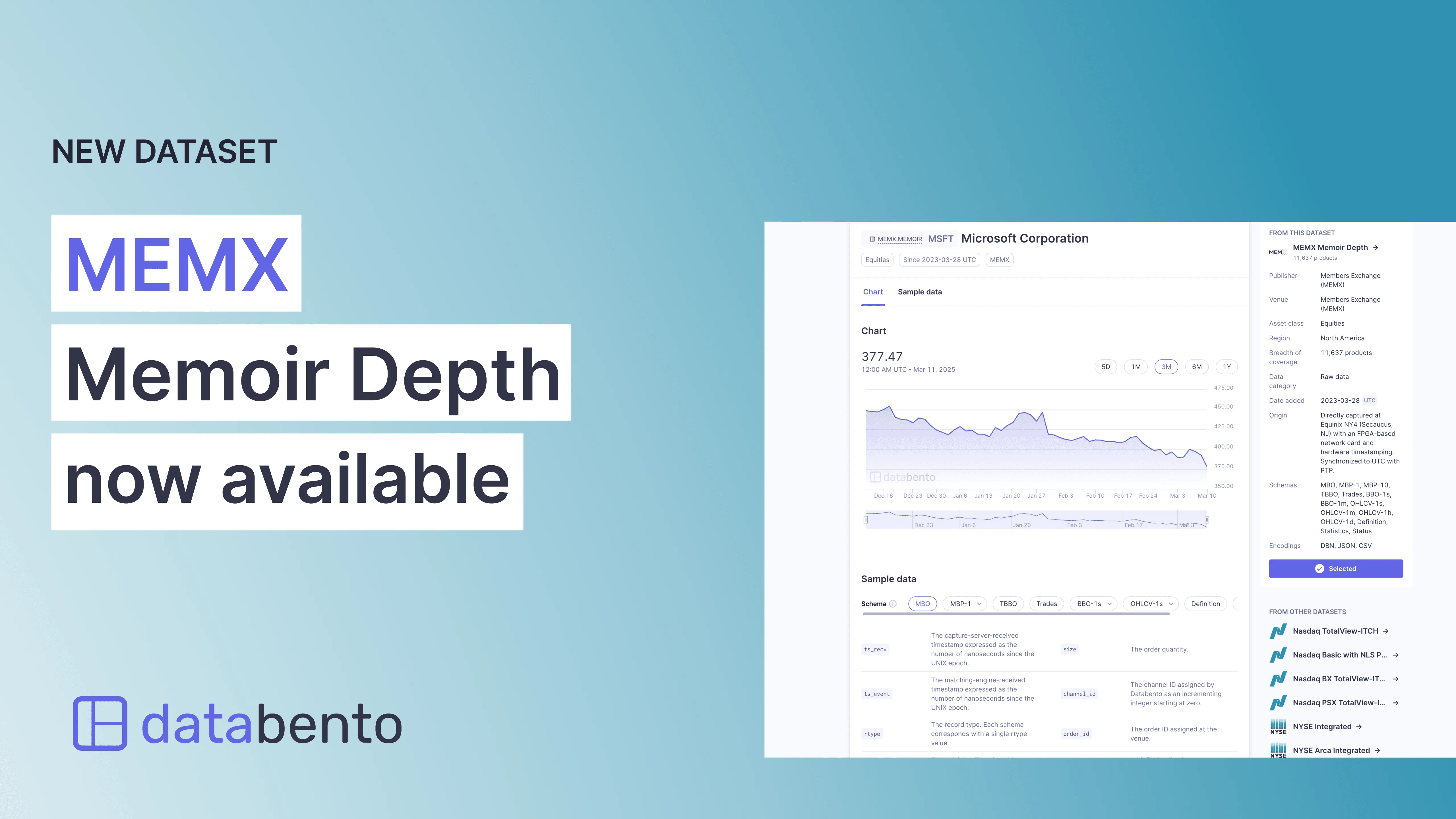

MEMX Memoir Depth now available

We're excited to announce that MEMX Memoir Depth data is now available through our Databento US Equities service, providing full order book depth for the Members Exchange (MEMX) Equities market. Users can access this dataset in L1, L2, or L3 granularity, as well as in trades, OHLCV, and additional data formats. A complete list of its 14 supported schemas can be found in our catalog.

MEMX Memoir Depth delivers every quote and order at each price level, along with any event that updates the order book after an order is placed, such as trade executions, modifications, or cancellations. Unlike top-of-book L1 data from the SIPs, this proprietary feed also includes information like trade aggressor side and odd lots. This enables users to accurately model order book imbalances, trade directionality, queue dynamics, and more.

MEMX launched as the 14th US equities exchange in 2020. Founded by nine investment firms aiming to lower fees and simplify market structure, it operates without the tiered fee models or complex order priority behavior found on some legacy exchanges. MEMX's low cost and transparent pricing have made it popular with proprietary trading firms, market makers, and algorithmic traders. As of February 2025, MEMX accounted for approximately 2.15% of average daily volume (ADV) across US exchange-listed securities.

Historical MEMX data starts from March 28, 2023, and is available for usage-based rates or with any Databento US Equities subscription. Visit our pricing page to upgrade your plan.

You can request historical data using its dataset ID: MEMX.MEMOIR. The example below demonstrates how to request one day of L3 (MBO) data for Apple Inc. (AAPL) using our Python client library.

import databento as db

client = db.Historical()

data = client.timeseries.get_range(

dataset="MEMX.MEMOIR",

symbols="AAPL",

schema="mbo",

start="2025-01-28"

)

print(data.to_df())