Empowering portfolio-level quant trading with institutional-grade data

Tickblaze is a next-generation hybrid trading platform designed for systematic traders, professional quants, and discretionary traders alike. Built from the ground up to support both strategy automation and manual trading, Tickblaze delivers the fastest portfolio-level backtesting and optimization engine in the industry. Its dual-language framework (C# and Python) and strategy desktop environment make it the only retail-accessible platform offering institutional-grade quant capabilities.

As Tickblaze expands into equities, futures, options, and crypto across global markets, the need for ultra-low-latency, high-fidelity market data becomes essential. That’s where Databento came in.

With Tickblaze supporting real-time strategy deployment, microsecond-level simulation, and global multi-asset coverage, standard retail data sources fell short. The team needed nanosecond-precision, normalized order book data across major exchanges—without the integration complexity and high costs of traditional vendors.

Most data providers required custom engineering just to prepare datasets for quant use. But Tickblaze needed a seamless solution to maintain performance across its portfolio optimization engine and multi-strategy live trading workflows.

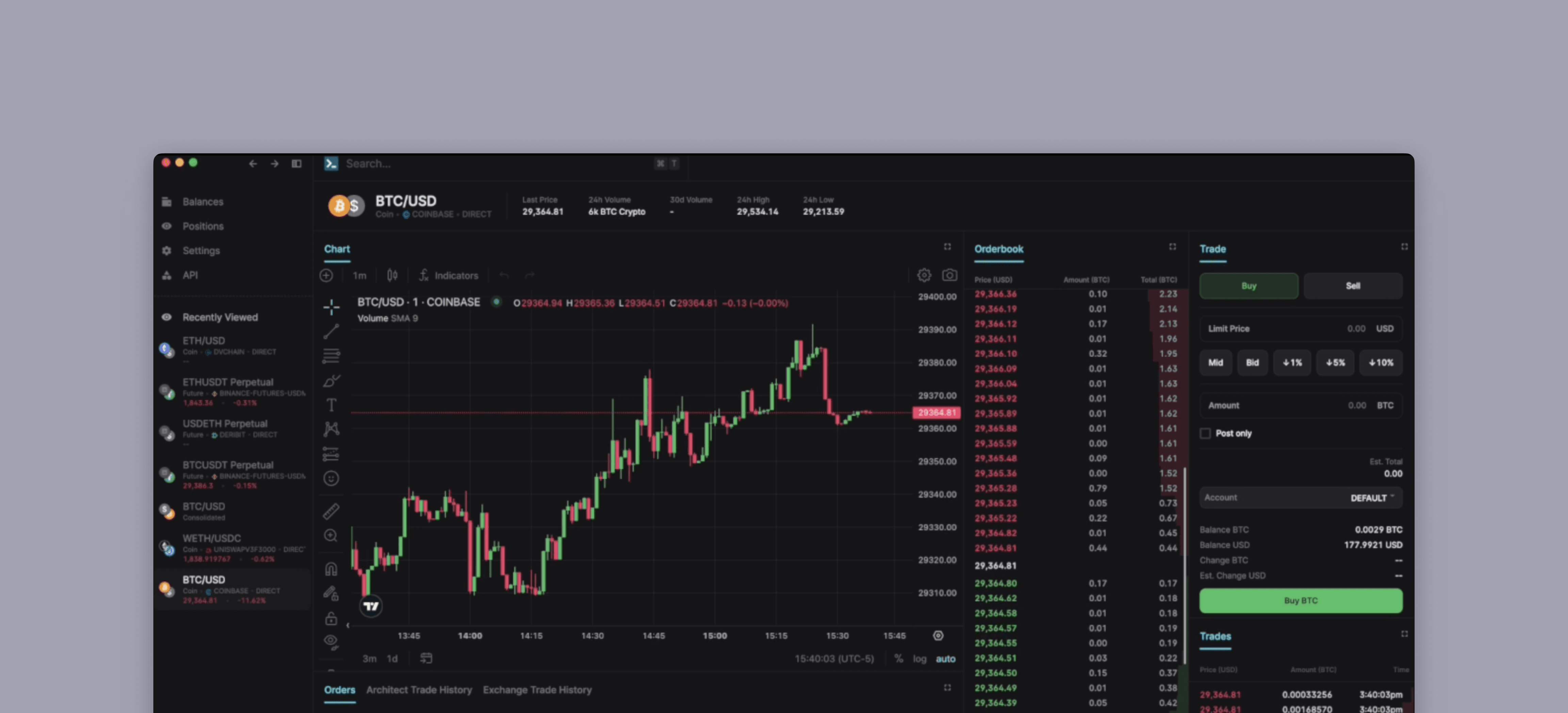

Databento’s institutional-grade market data—featuring nanosecond timestamps, normalized L2/L3 feeds, and support for both historical and real-time access—made them the clear choice. Tickblaze integrated Databento’s API into its strategy desktop, enabling clients to access the same high-quality data used by top hedge funds and quant desks.

The integration allows Tickblaze users to:

- Stream normalized order book data across equities, futures, and options.

- Power faster and more accurate portfolio simulations.

- Run live trading and backtesting on the same data structures.

