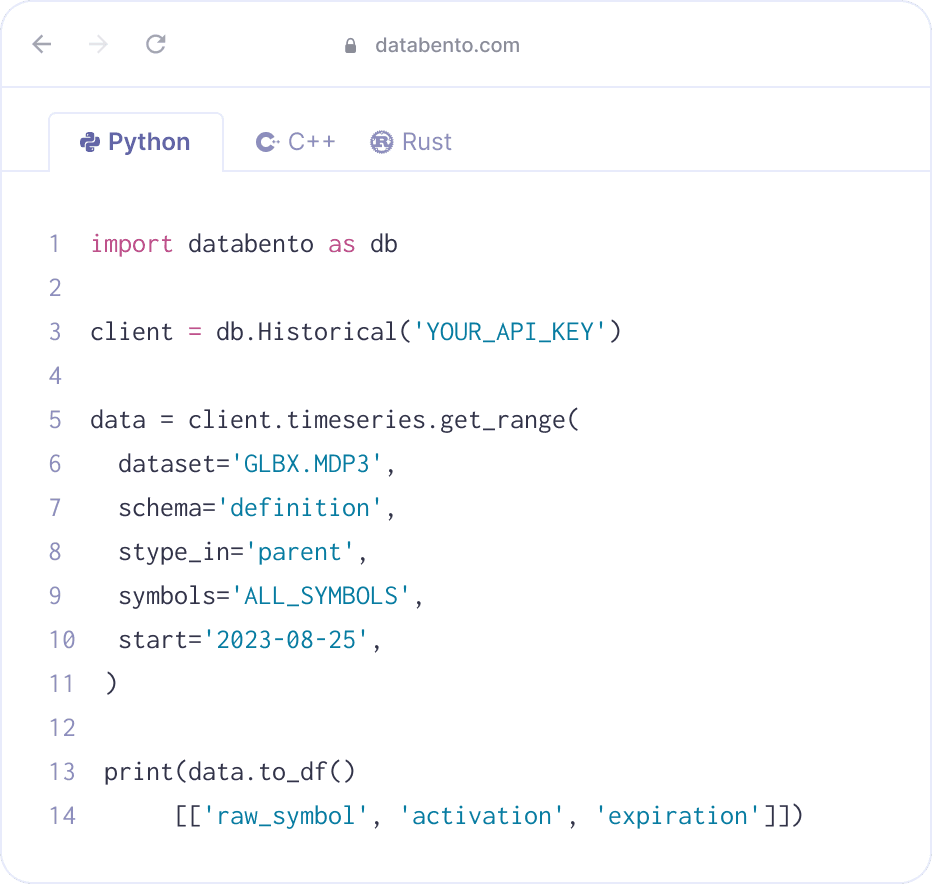

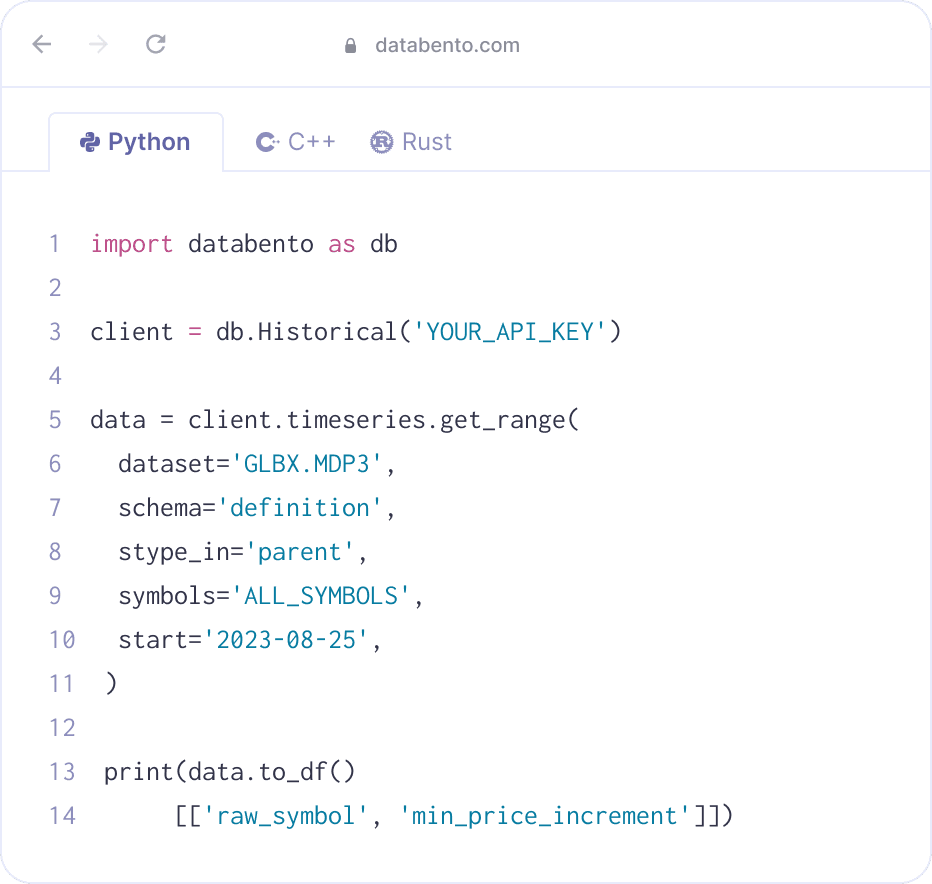

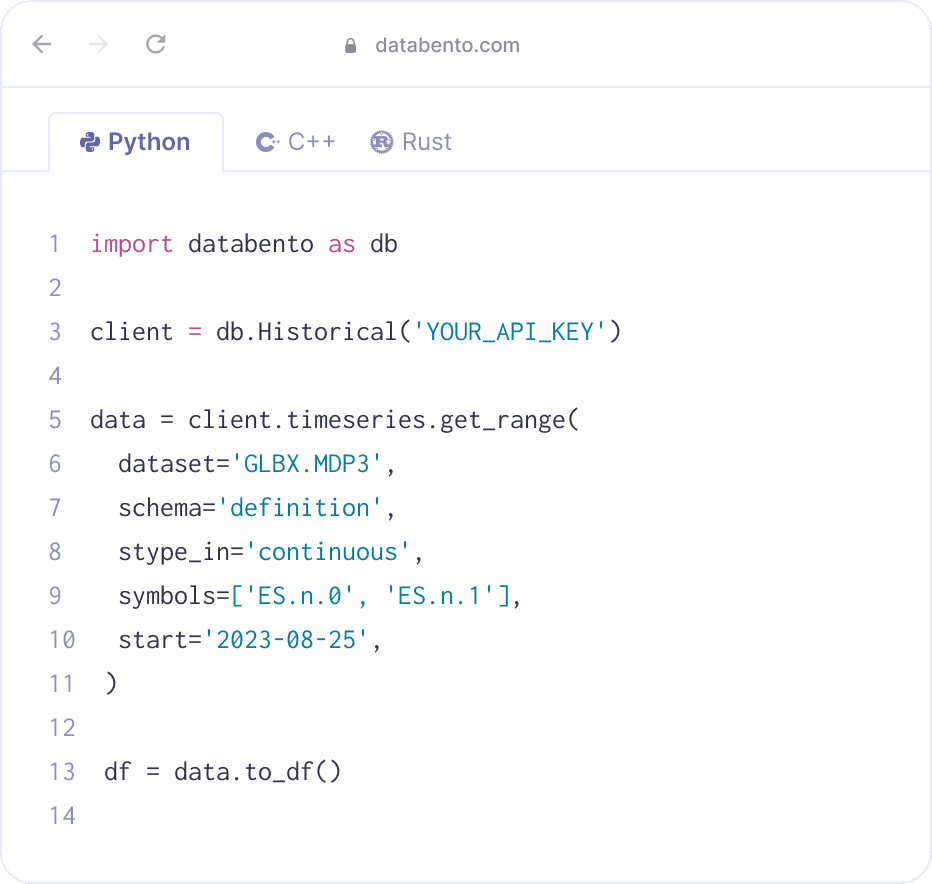

Simple workflows for futures trading

Nanosecond timestamps

The only normalized market data solution to provide up to four timestamps for every event, with sub-microsecond accuracy across venues.

Full order book

All buy and sell orders at every price level. Get each trade tick-by-tick and order queue composition at all prices.

Smart symbology

Handle rollovers and expirations with continuous contracts. Get every contract month with parent symbology.

Customize your data

Select symbols, format, encoding, and delivery. Get any range by the nanosecond.

Read our API reference and user guides

Documentation

Schemas

Our datasets support multiple formats, including order book, tick data, bar aggregates, and more. View all supported schemas ->

