Modern features built for top financial institutions

Self-service onboarding

Skip the sales call. Access your first dataset in as little as 3 minutes.

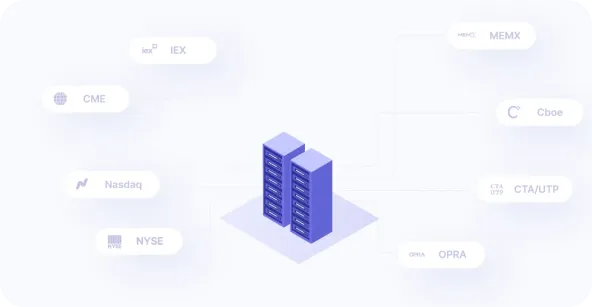

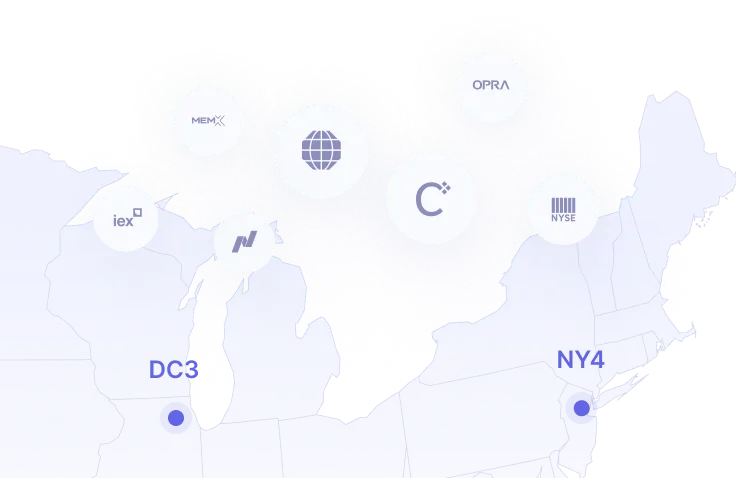

Direct from colocation facilities

Sourced and distributed straight from the colocation facilities that house each venue’s matching engine.

Complete normalization

Cover multiple asset classes and trading venues with one unified message format.

Multiple encodings

Choose between CSV, JSON, and our highly-compressible binary encoding, DBN.

Multiple symbology systems

Continuous contracts, options chains, rollover rules, venue-native numeric IDs, ticker symbols, and more.

Unlimited usage

Scale up with near-unlimited API calls and enough bandwidth even for a full-venue firehose.

The most powerful APIs for normalized market data

Learn more ->

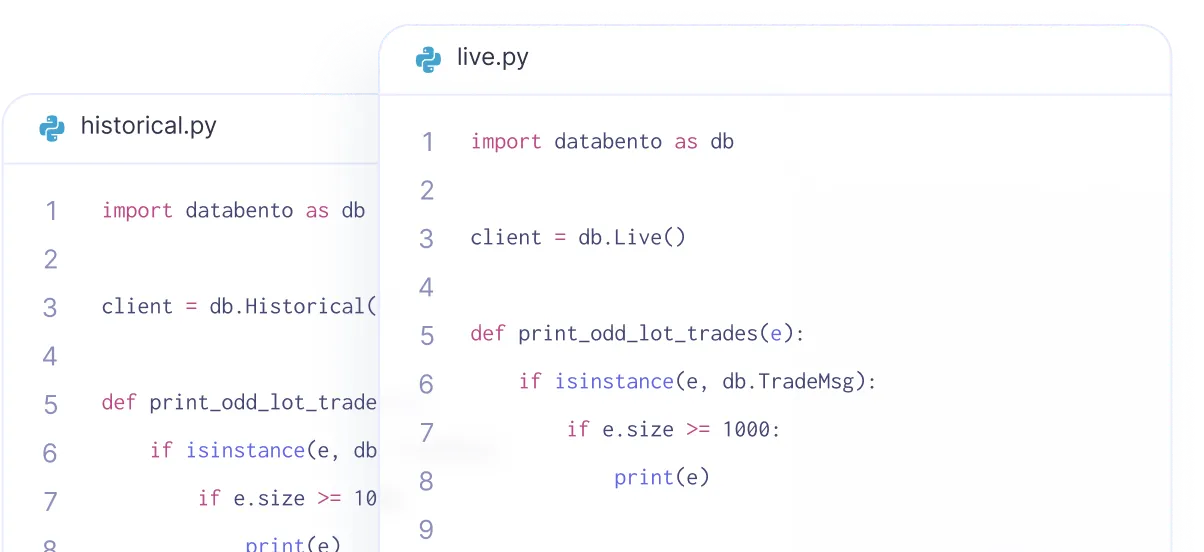

Same API for real-time and historical data

Our live API uses the same interfaces and data structures as our historical market replay, letting you use the same code for backtest and live trading.

