Stock data API

Our real-time and historical stock data API covers all 15 U.S. equity exchanges. Try our data for free.

Complete stock market coverage

Get the most granular U.S. stock data on the market, backed by powerful API features for every trading strategy.

All 20,000+ U.S. stocks and ETFs

Every company ticker symbol and ETF across 15 exchanges for full stock market coverage.

Up to 7 years of stock price history

Get price and size data for every individual stock order in the book, starting from 2018.

Fastest real-time stock API

Real-time, delayed, and intraday stock feeds. 590 μs median latency and 99.99% uptime.

Stock data direct from exchanges

U.S. equity market data from the same feeds used by top trading firms and hedge funds.

16 PB of normalized market data

Lossless futures, options, and equities data by the nanosecond—all in one universal API.

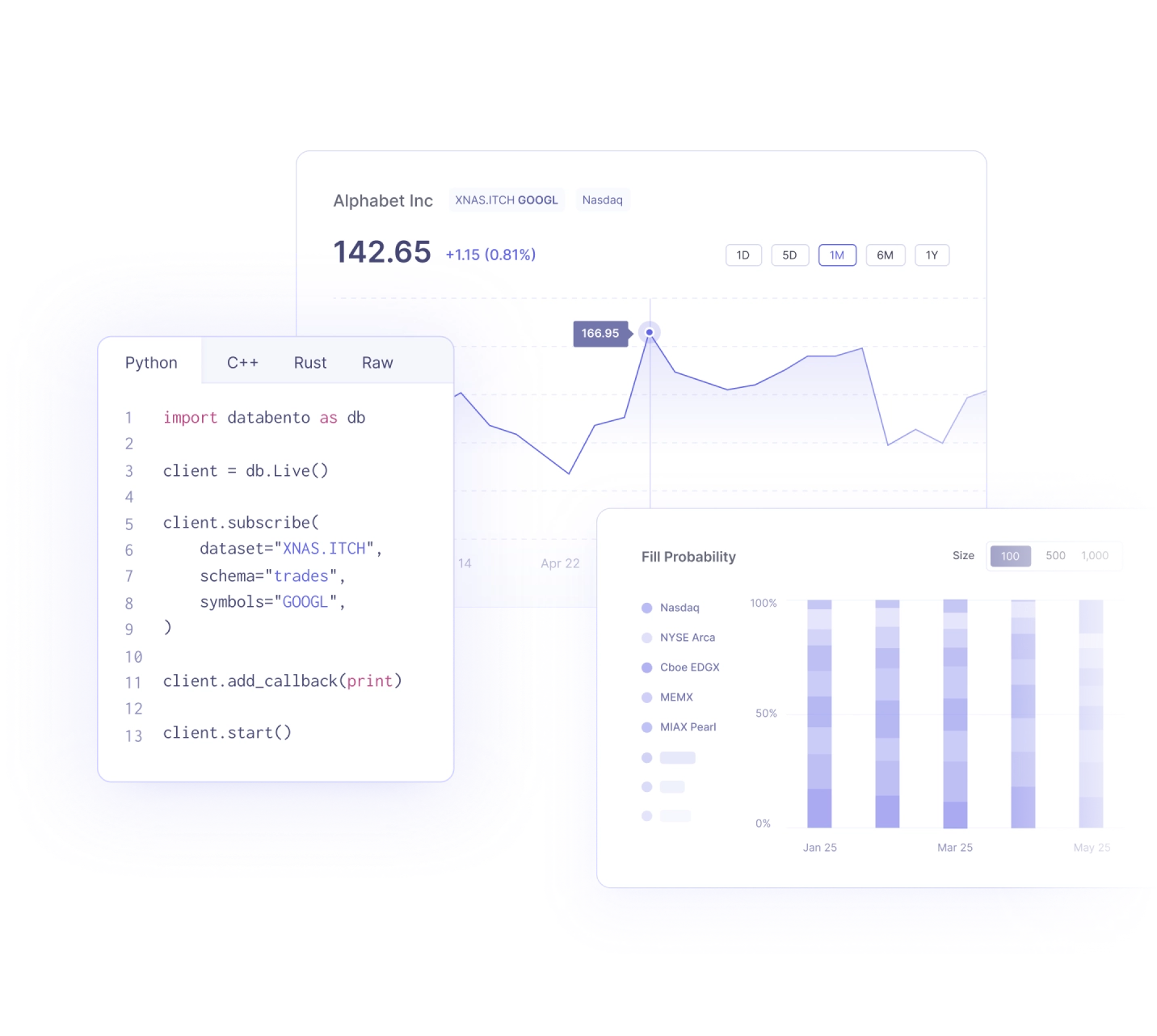

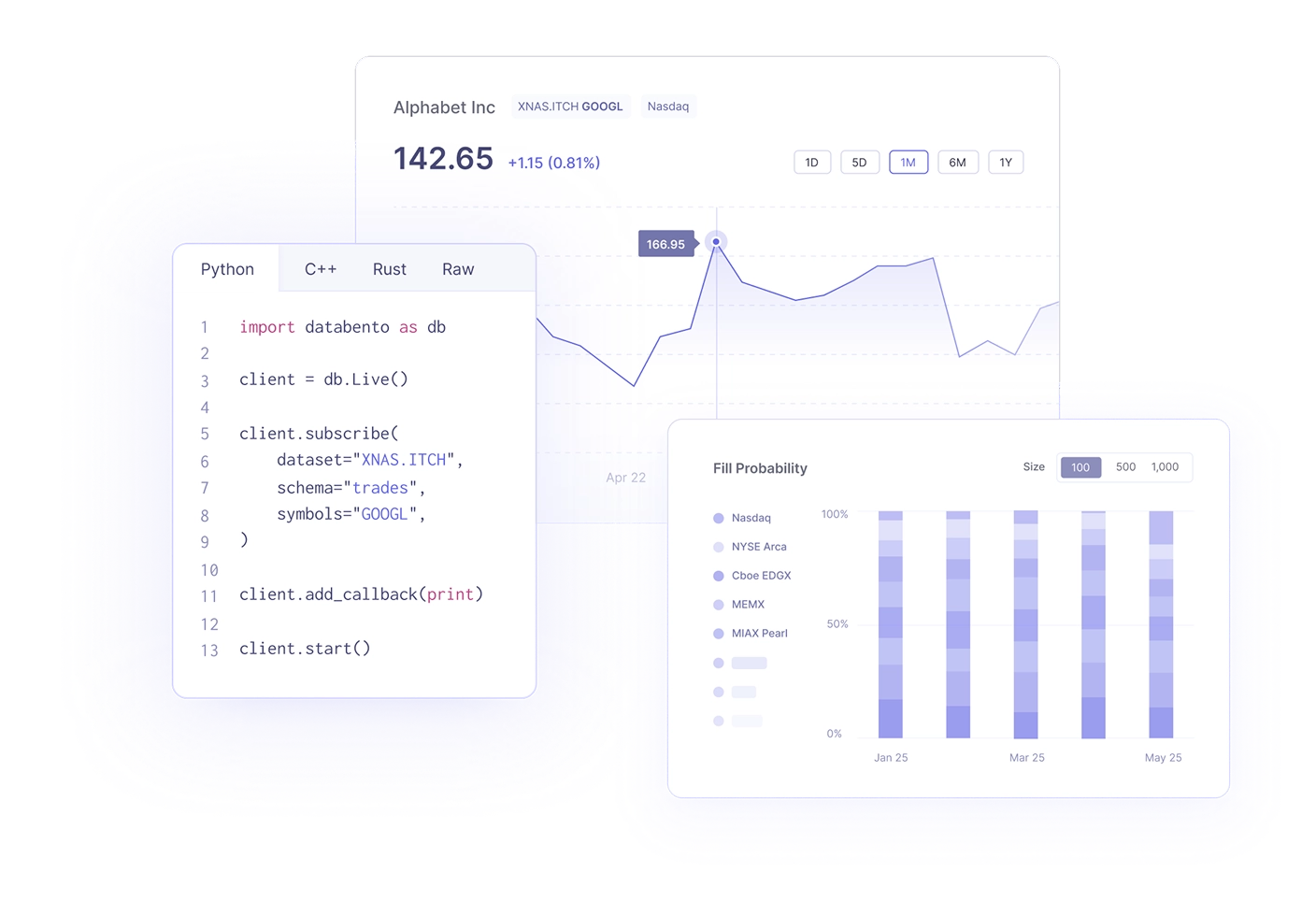

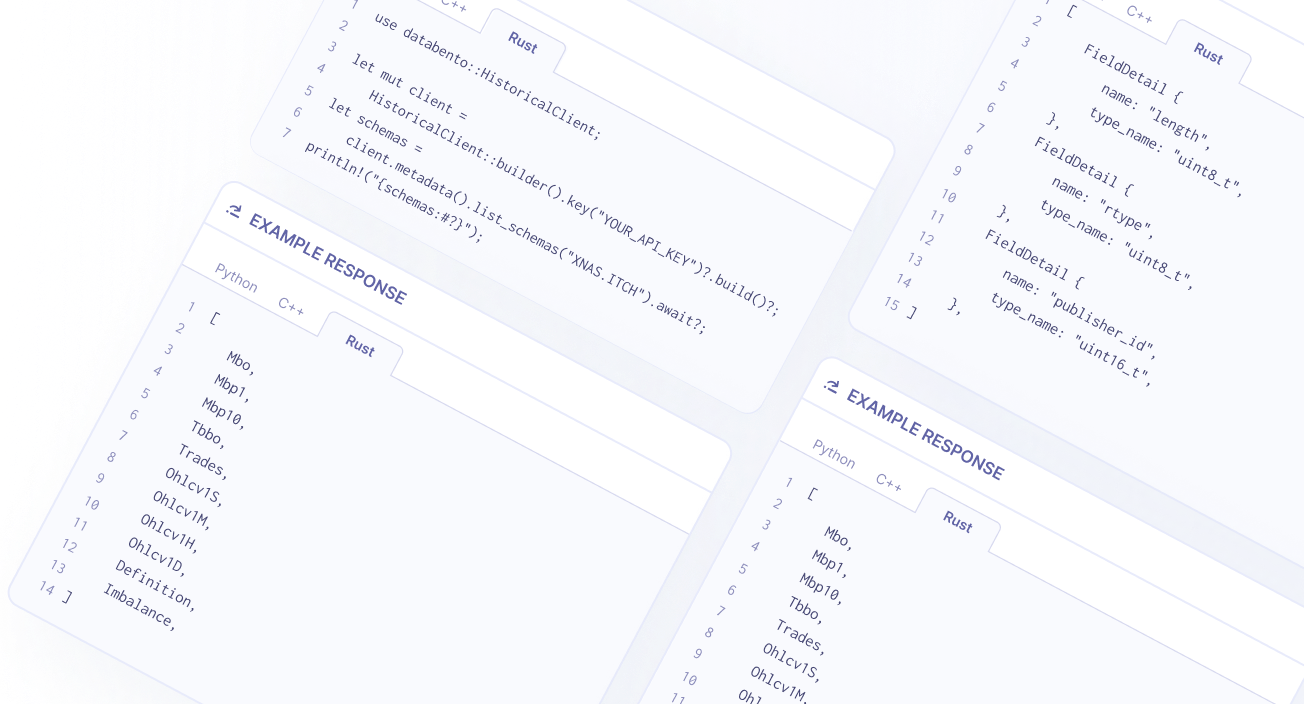

Use any programming language

You can also stream or download stock data with our Python, Rust, and C++ clients.

STOCK MARKET DATA FOR DEVELOPERS

Official distributor of 45 equities venues

NYSE, Nasdaq, Cboe, IEX, MEMX, and MIAX stock data sourced from proprietary feeds at our Equinix NY4 colo.

