Reimagining trading infrastructure with Architect

Architect offers fast, flexible, and secure financial infrastructure for trading firms, hedge funds, and professional investors. The company was founded by CEO Brett Harrison, previously the head of trading systems technology at Jane Street and semi-systematic technology at Citadel Securities. Like Databento, the Architect team brings decades of experience building large-scale distributed systems and trading infrastructure spanning multiple asset classes—including futures, options, ETFs, equities, fixed-income securities, and digital assets—at the financial industry's most successful quantitative trading firms.

Architect's technology facilitates tens of billions of dollars in daily trading volume at microsecond latency while managing clearing, settlement, and risk at scale. In bridging the operational gap between digital and traditional assets, Architect sought innovative market data vendors with the same critical market microstructure expertise.

As an early-stage startup, the ability to move quickly without sacrificing data quality was central to Architect's success. After evaluating numerous top data providers, Harrison was dissatisfied in several key areas: the implementation process was expensive and slow; their systems required incompatible infrastructure; and their APIs, which were not designed for cloud-native environments, managed live and historical data separately.

Databento was created to address the pain points that Harrison experienced with traditional data providers. Most demand a six to eight-figure upfront investment to access data, even if the firm or strategy is ramping up trading and only needs a few symbols to begin onboarding. In addition, many require customers to use their proprietary hardware, which Harrison noted was a costly and inflexible addition to Architect's server racks. They found that the integration process is overly complicated and involves months of customization and setup, all at their own expense.

Most providers have low-level, esoteric APIs, and the solutions that deliver real-time data are often completely distinct from those that can deliver past data time series for research and development. Many predate public cloud infrastructure and are rarely usable "out of the box." We spent hundreds of extra hours of engineering effort to build abstractions such as order-book construction and symbol filtering.

Databento's self-service platform enabled Architect to start working with data the same day they signed up for an account. Harrison shared a point-by-point comparison of why Databento was the best solution for their financial technology and brokerage needs.

The live API uses the same interfaces and data structures as the historical API, allowing users to replay events in the same order and use the same code for backtesting and live trading. Databento works with any language through its APIs and offers official Python, C++, and Rust client libraries. More than half of Databento's infrastructure is written in Rust, and Harrison cited the native Rust SDK as a game-changer.

Databento's solutions are completely turn-key. From sign-up to working code, building a highly complex CME order book took hours compared to months with other providers. Rust has slowly taken over the world of financial software development, and having Databento ’s Rust libraries available saved us an enormous amount of time while still being extremely performant.

Architect first onboarded with Databento's usage-based pricing to experiment with the data, which Harrison said gave their engineers greater conviction about the quality of Databento's tech stack. Easy delivery to AWS was essential for fast integration with their proprietary software, but Databento's co-location and dedicated connectivity offerings will be important for Architect in the future.

The Databento team has clearly thought extremely hard about the frameworks available to developers, making it a very low cognitive lift to go from concept to production.

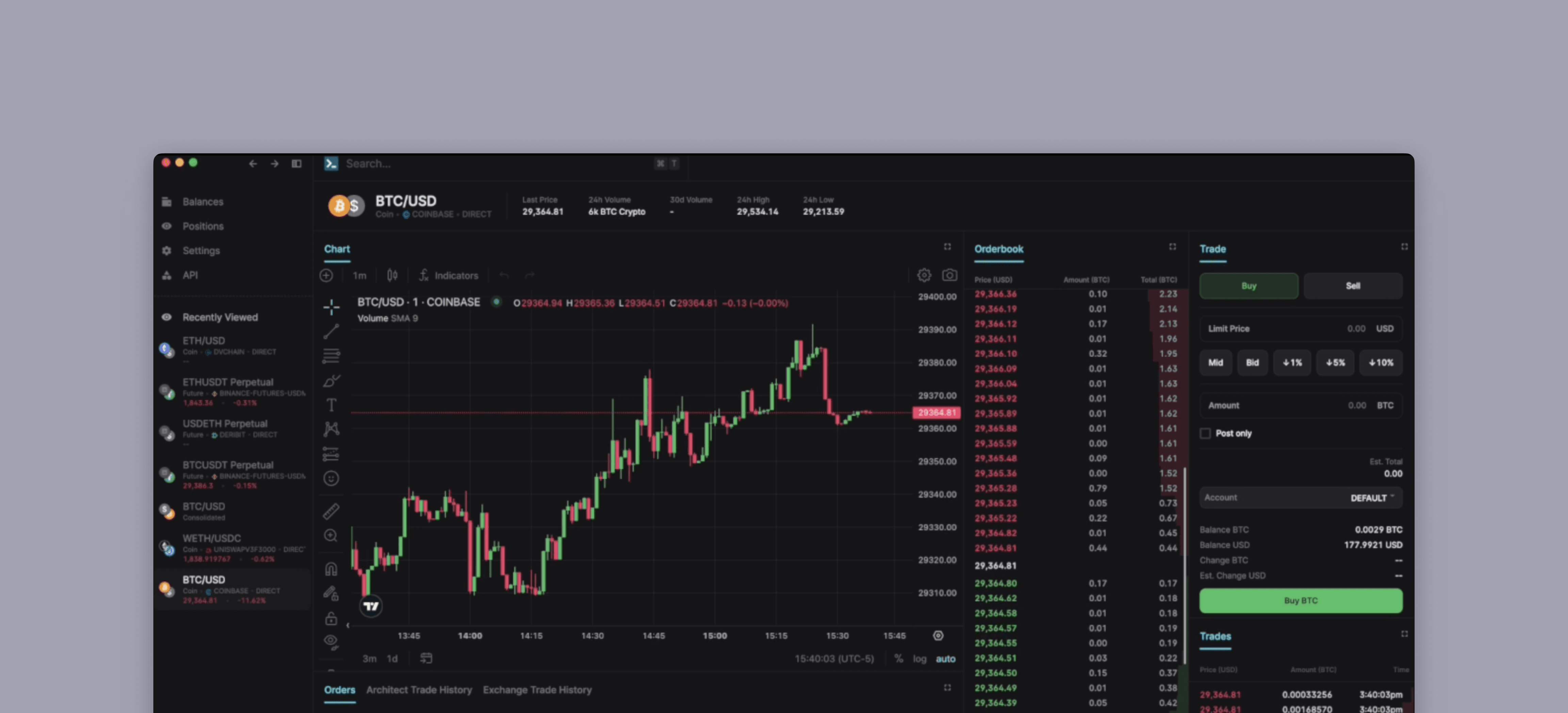

Architect is disrupting the institutional order and execution management system space with Rust-based tech, cross-asset support, and a snappy UI. The company recently announced the closing of a $12 million capital raise, bringing its total funding to $17 million since launching in January 2023.

We're very happy customers of Databento and expect to continue ramping up our usage as an enterprise customer as our business grows. We've been very pleased with the prompt and knowledgeable levels of support we’ve received from the Databento team, even when we were just getting started.