Using machine learning for algorithmic trading at Double River

Double River Investments is a quantitatively driven investment company that operates throughout global markets in search of alpha, achieving market-leading returns. Alongside its cutting-edge quant fund, the firm makes impact investments worldwide with a focus on developing markets and communities.

Nelson Griffiths leads machine learning system design and tooling development at Double River, enabling data scientists to rapidly build, test, and deploy models to production environments. He oversees the systems team, which includes data engineering, trading, and machine learning.

Before discovering Databento, Double River struggled to balance data quality with affordability. Finding a reliable data vendor that fit their startup budget and offered the US equities coverage they needed was a challenge.

They were either too expensive or had poor data quality and tech stack. Some had both. Conversely, Databento's API was fantastic, and we had a great experience onboarding. The team was extremely responsive and helpful.

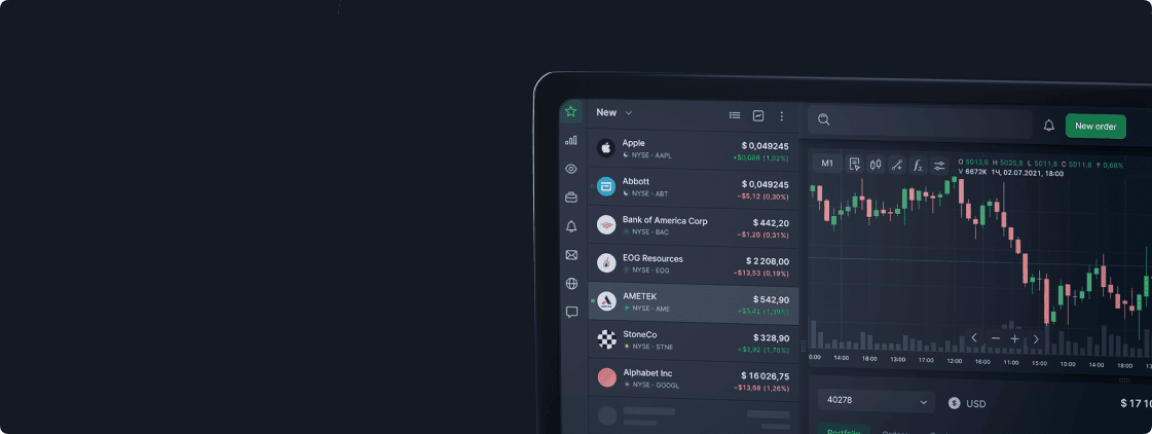

Databento is the first market data provider to offer usage-based pricing and a real-time equities data solution without licensing fees for commercial use. These equities bundles combine a strategic selection of trading venues into one consolidated feed for maximum coverage and zero non-display fees. Databento's parsers normalize a blend of price-level (L2, market by price) and full order book (L3) protocols and symbology, reducing complexity for engineers and enabling seamless integration with existing systems.

Double River first integrated Databento's live API and Python client library on a pay-as-you-go basis before transitioning to an unlimited plan. The firm uses intraday pricing data for daily portfolio rebalancing and other processes.

It was easy to start with what we needed in the Databento Equities Basic package. The quality was better than some of the standalone exchange data we'd accessed in the past, including IEX itself.