View all venues ->

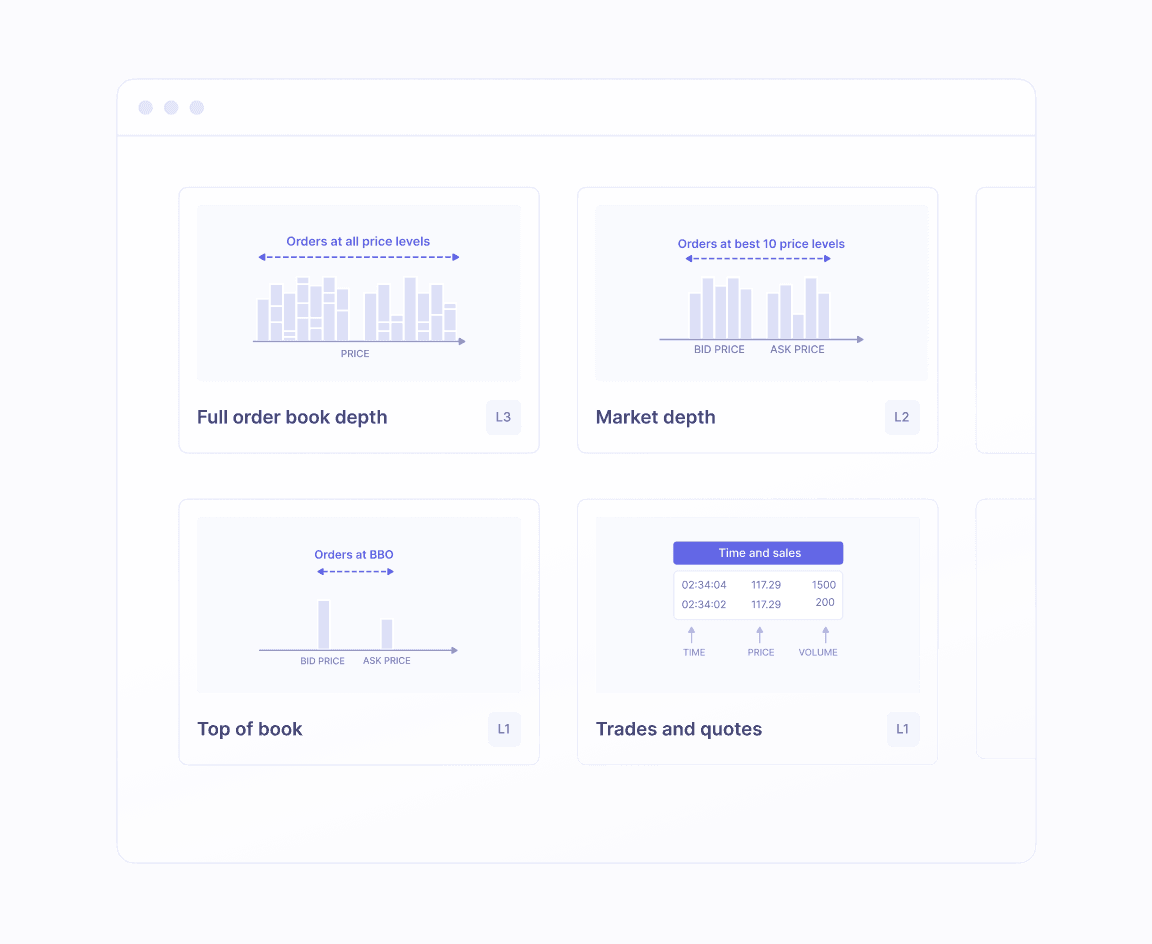

FULL ORDER BOOK DEPTH

Download stock data in multiple formats

Request stock data in any of our 16 schemas and download as a flat file in CSV, JSON, Parquet, or our binary encoding. Get the right granularity for your use case: tick data, stock quotes, OHLCV aggregates, EOD summaries, and more.

Nanosecond-resolution timestamps

The only normalized stock market data API to provide up to four timestamps per event. Nanosecond precision and sub-microsecond accuracy across U.S. equities venues.

Full stock market replay

Replay every U.S. equities trade, quote, and order at up to 19.2 million ticks per second. Subscribe to every update of each symbol on the venue in a single API call.

Market data beyond the SIPs

Access live auction imbalances, paired and total quantities, and intraday symbol definitions for all U.S. equities. Track IPOs, trading status changes, and listing events in real time.

Discover the modern standard for stock market data

The first API to deliver full order book depth over the internet. Access the entire universe of U.S. stocks and ETFs from anywhere.

Databento US Equities

Equities

Data from 15 US equities exchanges and 30 ATSs under a single pricing plan.