- Access real-time and historical data without switching tools.

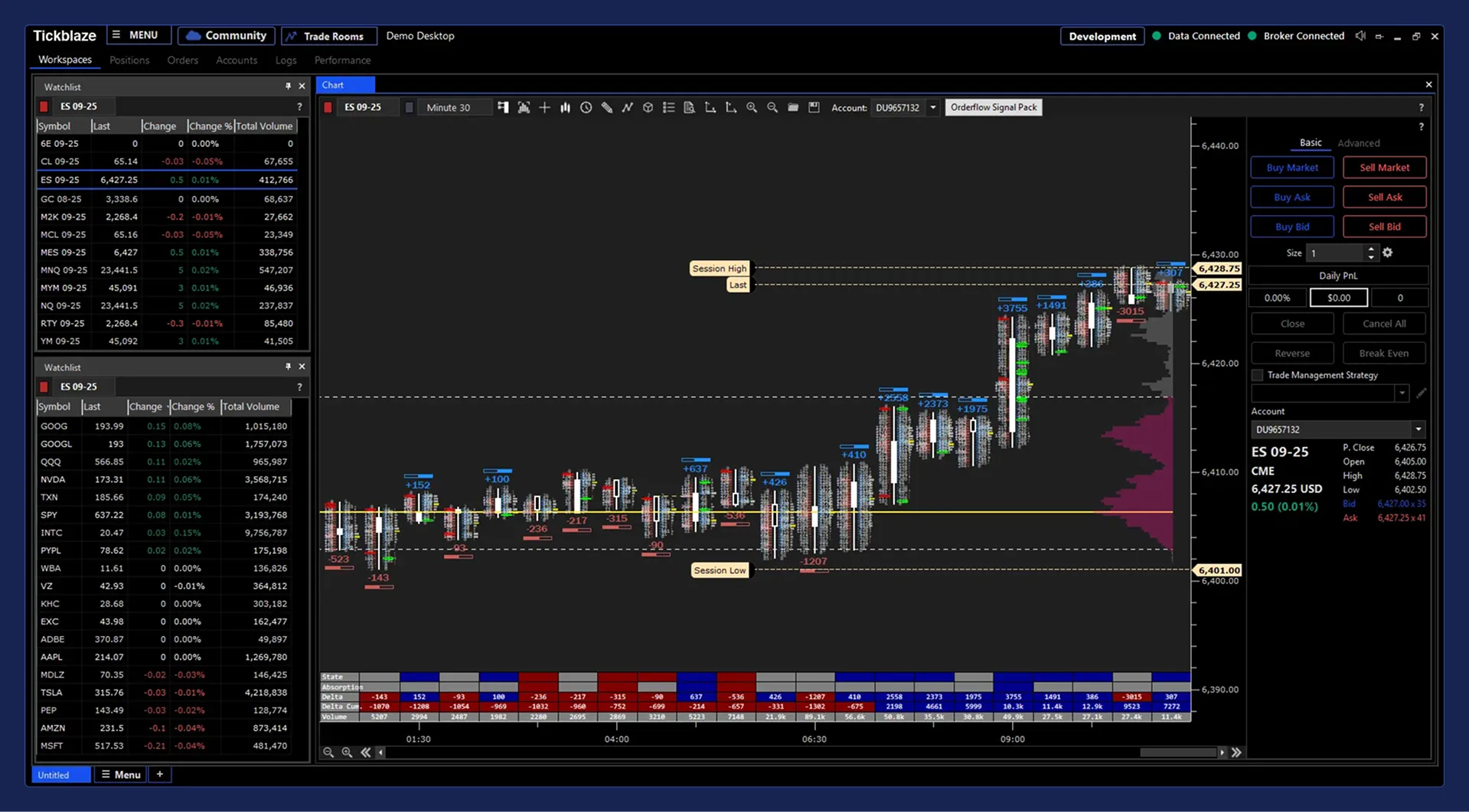

Real-time order flow and volume profile analysis for ES futures.

This partnership unlocks a full-stack quant ecosystem inside Tickblaze—from strategy design and backtesting to live deployment—powered by the most precise market data in the industry. Together, Tickblaze and Databento are leveling the playing field for professional-grade quant trading.

