How to get real-time US stock market data (without paying license fees)

Have you ever bought stock on your brokerage app and wondered why the execution price rarely matches the quote price, even when there appears to be plenty of depth and a stable spread?

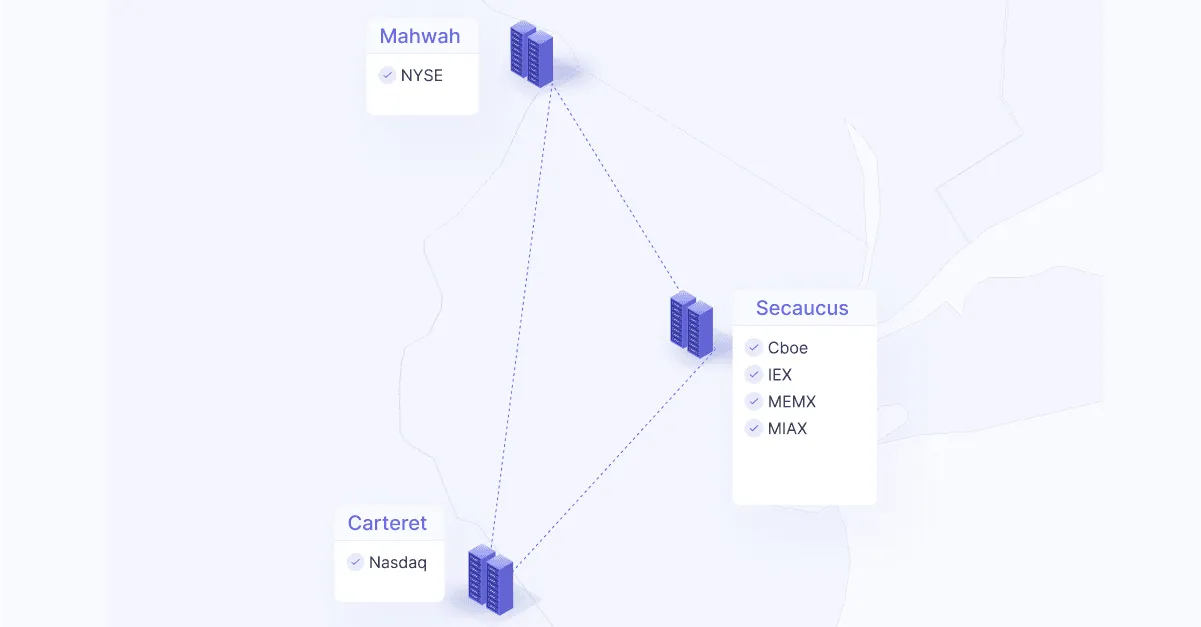

A primary reason is that brokerages usually use a proprietary feed like IEX, Cboe One, or Nasdaq Basic to display real-time quotes but match your trades using the SIPs. While there's a regulatory requirement to execute at NBBO or better, there's no such requirement mandating that you display the NBBO in real-time on your mobile app.

The SIPs and most exchanges consider the display of real-time quotes on a web or mobile app as a distribution use case, and distribution fees are usually the most expensive item on their fee schedules. If you're building a retail-scale app with 100k users and above, even a $3 monthly per-user display device fee on CTA and UTP can start to have an appreciable effect. More importantly, having that many reported users starts to carry a significant audit risk, and compliance is costly as well.

In this situation, it's best to avoid distribution fees, which is where prop feeds come into play. Here are two tips to get real-time data without paying distribution licensing fees.

The main upside of mixing IEX's prop feed with the SIPs is that IEX has the most permissive real-time redistribution rules among all of the US stock exchanges. As long as the feed is delayed by 15 ms, it's free to display and IEX won't require end users to paper with the exchange.

Note that zero license fees don't mean the data is completely free. Users will need to pay for a cross-connect and hosting to pick up IEX's feed directly or pay vendor service fees to get it through for IEX's own IEX Cloud service or a third-party vendor.

At this time, cross-connect and hosting fees with any MSP at IEX's Equinix POP cost at least $800/month with no server redundancy.

Why this works: microstructure of single-venue trades and quotes

There's one reason why this tip works: trades and quotes on a single venue or subset of venues are usually very close to NBBO.

For instance, Cboe One is claimed to be within 1% of NBBO 98.29% of the time. And many of our customers using our Nasdaq TotalView-ITCH feed find the EOD prices on Nasdaq are sufficiently close to the consolidated EOD prices.

Price protection and improvement rules keep the last sale prices in sync. Venues need competitive spreads to stay in business. Market makers are incentivized to capture market share on any venue with significant ADV, which drives their quotes towards NBBO.

This is good enough for most users looking at the real-time prices over a screen.

Alternatives to IEX

Cboe One and Nasdaq Basic are good alternatives to IEX, however, they're not free.

Cboe One has a competitive enterprise fee tier, which starts to make sense when you have a large number of customers. If you only want to write a client for a single protocol, the 12+% ADV on the Cboe venues is compelling compared to the 2+% ADV on IEX.

Nasdaq Basic also gives you the ability to pick up the Nasdaq TRFs with the NLS add-on, in which a good 40+% ADV from alternative trading facilities is reported. However, the distribution fees start at $2,000 per month.

The other option to get real-time US stock data with zero license fees is with Databento Equities Basic.

This US equities bundle features four exchanges: MIAX Pearl Equities, IEX*, NYSE National, and NYSE Chicago. The bundle includes the following features:

- Includes both real-time data and historical data starting from April 2023, and continuously available on a T+1 basis.

- Both usage-based and flat rate pricing available: only pay for what you use, or get unlimited use of historical and real-time data for only $825 per month.

- Multiple data schemas: market depth (MBP), last sale, OHLCV aggregates, and more.

- High-fidelity capture with nanosecond-resolution hardware timestamps and PTP time synchronization.

- Multiple encodings, including CSV, JSON, and our ultra-fast compressed binary format (DBN, learn more on our Github or Docs).

- Support for batch flat file downloads, direct-to-application streaming, and market replay.

- Point-in-time instrument definitions.

No vendor has offered this combination in a single API until now. Databento Equities Basic is the industry's first multi-venue prop feed consolidation that has zero distribution license fees and can be accessed from our data catalog. Nasdaq BX and PSX have zero distribution fees but carry an activation fee.

To our knowledge, there isn't any literature mentioning this combination, despite all exchange fee schedules being publicly available. It's easy to overlook when there are 16 exchanges and fee schedules with hundreds of line items, exceptions, and waivers combined. Additionally, writing multiple parsers and normalizing this blend of price-level and order book protocols and their symbology systems is nontrivial.

If you're building a fintech or brokerage app that needs to display real-time US stock market data to customers, Databento Equities Basic will be the most complete solution with the lowest possible all-in price point that supports unlimited commercial use and distribution.

To learn more, explore our coverage and get pricing, read our blog post, or contact sales to schedule a demo.

*Note: IEX TOPS feed is delayed 15 milliseconds per exchange requirements. All other venues are real-time.