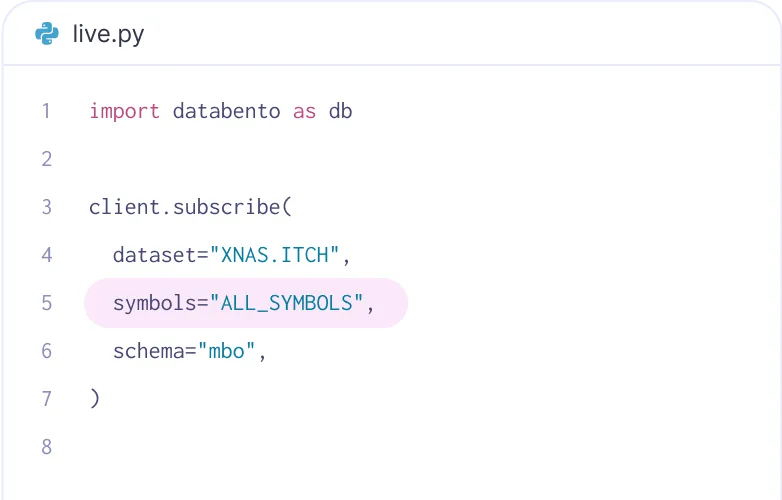

Entire venue in a single subscription

Subscribe to every update of every symbol on the venue, in a single API call—like a direct feed—be it over internet or cross-connect.

Tick-by-tick with full order book depth

All buy and sell orders at every price level. Get each trade, every tick, and order queue composition at all prices.

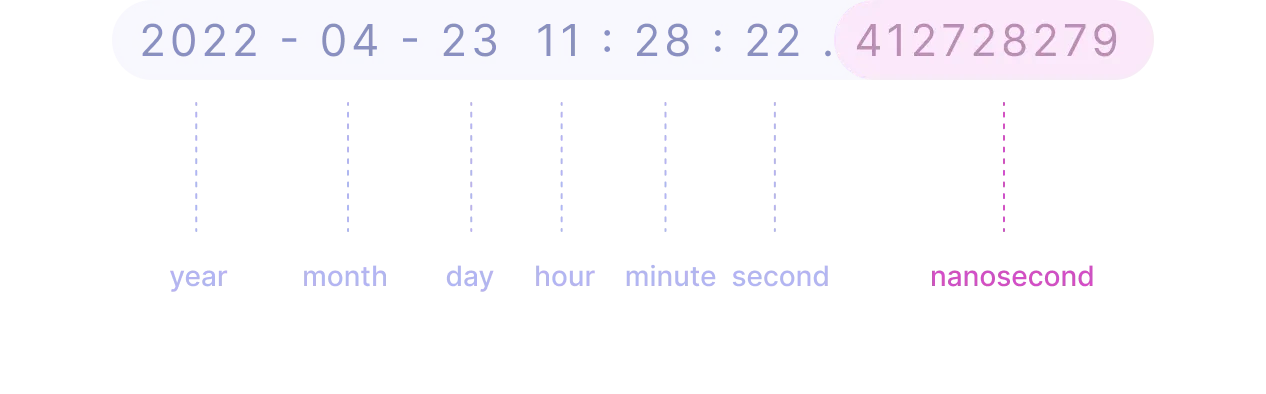

Nanosecond, PTP-synchronized timestamps

The only normalized market data solution to provide up to four timestamps for every event, with sub-microsecond accuracy across venues.

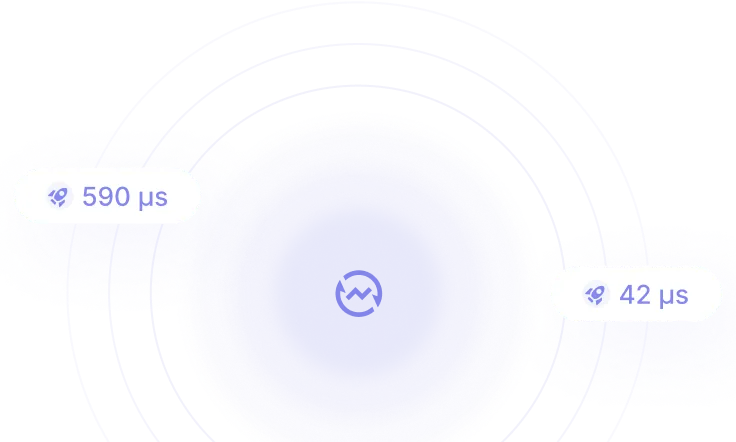

Low latency

The fastest real-time feed over public cloud. 90th percentile latency up to your application at 42 microseconds (cross-connect) or 590 microseconds (internet).

Seamless intraday replay

Join your real-time subscription with a seamless, streaming replay of the session. All within the ease of a single API call.

Multiple connectivity options

Get the full feed wherever you are. Cross-connects in NY4 and Aurora. Dedicated interconnect to AWS, GCP, Azure, and 8 PoPs.

Build your first application in 4 lines of code

Databento works with any language through our Raw API, which uses a binary protocol over TCP, and our HTTP API. We also provide client libraries for Rust, Python, and C++.