-

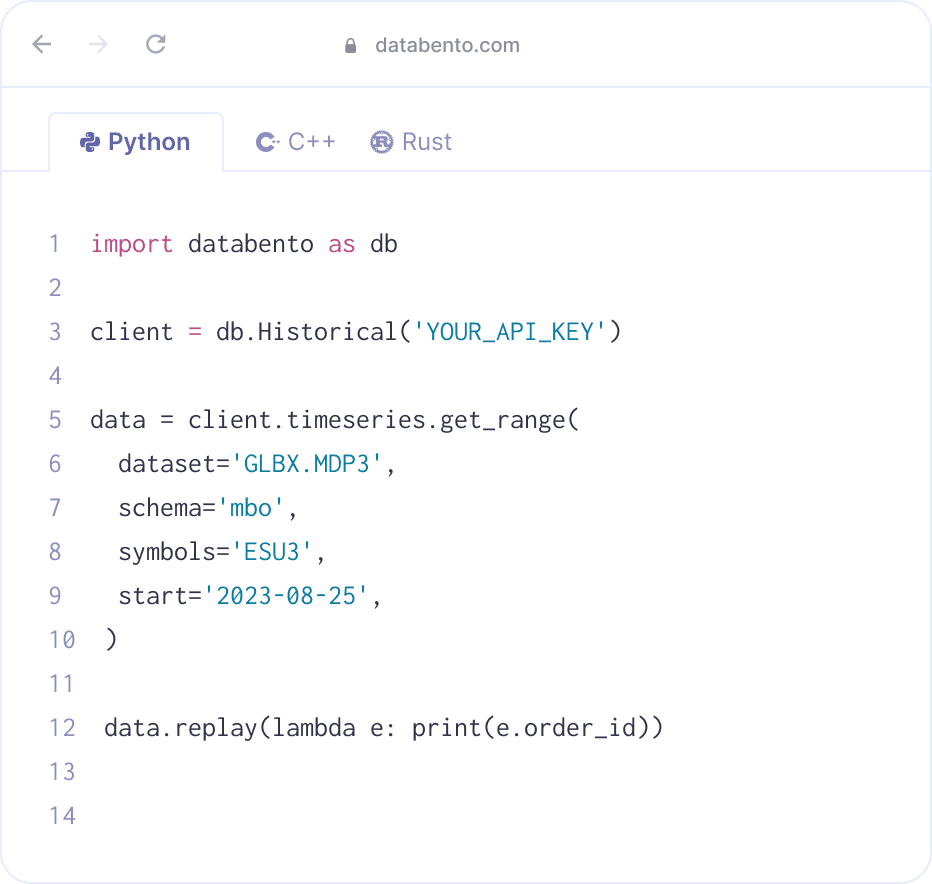

mbo

Market by order

Market by order, full order book, L3.

-

mbp-10

Market by price

Market by price, market depth, L2.

-

mbp-1

Market by price

Top of book, trades and quotes, L1.

-

tbbo

Top of book

Top of book, sampled in trade space.

-

trades

Trades

Tick-by-tick trades, last sale.

-

ohlcv-t

Market bars per second

Aggregates per second, minute, hour, or day.

-

definition

Definitions

Point-in-time instrument definitions.

-

imbalance

Imbalance

Auction imbalance, order imbalance.

-

statistics

Statistics

Intraday and end-of-day trading statistics, static data.

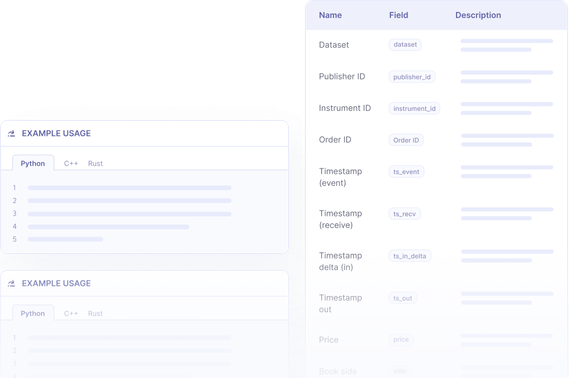

Fields

Examples of frequently used data fields. Each schema is represented as a collection of fields. View all supported fields by schema ->

-

publisher_id

Publisher ID

The publisher ID assigned by Databento, which denotes the dataset and venue.

-

instrument_id

Instrument ID

The numeric instrument ID.

-

order_id

Order ID

The order ID assigned at the venue.

-

ts_event

Timestamp (event)

The matching-engine-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_recv

Timestamp (receive)

The capture-server-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

-

ts_in_delta

Timestamp (sending)

The matching-engine-sending timestamp expressed as the number of nanoseconds before

ts_recv. -

price

Price

The order price where every 1 unit corresponds to 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

-

action

Action

The event action. Can be Add, Cancel, Modify, cleaR book, Trade, or Fill.

-

size

Size

The order quantity.

-

flags

Flags

A combination of packet end with matching engine status.

-

expiration

Expiration

The last eligible trade time expressed as a number of nanoseconds since the UNIX epoch.

-

strike_price

Strike price

The exercise price if the instrument is an option. Converted to units of 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

API methods

Examples of popular API methods. Our APIs are organized into four categories: metadata, timeseries, symbology, and batch download. View all supported API methods ->

-

timeseries

Get range

Stream time series data using our Historical API.

