Real-time NYSE imbalance feeds added to Databento US Equities

We're excited to announce that our Databento US Equities service now includes real-time imbalance data from the NYSE, NYSE Arca, and NYSE American. Historical imbalance data for these venues was already made available earlier as part of the full order book Integrated feeds in our January 2025 release.

By revealing unmatched buy and sell interest in real time, imbalances show how supply and demand shift leading up to the auction, helping firms anticipate match prices and market direction at the open or close. This data offers real-time insight into the opening and closing auctions across these three NYSE-operated exchanges, providing details such as:

- Reference price (

ref_price), the indicative price used to calculate paired and imbalance volume (quantities). - Imbalance quantity (

total_imbalance_qty), the unmatched buy or sell volume at the reference price. - Paired quantity (

paired_qty), the volume that would execute at the reference price if the auction occurred now.

It also includes multiple projected book clearing prices:

-

ind_match_pricereflects the price that would match the highest volume, subject to collars. -

cont_book_clr_priceincludes both auction and continuous book interest. -

auct_interest_clr_priceconsiders only auction (cross) orders. -

ssr_filling_priceis used if a sell short restriction is triggered.

A complete list of fields is available in our imbalance schema documentation.

Real-time NYSE, NYSE Arca, and NYSE American Order Imbalances data is included with a Plus or Unlimited subscription through our Databento US Equities service with the required licensing. Visit our service page for pricing or to upgrade your plan.

The NYSE is the primary listing venue for large-cap and blue-chip stocks, capturing 7.59% of average daily volume (ADV) across all exchange-listed US securities as of July 2025. With floor interest contributing over 40% of Closing Auction volume, NYSE imbalance data plays a critical role in sizing, timing, and routing large orders.

NYSE Arca is the leading exchange for listing and trading exchange-traded funds (ETFs), offering the narrowest quoted spreads and maintaining the highest percentage of time (71.1%) at the NBBO for all US ETFs. It represented 10.01% of equities ADV as of July 2025, and its imbalance feed is particularly useful for firms trading ETPs during openings, closings, and rebalance periods.

NYSE American specializes in small- and mid-cap stocks and accounted for 0.23% of equities ADV as of July 2025. Its imbalance data supports execution modeling in less-liquid names, especially during the close.

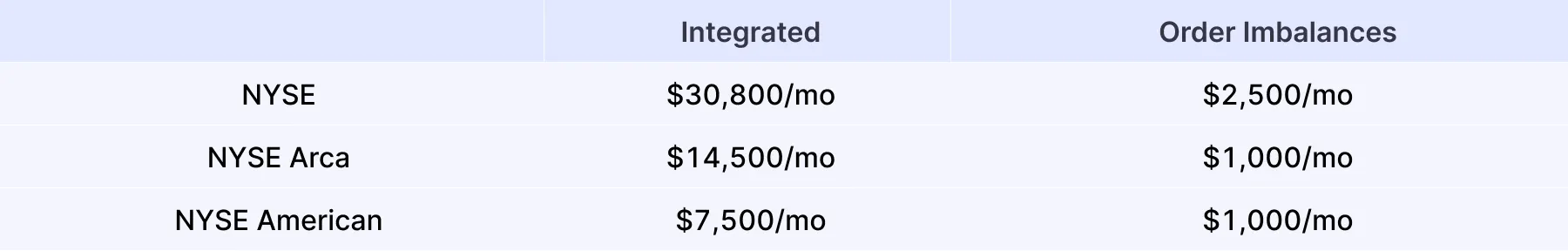

While real-time imbalance data can be licensed as part of the full Integrated feeds for the NYSE, NYSE Arca, and NYSE American, this costs upwards of $7,500/month in exchange fees for non-display use. The Order Imbalances feeds start at $1,000/month and offer a more cost-effective option to license this data.

A comparison of license fees for each venue is shown below:

Once your subscription plan and license are active, you can begin streaming real-time NYSE Order Imbalances data using the same dataset IDs as the Integrated feeds:

-

XNYS.PILLARfor NYSE -

ARCX.PILLARfor NYSE Arca -

XASE.PILLARfor NYSE American

Only the imbalance and definition schemas are supported. The example below demonstrates how to stream real-time NYSE Arca imbalance data for the S&P 500 ETF (SPY) with our Python client library.

import databento as db

# Create a live client

client = db.Live(key="YOUR_API_KEY")

# Subscribe to NYSE Arca Order Imbalances feed

client.subscribe(

dataset="ARCX.PILLAR",

schema="imbalance",

symbols="SPY",

)

# Print records for 10 seconds, then stop session

client.add_callback(print)

client.start()

client.block_for_close(timeout=10)For more details on using the live API, see our documentation.