Since 2018

20,000+ symbols

Historical

Live

| Exchange | Dataset | Definitions | L1 | L2 | L3 |

|---|---|---|---|---|---|

| Nasdaq | Nasdaq TotalView-ITCH | | | | |

| Nasdaq BX | Nasdaq BX TotalView-ITCH | | | | |

| Nasdaq PSX | Nasdaq PSX TotalView-ITCH | | | | |

| NYSE | NYSE Integrated | | | | |

| NYSE American | NYSE American Integrated | | | | |

| NYSE Arca | NYSE Arca Integrated | | | | |

| NYSE National | NYSE National Trades and BBO | | | | |

| NYSE Texas | NYSE Texas Integrated | | | | |

| Cboe BZX | Cboe BZX Depth | | | | |

| Cboe BYX | Cboe BYX Depth | | | | |

| Cboe EDGA | Cboe EDGA Depth | | | | |

| Cboe EDGX | Cboe EDGX Depth | | | | |

| MEMX | MEMX Memoir Depth | | | | |

| MIAX | MIAX Pearl DoM | | | | |

| IEX | IEX TOPS | | | | |

| FINRA/Nasdaq TRF Carteret | Nasdaq Basic with NLS Plus | | | | |

| FINRA/Nasdaq TRF Chicago | Nasdaq Basic with NLS Plus | | | | |

| FINRA/NYSE TRF | Coming soon NYSE Trades | | | | |

The most powerful and customizable stock data API

Stream real-time stock prices, query historical tick data, and download intraday market feeds in any format.

Read our API reference and user guides

Documentation

Data formats

When requesting stock data, you specify which data format (schema) to receive your data in. View all schemas ->

-

mbo

Market by order

Level 3 stock data. Full order book depth with all buy and sell orders at every price level.

-

mbp-10

Market depth

Level 2 stock data. Aggregated book depth with trades and updates at top 10 price levels.

-

mbp-1

Top of book

Level 1 stock data. Stock trades and quotes at at the top price level (best bid and offer).

-

tbbo | bbo

BBO on trade or interval

Top-of-book stock quotes captured before each trade or at 1s or 1m intervals.

-

trades

Tick-by-tick trades

Last sale stock data. Every executed stock trade with price, size, depth, side, and more.

-

ohlcv-t

Aggregate bars

Open, high, low, close stock price bars with volume per second, minute, hour, or day.

-

definition

Reference data

Symbol-level stock metadata like instrument name, tick size, and listing status.

-

imbalance

Auction imbalance

Stock auction imbalance data such as clearing prices and paired quantity during auctions.

-

statistics

Summary statistics

Intraday and end-of-day stock trading stats published by each U.S. exchange.

Fields

Schemas are made up of standardized fields. The following fields appear in most schemas and apply to all asset classes. View all fields per schema ->

-

publisher_id

Publisher ID

A unique ID for the data publisher, used to identify the exchange or trading venue in normalized market data.

-

instrument_id

Instrument ID

A numeric ID assigned by the exchange that maps to a stock or other instrument across financial markets.

-

order_id

Order ID

The venue-assigned ID for a specific order in the order book.

-

ts_event

Event timestamp

The timestamp when the event was received by the matching engine, in nanoseconds since the UNIX epoch.

-

ts_recv

Receive timestamp

The timestamp when the event was received by Databento’s capture server, in nanoseconds.

-

ts_in_delta

Send latency

The difference in nanoseconds between when the matching engine sent the data (

ts_event) and when it was received (ts_recv). -

price

Stock price

The price of an order or trade, represented as a fixed-point integer where 1 unit equals 0.000000001 (1e-9).

-

action

Order book event

The type of order book event: Add, Cancel, Modify, cleaR book, Trade, or Fill.

-

size

Order quantity

The number of shares specified in the order or trade.

API methods and endpoints

Common API methods used to request historical equities data. These methods also support other asset classes, with all access provided through one historical and one real-time API. View API docs ->

-

timeseries

Get range

Stream historical stock data in any schema and file format for a specified date range.

-

batch

Submit job

Submit a historical data request for batch download. Recommended for jobs over 5 GB.

-

batch

Download

Download stock data from a completed batch job as individual flat files or in a single ZIP.

-

metadata

Get cost

Quote the USD cost for a historical streaming or batch request in advance.

-

metadata

Get dataset range

Get the available date range for historical stock data per U.S. equities dataset.

-

metadata

List schemas

View all supported market data schemas for a given dataset.

Sampling frequencies

Each schema uses a fixed resolution based on the market activity it captures. All schemas are derived from full order book data, so you can resample any dataset to your preferred frequency.

