Options Price Reporting Authority (OPRA)

Quick definition

The Options Price Reporting Authority (OPRA) is the exclusive SIP that consolidates and disseminates last sale, NBBO, local exchange quotes, and other regulatory market data across all US equity options exchanges. The OPRA feed covers all index options, ETF options, and single name stock options on these exchanges.

OPRA is the exclusive SIP that disseminates regulatory market data (also called public market data) across all US equity options exchanges, as mandated by Regulation NMS.

OPRA covers all index options (e.g. VIX, SPX options), ETF options (e.g. SPY options), and single name options (e.g. NVDA, AAPL options) traded on US equity options exchanges. OPRA does not cover options on equity index futures, which are traded on futures exchanges like CME.

The OPRA feed provides a variety of event messages:

- Last sale

- National best bid and offer

- Local best bid and offer at each exchange

- End of day summary information like open, high, low, close, volume, and open interest.

- Open interest

- Trade condition codes

OPRA is managed by a committee of participant exchanges, specifically consisting of all equity options exchanges in the US. The plan participants report the trading activity on their exchanges to the OPRA SIP in Mahwah, which in turn consolidates and disseminates the data. As of 2024, the OPRA participant exchanges are:

- BOX Options Exchange

- Cboe Options Exchange

- Cboe EDGX Options Exchange

- Cboe BZX Options Exchange

- Cboe C2 Options Exchange

- Members Exchange (MEMX)

- MIAX Options Exchange

- MIAX Emerald

- MIAX Pearl

- MIAX Sapphire

- Nasdaq PHLX

- Nasdaq ISE

- Nasdaq Options Market

- Nasdaq MRX

- Nasdaq GEMX

- Nasdaq BX Options

- NYSE Arca Options

- NYSE American Options

Unlike CTA and UTP which have distinct names for the feeds that they oversee (such as CTS and CQS), OPRA does not have a specific name for its feed. As such, it's also common to refer to the feed generically as the "OPRA feed". It's also common to refer metonymically to the feed itself as OPRA, even though OPRA is the entity that oversees the feed.

The latest iteration of the OPRA feed is sometimes referred to as the OPRA binary feed to distinguish it from the earlier generation of the feed, which wasn't built on the Pillar architecture. It can also be also referred to as the OPRA Pillar feed, adopting the same convention as their feed specification docs. The earlier feed is sometimes called the legacy OPRA feed.

Another point of confusion that commonly arises is in the application of the term "securities information processor". A securities information processor (SIP), legally defined in 15 USC § 78c(a)(22), refers to the entity that is engaged to collect, process and distribute market data on behalf of exchanges. However, it has become widespread for practitioners to use "SIP" to refer specifically to the infrastructure, feed, or system that is overseen by said entity.

As such, it is common to use the term "OPRA SIP" in specific contexts to refer to the infrastructure per se and not the organizational entity, as in "OPRA SIP latency".

The term "SIP" is more commonly associated with the equity market SIPs, specifically CTA and UTP. This leaves some ambiguity when one says "the SIPs", which is often interpreted to mean only the CTA and UTP SIPs. Hence, some practitioners and vendors will usually say "OPRA and the SIP feeds" to clarify that they're referring to all three SIPs. In such situations, it's also possible to say "OPRA, CTA and UTP" or "OPRA and the equity (market) SIPs" to avoid confusion. It's also clearer to state "all three consolidated feeds" instead of "all three SIPs" in case your counterparty is not familiar with regulatory definitions.

The Securities Industry Automation Corporation (SIAC), a wholly-owned subsidiary of NYSE, is responsible for the infrastructure and technical maintenance of the OPRA and CTA SIPs. In other words, SIAC is responsible for all planning, development, operation and maintenance of the OPRA system. As such, OPRA shares some similarities to NYSE, including the adoption of a binary protocol based on the NYSE Pillar wire protocol. Likewise, the systems of OPRA, NYSE, and CTA are all based in the same Mahwah data center.

Since OPRA already requires a significant amount of storage and bandwidth to handle, most vendors and trading participants source their US equity options market data from OPRA instead of the proprietary exchange feeds. This deviates slightly from a typical practice in US equities, where proprietary feeds such as Nasdaq Basic, Cboe One, and NYSE Best Quotes and Trades (BQT) exist specifically as alternatives to the SIPs in use cases that do not need to conform to the Vendor Display Rule.

On July 26, 2021, OPRA migrated to the Pillar platform, bringing improvements to the feed's performance and adopting a new binary format.

On February 5, 2024, after several scheduling changes, OPRA finally completed its migration from a 48-line to a 96-line multicast network. The change was intended to increase the feed's capacity and reduce its latency.

In anticipation of these changes and OPRA's guidance on the increased bandwidth requirements that come with the migration, many MSPs and vendors upgraded to 100 gigabit networking in 2023.

Immediately after the 96-line migration in Feburary 2024, OPRA's capacity increased from 400 billion transactions per day to 1 trillion transactions per day, and 99th percentile latency reduced from 543.5 microseconds to 57.5 microseconds. Since the upgrade to Pillar, the OPRA SIP's median latency has been mostly unchanged around 19.5 to 20.5 microseconds, and the peak message microbursts on OPRA have gone over 40 million messages per second.

