Direct proprietary feeds vs SIPs: which is right for you?

We frequently receive inquiries about the types of data provided by consolidated feeds from the Securities Information Processors (SIPs) compared to direct proprietary (prop) feeds from individual venues.

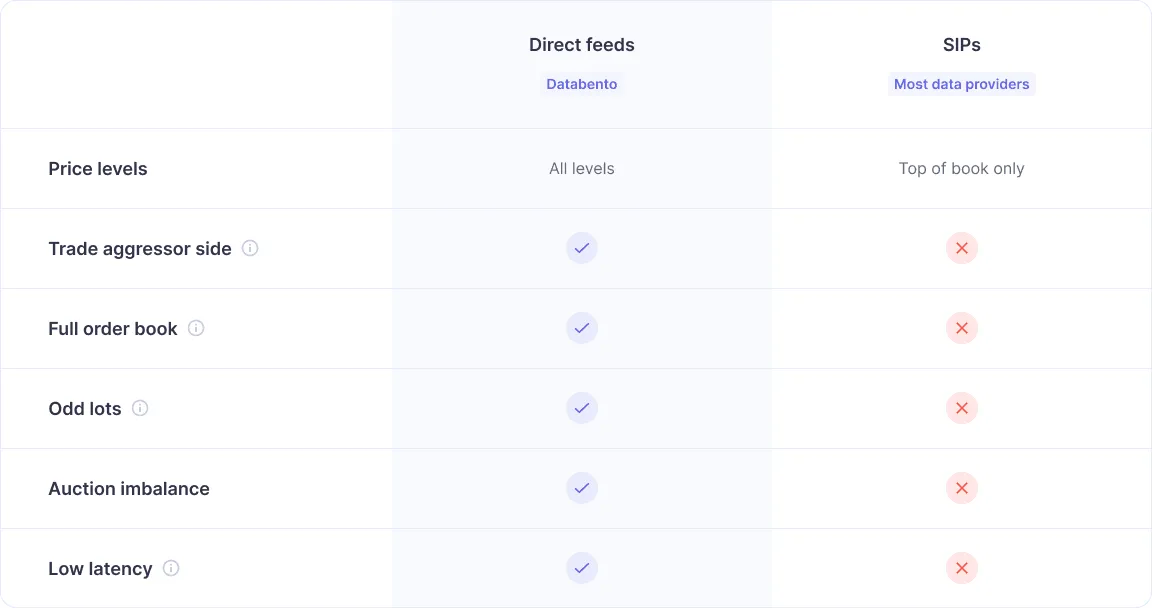

Most market data providers source their data from the SIPs, limiting users to only top-of-book information. At Databento, we source our US equities data from direct prop feeds, which provide more granular data than the SIPs.

This article explores the disparities between SIP and direct prop feeds and the types of users who might find each beneficial.

Before delving into the distinctions between these feeds, let's establish a few key definitions.

The Securities Information Processors, known colloquially as "The SIPs," are part of the public infrastructure for market data. The SIPs are overseen by the Consolidated Tape Association (CTA) plan and the Unlisted Trading Privileges (UTP) plan to collect, process, and distribute quote and trade data for US equities. The Option Price Reporting Authority (OPRA) oversees this functionality for US equity options.

A few primary purposes of the SIPs are to publish the National Best Bid Offer (NBBO), calculate market-wide circuit breakers for market-wide halts, and calculate limit-up limit-down (LULD) price bands for individual instrument halts.

Today, there are three SIPs: the Consolidated Tape Association (CTA), the Unlisted Trading Privileges (UTP), and the Option Price Reporting Authority (OPRA). The CTA processes and administers data for securities listed on NYSE through Network A and all other NYSE-affiliated venues through Network B. Serving the same purpose, the UTP processes and administers data for Nasdaq-listed securities and over-the-counter (OTC) markets through Network C. OPRA, administered by the Chicago Board Options Exchange (CBOE), aggregates and disseminates consolidated last sale and quotation information for exchange-traded options.

Most exchanges sell their data through proprietary data feeds, such as Nasdaq's TotalView-ITCH feed. These feeds offer additional quote and trade information, like trade aggressor side, odd lot quotes, and auction imbalance which aren't available from the SIPs.

SIP feeds can be a great choice for users who don't require latency-sensitive data or information beyond top-of-book trades and quotes. For users requiring data for individual, non-professional use, SIP feeds will most likely include all the information you need.

SIP data only provides "Level 1" data, including trades, top-of-book quotes, and supplementary information (e.g., trade conditions, trade status, LULD price bands, and official OHLC prices and volume). Unlike prop feeds, SIP data leaves out valuable information that other participants have access to, such as odd lot quotes, order book depth, and full order history.

Additionally, the SIPs never tell you whether a trade is buyer or seller-initiated. Users must use quote prices and participant timestamps to determine whether a trade is buyer or seller-initiated, leading to inaccurate information on as much as 45% of trades.

Direct prop feeds are a great choice for users that require more granular data, such as MBP ("Level 2") or MBO ("Level 3"), and lower latency data. Prop feeds provide additional insights on quotes and trades that aren't protected by Reg NMS, such as odd lot quotes, constituting nearly 50% of unreported U.S. equities market activity to the CTA/UTP SIPs.

Prop feeds are also known for their latency advantage over the SIPs. The CTA/UTP SIPs can incur unnecessary latency due to the locations being in Mahwah and Carteret. For example, when reporting trades in NYSE-listed stocks on Nasdaq in Carteret to the CTA in Mahwah. For high-frequency traders and those requiring lower latency data, direct prop feeds are much faster than the SIPs.

Unlike SIP data, prop feeds show quotes and trades on a given venue. An advantage of SIP feeds is that they consolidate NMS-protected quotes and trades from all markets.

Our equities data is sourced from premium direct prop feeds, including Nasdaq TotalView-ITCH (XNAS.ITCH) and Databento Equities Basic (DBEQ.BASIC). We only source data from direct feeds to provide more reliable and granular information to our users requiring more than top-of-book, "L1" data.

Additionally, we consolidate the prop feeds in Secaucus NY4, minimizing the average distance to all equities matching engines and providing lower latency data than the SIPs.

This can result in slight discrepancies between our data and other data vendors. However, due to price protection rules under Reg NMS, the prices on prop feeds compared to the prices on CTA/UTP will still be similar.

Ultimately, using SIP or direct prop feeds depends on your use case. SIP data is sufficient for those only needing top-of-book information. Direct prop feeds are better for those needing lower latency and more granular data.