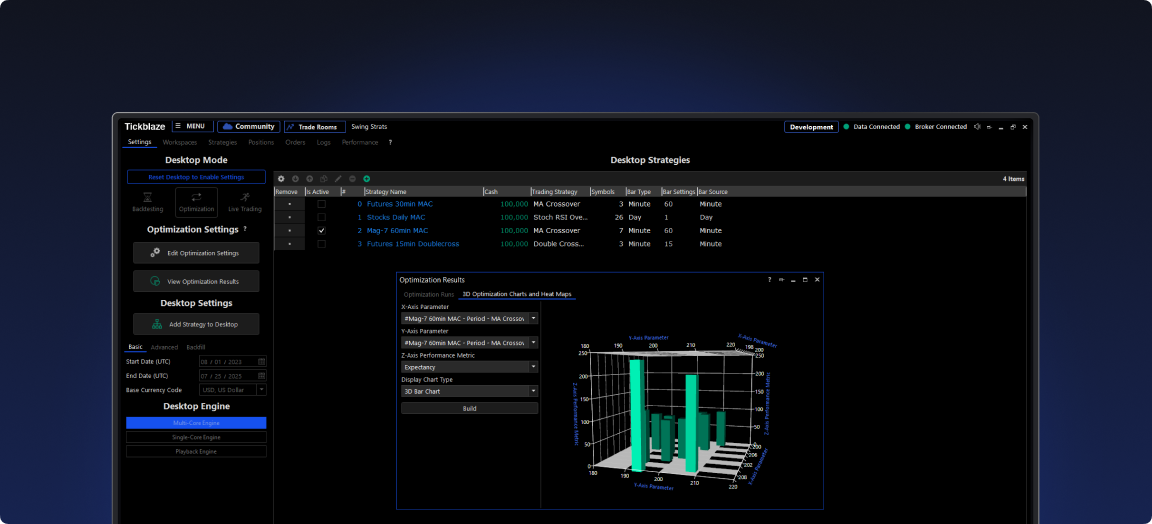

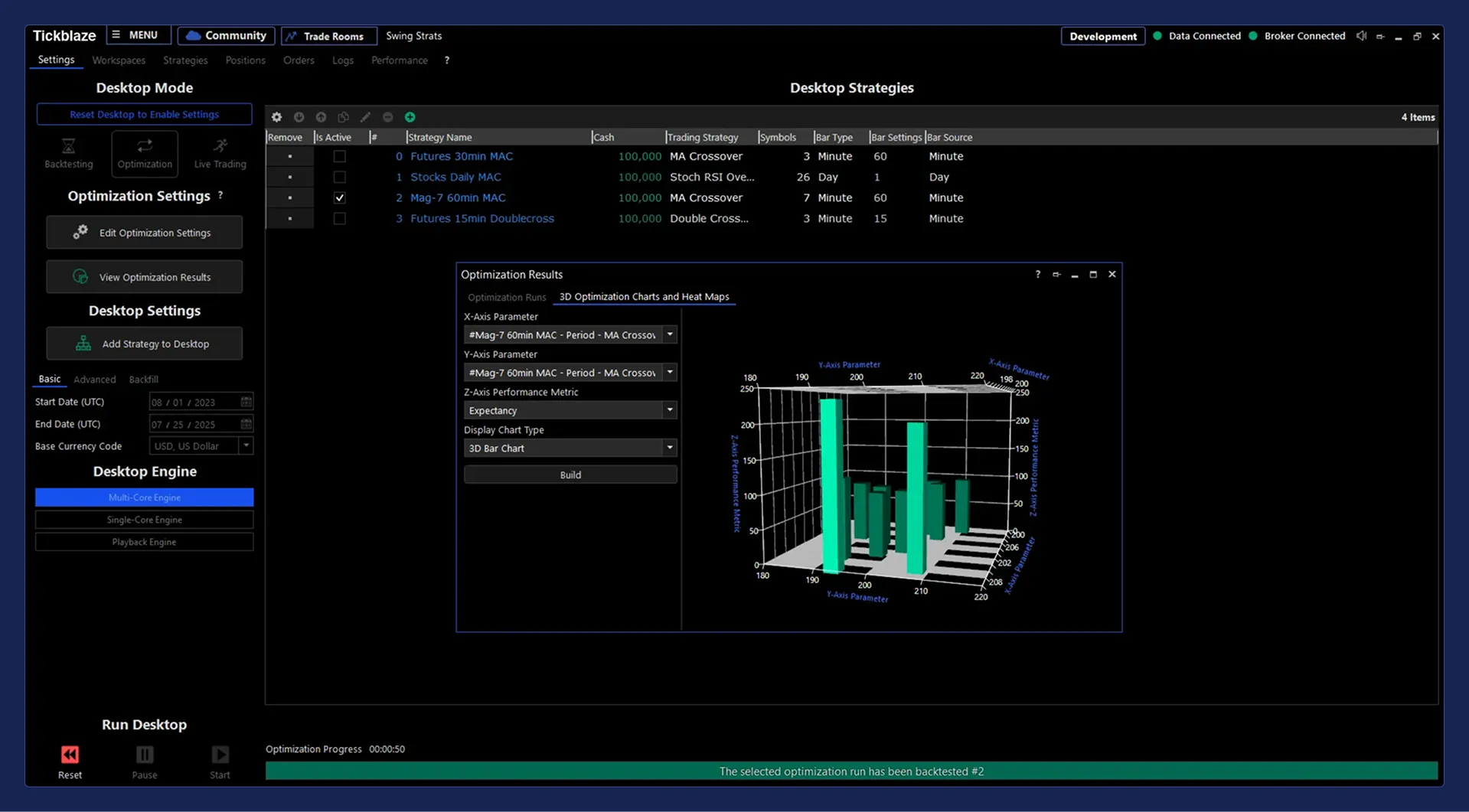

Optimization results ranked by PnL, drawdown, and win rate.

3D bar chart view of a Tickblaze strategy optimization run.

Backtest results on NASDAQ-100 futures, with trade-by-trade PnL.