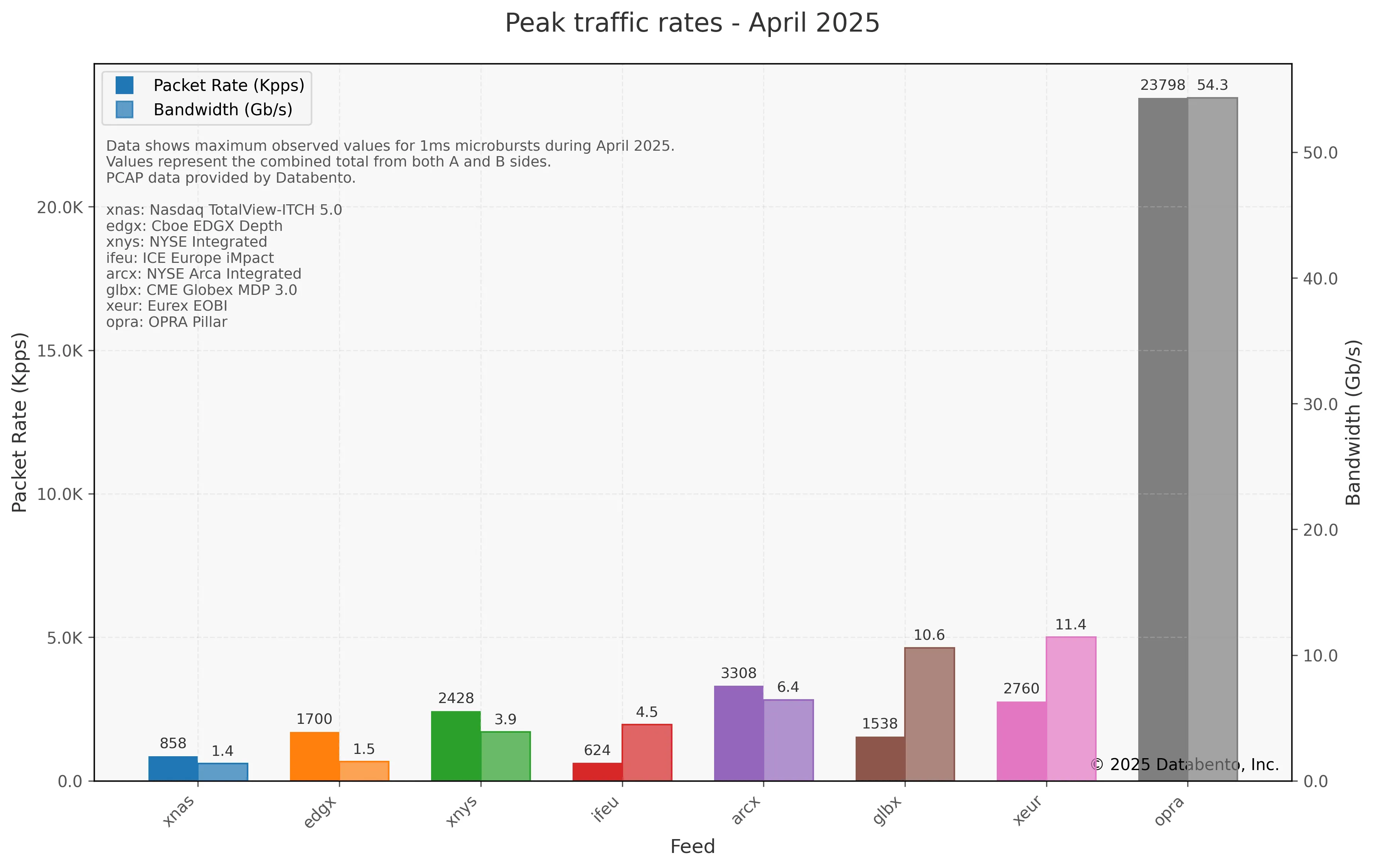

During the April 2025 market sell-off, peak 1-millisecond bursts on OPRA exceeded 23.7 million packets per second—over 187 million messages per second.

OPRA is a L1 feed—it only provides trades and quotes. While it's possible to aggregate and overlay each exchange's best bid and offer to create the impression of a market by price (L2) feed, this is not an accurate L2 representation since the sweep-to-fill liquidity up to any price will be underestimated. To get L2 or full order book data on any US options exchange, an exchange prop feed is required.

OPRA is notable for its high bandwidth and performance requirements even compared to other raw direct feeds. 40 or 100 gigabit networking is often used in deployments that receive the raw OPRA feed. Over 1 million unique instruments (options contracts) are listed and active on OPRA at any time—two to three orders of magnitude more than the total number of listings on the US stock markets—bringing challenges with symbology and reference data management. The above challenges have significant implications and limitations on how you can receive the OPRA feed without a cross-connect or direct handoff.

Few vendors offer historical OPRA data than CTA or UTP SIP data, since they might not have the capacity to process and deliver large amounts of data. Very few vendors provide real-time OPRA data over the internet or public cloud, since they may not have the internet bandwidth, inline compression or normalization strategy to support the feed's demanding requirements. Even among the very few vendors that do provide real-time OPRA data over internet, most will conflate the updates, and only send NBBO updates or a subsampled feed.

More often, vendors will offer real-time OPRA data only over a feed handler or managed ticker plant solution that requires a cross-connect or direct handoff in a colocation environment—a configuration that will cost significantly more than receiving a normalized feed over WAN.

Databento provides both historical and real-time OPRA data, and is able to deliver OPRA over a variety of connectivity options, including internet, dedicated interconnects to public cloud, and physical cross-connects.