1 2 3 4 5 6 7 8 9 10 11 12

import databento as db

client = db.Historical('YOUR_API_KEY')

data = client.timeseries.get_range(

dataset='GLBX.MDP3',

schema='mbo',

start='2023-01-09T00:00',

end='2023-01-09T20:00',

limit=100,

)

data.replay(print)Get started

Examples

Reference – Historical

Reference – Live

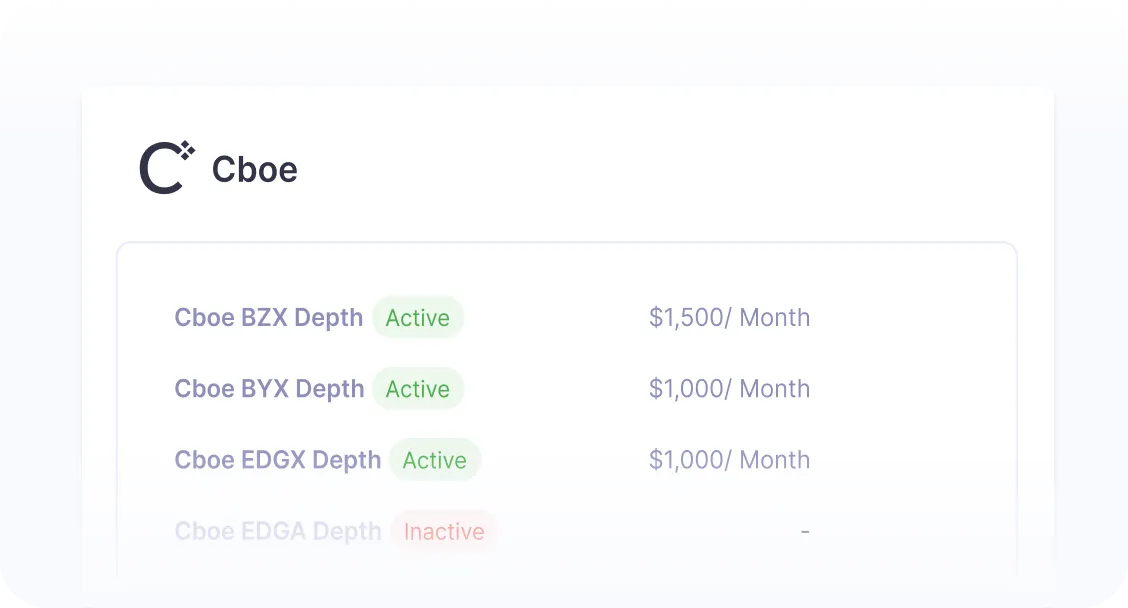

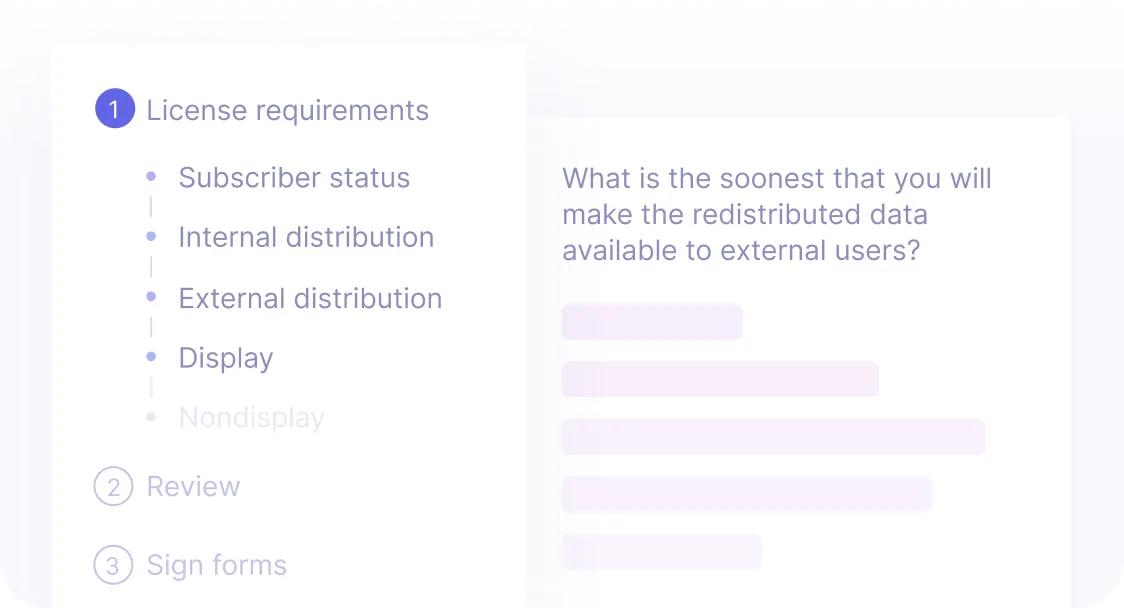

Get licensed for live data in 3 minutes

Understand pricing in a simple way

Answer a short questionnaire to determine your actual monthly license fees and submit your license agreements. We pass through these license fees with no upcharge.

Keep track of license agreements in one place

Keep track of all past and active licenses from your Databento portal. Easily update the license based on any team composition changes.