-

batch

Submit job

Submit a batch job to extract historical data files in bulk.

-

batch

Download

Download a completed batch job.

-

symbology

Resolve

Resolve a list of symbols into their exchange specific identifier.

-

metadata

List publishers

List all our dataset publishers.

-

metadata

List datasets

List all our available dataset names.

-

metadata

Get cost

Get the cost in US dollars for a historical streaming or batch download request.

-

metadata

Get dataset range

Get the available date range for a dataset.

-

metadata

List schemas

List all available market data schemas for a dataset.

Sampling frequencies

All datasets provide full flexibility and the ability to customize sampling resolution.

-

Every book update

Every order execution, add, cancel, replace, book snapshot, and more. By the nanosecond.

-

Tick-by-tick

Every trade and quote. By the nanosecond.

-

1 second

Subsampled BBO, last sale, and OHLCV aggregates by the second.

-

1 minute

Subsampled BBO, last sale, and OHLCV aggregates by the minute.

-

Hourly

OHLCV aggregates by the hour.

-

Daily

Daily market statistics, indicative opening and closing prices, OHLCV aggregates, and more.

What our users are saying

Michael Tung, Investments Lead

Rick Zhan, VP Quant Research

Paul Aston, Founder

Brett Harrison, Founder

Nikita Ostroverkhov, Algo Trading

V. Chen, Equity Research Associate

Chris Pento, Co-founder and CEO

Matt Papakipos

C. Garcia, Senior Quant Researcher

Frequently asked questions

Do you include options on futures data?

Yes, we include every listed options contract across all of the venues that we cover.

Do you support exchange-listed spreads on futures?

Yes, we include all multi-legged instruments, including calendar spreads.

What is CME Globex—how does it relate to CME, CBOT, NYMEX, and COMEX?

CME Globex is the electronic trading platform for all of CME Group's futures markets. The CME Globex MDP 3.0 feed includes data for all of CME, CBOT, NYMEX, and COMEX products.

Do you support both lead-month and far month futures contracts?

Yes, we provide an exchange-wide feed, meaning all listed expirations–front-month and far-month contracts—are included. We'll provide reference data and the order book even for very illiquid instruments that have zero volume.

I downloaded data from your website for 1 futures contract—why do the prices keeping jumping around, sometimes to nearly zero?

You're likely seeing these jumps because you downloaded a file with multiple instruments in it. You can confirm if this is the case by checking the symbol or instrument_id field to see if there are multiple instruments in your data.

Our website lists any futures and options product as a group of instruments, so for example if you set up a batch download for ES futures, you'll get all instruments associated with ES such as ESH5, ESM5, ESH5-ESM5, etc. This is equivalent to the ES.FUT parent instrument based on our parent symbology. Spread prices represent the basis and are often much closer to zero than the price of the outright, and it's quite common for spread prices to be negative.

If you only want to a single instrument like the front month contract, you have to use our API or filter out the unwanted symbols from any files that you download from our web portal.

What's the maximum number of API calls I can make per second or minute?

You can find API rate limits in our documentation.

Keep in mind that Databento's API limits are likely different from those you are used to from other vendors. Most other vendors only allow you to request data for 1 symbol at a time and paginate their API responses, often forcing you to make hundreds of API calls to fetch a million row of data.

Our API allows you to fetch arbitrary combination of symbols or every symbol across an exchange, and does not paginate results. You can fetch billions of rows of data with a single API call. As a result, our API limits are practically unlimited—you should never hit those limits if your application is behaving correctly.

Which asset classes do you cover under futures?

Our futures data is agnostic to asset class. We include all of them so long as they're listed on the exchange: futures on equity indices, interest rates, energies, agriculture, precious metals, FX, power, emissions, cryptocurrencies, and more.

Do you support intraday historical data for futures?

Yes, our historical data includes intraday-level granularity such as tick data (trades), top of book updates (MBP-1), market depth (MBP-10), and full order book (MBO). If you prefer aggregates, we provide top of book snapshots and OHLCV aggregates at the second and minute intervals.

We also let you fetch historical data intraday and access data from the current trading session. This can be done either through the historical API, if you've activated the appropriate license, or through the real-time API using intraday replay.

What type of API do you have for real-time futures data?

Our real-time data is provided over a simple TCP socket-based API, which we call our Raw API.

You'll find that our API is more lightweight and achieves lower latency compared to APIs using common application layer protocols like WebSocket or SSE; TCP is the same transport layer protocol used beneath WebSocket.

You can integrate our API in any programming language, as all it requires is that you can open a TCP socket. Our Python, C++, and Rust client libraries wrap our Raw API and make it easier for you to authenticate and subscribe to real-time data.