What are 0DTE options?

0DTE (Zero Days To Expiration) options are options contracts that expire at the end of the current trading session. No matter when the options contract began trading, it will eventually be 0DTE.

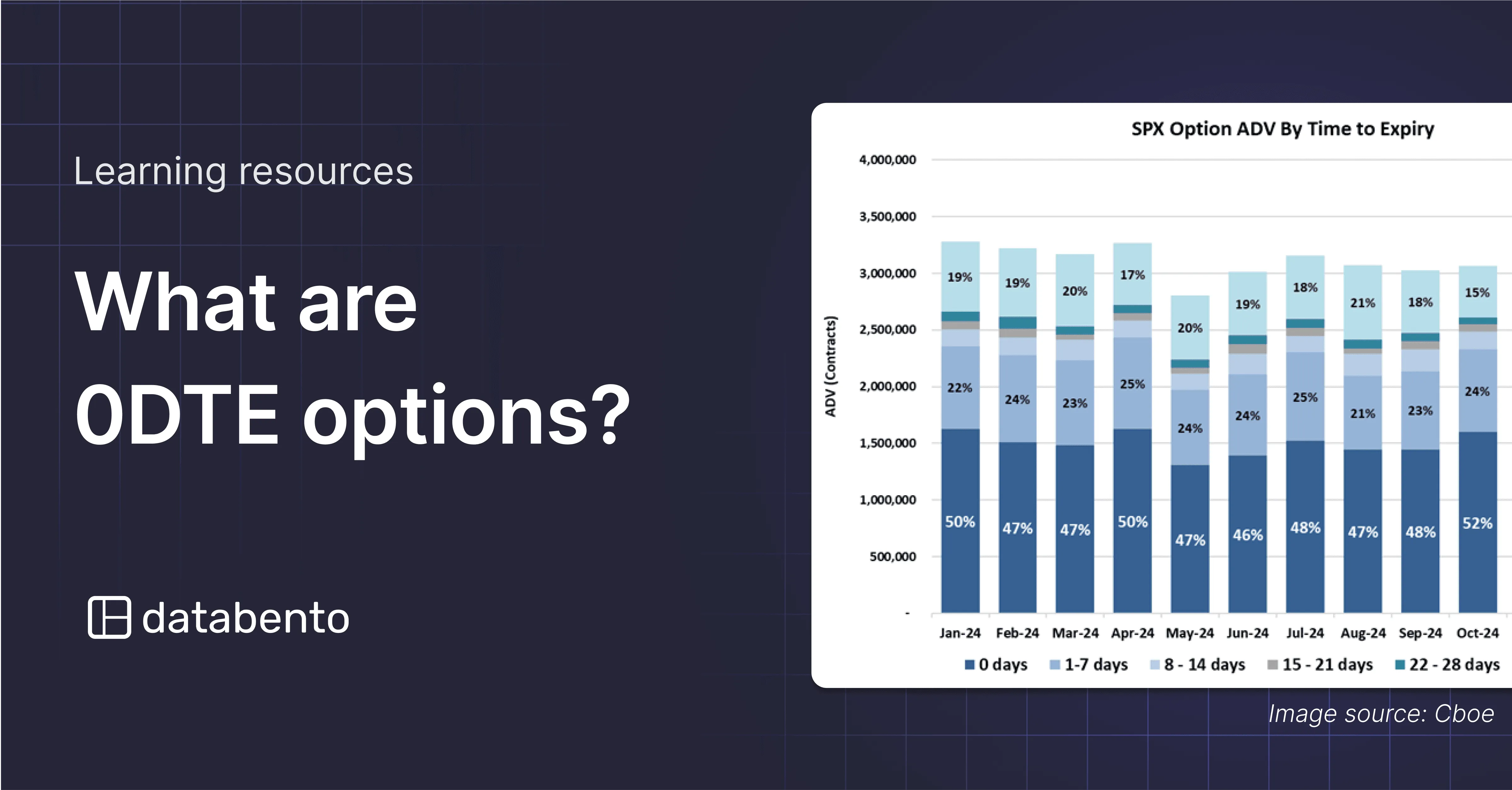

The Cboe first introduced weekly options in 2005. These options allowed investors to trade 0DTE once per week. Monday and Wednesday expires were added in 2016, and in 2022, all five trading days per week had options. As of February 2025, approximately 56% of all SPX options volume was in 0DTE contracts. Approximately 30% of all options on futures traded in Q1 2024 were 0DTE.

0DTE options are popular with retail speculators for a variety of reasons:

- 0DTE options tend to have lower premiums than their >0 DTE counterparts since there is less time value priced in. This allows the trader to control a large notional position with a small amount of capital.

- Volumes and liquidity in 0DTE contracts have grown significantly, tightening their bid-ask spreads and reducing overall transaction costs.

- Popular strategies for 0DTE options are relatively simple to execute. Many retail traders use 0DTE options to capitalize on short-term volatility spikes around major economic releases (CPI, FOMC meetings, etc.) and earnings announcements. Others take advantage of the rapid theta decay on 0DTE options in different ways like selling credit spreads or collecting premium on OTM options.

On the flip side, some of these strategies carry extreme leverage and long positions lose value quickly from theta decay.

Our docs example demonstrates how to request live or historical data for 0DTE options using Databento's API.

Databento provides equity options data from the OPRA feed. We also provide options on futures data from CME Globex, ICE Futures Europe, and ICE Endex. New users get $125 in credits to explore our catalog.