-

Order book update

Every execution, add, cancel, snapshot, and more, timestamped to the nanosecond (

mbo). -

Tick-by-tick

Every trade and quote, timestamped to the nanosecond (

trades). -

1 second

BBO and last sale data or OHLCV price aggregates per second (

bbo-1s,ohlcv-1s). -

1 minute

BBO and last sale data or OHLCV price aggregates per minute (

bbo-1m,ohlcv-1m). -

Hourly

OHLCV price aggregates per hour (

ohlcv-1h). -

Daily

Daily stats with indicative open/close prices or OHLCV price bars (

statistics,ohlcv-1d).

Pricing

Frequently asked questions

How do I get started? Is there a free API tier available?

Getting started is simple—just sign up to instantly generate your API key. Whether you're evaluating data sources, comparing financial data providers, or ready to start building a production-ready application, new users are automatically credited with $125 in free API credits. These can be applied toward historical data requests or used to offset the cost of a subscription plan if you want to try real-time data.

Databento is the only financial data provider to offer real-time stock data with zero license fees, free redistribution rights, and full exchange compliance. This means you can start testing live data without the need to purchase a separate exchange license. This benefit is available exclusively through our US Equities Mini feed with any active subscription plan. Many users rely on this dataset to power dashboards, financial news applications, and real-time ticker visualizations—especially those accessed by a large number of end users—without the cost or complexity of traditional licensing.

Our APIs share a unified structure across asset classes, making it seamless to move from backtesting to live trading. We provide a Quickstart guide and code examples tailored to common use cases to help you get up and running fast.

Is the stock API separate from your other services?

No. Our real-time and historical APIs are unified across all asset classes: futures, options, and equities. Our APIs share the same methods and endpoints regardless of which asset class you're working with, and our schemas use consistent fields across all datasets. This makes the API more scalable and easier to extend into new markets without rewriting your integration.

Databento US Equities, however, is a standalone service made up of 18 datasets sourced from every major U.S. exchange. You can request historical market data from any of its constituent datasets for usage-based rates, or start a subscription plan to unlock unlimited historical and real-time access.

Note: We don’t currently support cryptocurrencies or digital assets. We're considering future coverage of forex data and additional global markets based on user demand.

Are all ticker symbols covered?

Yes. Each of our equities datasets includes all exchange-listed U.S. stocks (also known as NMS securities), which are traded across multiple venues regardless of their primary listing. For example, a Nasdaq-listed stock like AAPL is also available on IEX and other U.S. exchanges. This ensures complete coverage across the U.S. market.

Are ETFs, mutual funds, and indices included?

We support U.S.-listed ETFs and index-tracked products like SPY and QQQ. Mutual funds aren't included in our data because they aren't traded on exchanges. We also don't provide official index values such as SPX, , since separate index providers publish those. However, many ETFs in our datasets are designed to track major U.S. financial indices.

Which programming languages are supported?

Our APIs are language-agnostic. You can use any language that can make HTTP requests for historical data or open raw TCP connections for real-time data. We offer official client libraries for Python, Rust, and C++, but you can also build custom integrations in Java , Go, C, or other languages using standard networking libraries.

However, since we don’t currently offer REST or WebSocket APIs, building your own integration—particularly for real-time data—may require lower-level networking. For most users, our client libraries are the fastest way to get started and are designed to abstract away this complexity. REST and WebSocket APIs are easier to implement in some environments, but they introduce added latency and protocol overhead that make them less suitable for high-performance financial data.

Do you offer fundamental data?

We don’t currently provide company fundamentals like earnings, balance sheets, or analyst estimates. These are typically sourced from public filings available for free through the SEC.

Our stock data APIs focus on real-time and historical price data, trade volume, order book depth, and market microstructure signals—all critical inputs for technical indicators, quantitative models, and backtesting. We also offer corporate actions data, including splits, dividends, and mergers, which can be used alongside external fundamental datasets for a more complete view of the financial markets.

We're currently working on equities reference data and fundamentals, e.g., shares outstanding, short interest, market capitalization, and P/E ratios. In the meantime, you can always combine our data with external providers of financial news and company fundamentals for a full picture.

What our users are saying

Michael Tung, Investments Lead

Rick Zhan, VP Quant Research

Paul Aston, Founder

Brett Harrison, Founder

Nikita Ostroverkhov, Algo Trading

V. Chen, Equity Research Associate

Chris Pento, Co-founder and CEO

Matt Papakipos

C. Garcia, Senior Quant Researcher

New users get $125 in free credits

Free credit applies to all of our historical data and subscription plans.