Databento announces launch of real-time CME market data service

SALT LAKE CITY, USA – May 16, 2023 - Databento, the world’s first platform to offer market data on a usage-based pricing model, recently announced the launch of Databento Live, offering real-time and intraday historical data from the past 24 hours.

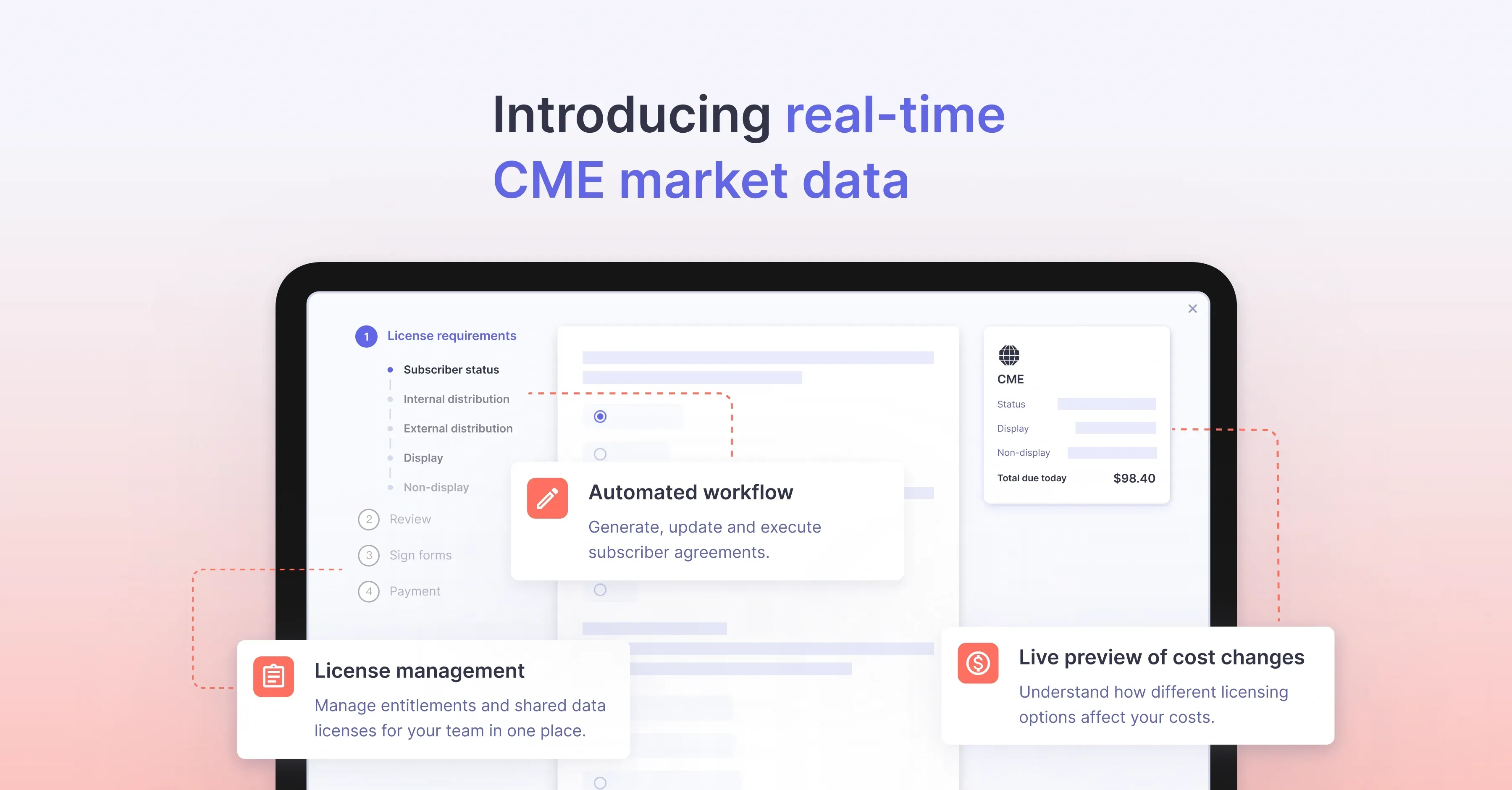

Databento Live provides full venue coverage, which includes BBO, depth, and full order book market data via our MBP-1, MBP-10, and MBO schemas, as well as bars per second, minute, and hour. Databento is a licensed distributor of CME Globex data, including all four main market segments: CME, CBOT, NYMEX, and COMEX. The service launched with real-time CME data, with additional datasets to follow.

Users can subscribe to any arbitrary combination of symbols—or even every symbol listed on the venue—simultaneously with Databento Live. Both historical and real-time APIs share identical interfaces and normalization formats, enabling users to use the same code for backtesting and production trading. Databento's real-time feed comes at the lowest starting price point of any CME full order book feed on the market. License fees are passed through without an upcharge, and the company's usage-based pricing model allows users to get tick data for all 30+ ES outrights and 1,600+ CL outrights for as little as $15.78/month over license fees.

- Official source of CME data

- Python and C++ APIs with full build support for Linux and macOS

- Fastest commercially-available CME feed over the internet, directly distributed from Aurora I with median feed latency as low as 6.1 microseconds and sub-millisecond end-to-end latency to Chicago metro

- No instrument limits—you can subscribe to any combination of symbols, up to the full order book of the entire venue (all 600k+ symbols at once)

- Flexibility to subscribe to multiple schemas, including MBO, market depth, OHLCV aggregates, tick-by-tick trades, top-of-book, and point-in-time instrument definitions

- Nanosecond resolution, PTP timestamps

- Identical API and data format as our historical market replay interface—use the same code in production and backtest

The launch marks a significant milestone for the company. Founded in 2019, Databento has raised $31.8 million in early funding, led by Redpoint Ventures, Indicator Ventures, Unusual Ventures, and Trousdale Ventures.

The release of Databento Live also coincides with six consecutive months of record growth, with users coming from 11 of the leading market-making firms and various hedge funds managing over $180B AUM.