Real-time execution and data integration for modern quant workflows

Lime Trading Corp has built a strong reputation for delivering low-latency execution and direct market access to U.S. equities and options. Its infrastructure is trusted by proprietary trading firms, hedge funds, and experienced retail traders alike.

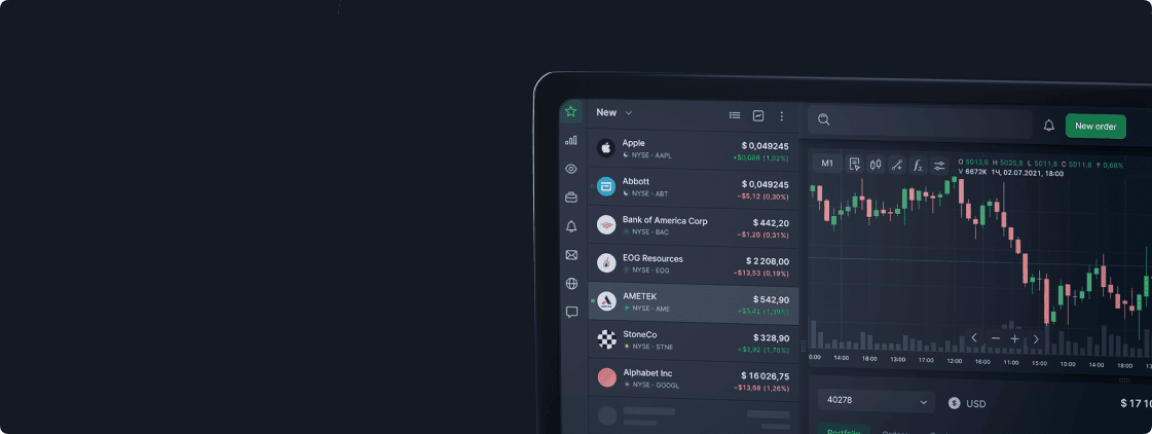

But the landscape is shifting. A growing number of independent quants, fintech builders, and AI-native developers are looking for infrastructure that’s programmable, transparent, and easy to integrate. Lime is expanding its reach to serve these users—offering the same performance and reliability, now with a developer-first experience.

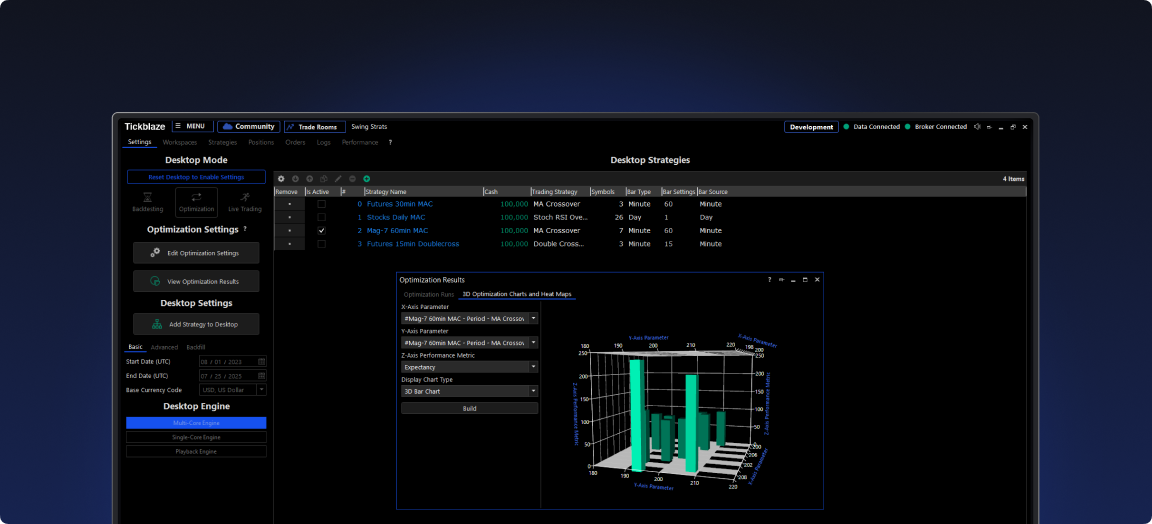

That evolution includes Lime Fintech, a platform where users can experiment, test, and refine strategies in a risk-free environment. It's designed to lower the barrier to entry for strategy development and help new traders move quickly from concept to deployment.

To support this shift, Lime integrated market data that matches its goals: clean, high-quality, and accessible via API. With consolidated equities and CME futures data delivered through an API-first model, users can work with the same kind of data professional firms rely on—without the friction of legacy vendors.

This integration supports a broad range of users—from students and solo quants to early-stage fintech teams—enabling backtesting, simulation, and strategy iteration using real market inputs.

We wanted to ensure users could move from learning to live trading with as little friction as possible. That meant simplifying not just the user experience, but also how they access and use data.

Lime’s broader vision is to make institutional-grade tools programmable and accessible. This means putting fast, reliable execution and market data into the hands of individuals ready to build.

- Real-time access to U.S. equities and futures data via modern APIs.

- Simple, transparent pricing model.

- Developer onboarding in minutes with SDKs and API keys.

- Supports a wide range of educational and strategy development use cases.

Lime is redefining what it means to be a modern trading infrastructure provider—by removing friction, reducing complexity, and helping the next generation of traders build with confidence.

Learn more at lime.co.