Partnering with UC Berkeley's top-ranked MFE program

UC Berkeley's MFE program was founded in 2001 by quant finance legend Mark Rubinstein, best known for his contributions to options pricing and developing the first exchange-traded fund (ETF). It was the first financial engineering program in a U.S. business school and consistently ranks #1 in the nation.

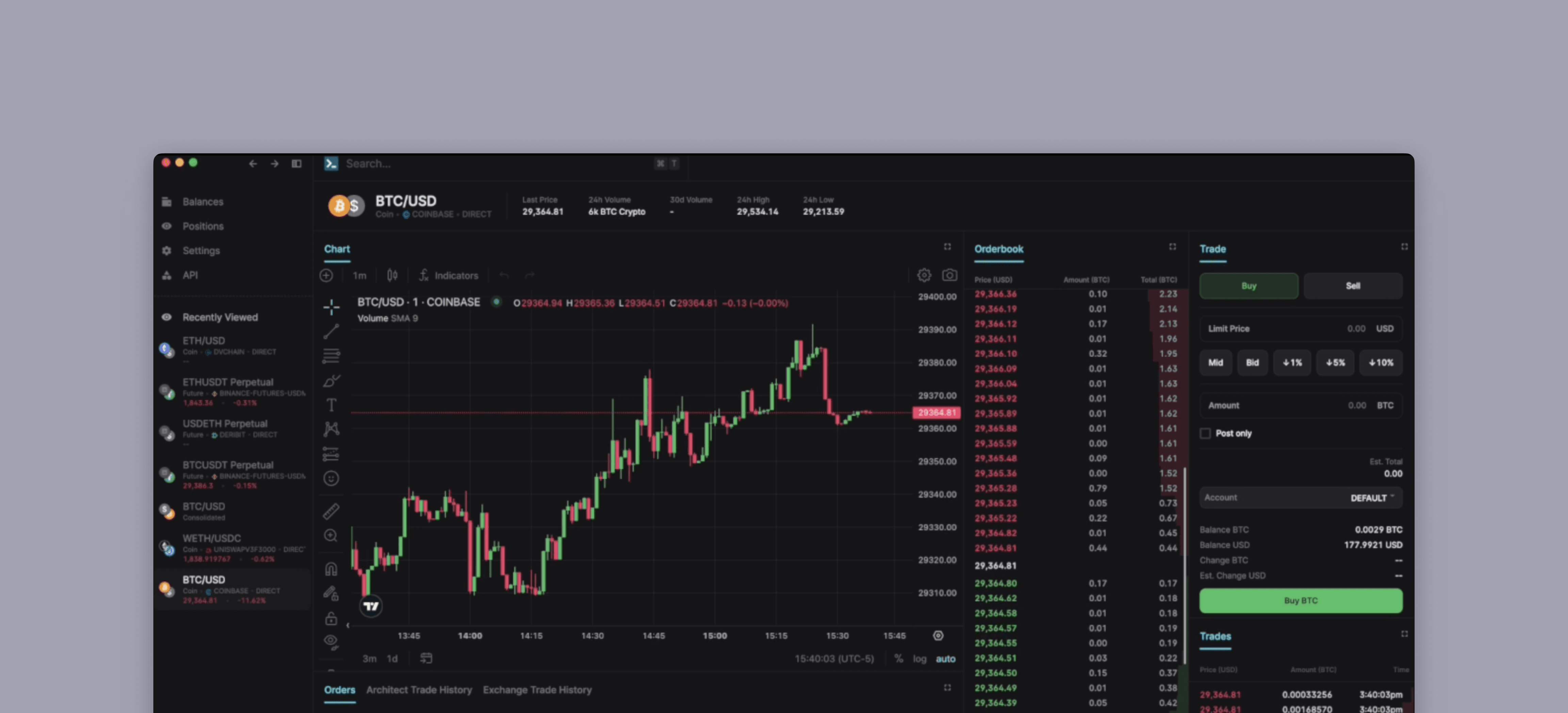

The program's innovative curriculum requires market data to support hundreds of students and faculty across various use cases, including academic research, high-frequency trading coursework, and the Applied Finance Project. In this capstone, students leverage their quantitative skills, tools, and techniques to solve a real-world challenge. Experiential learning is paramount, so graduates collaborate in teams across strategy, fixed-income, cross-market, and other disciplines throughout their year in the program.

As a result, managing access and permissions to market data for the entire student body and faculty—across multiple courses and initiatives—presents a complex challenge for UC Berkeley's MFE program. Budgeting and resource allocation have also become major concerns for the program's leadership.

Databento offers free team management and billing features with its self-service portal. UC Berkeley's MFE program was able to create a Databento team for its students at no additional cost per user, provision access to historical market data on a per-project basis, and assign monthly limits to ensure their budget was never exceeded. Additionally, Databento's ability to deliver data over the cloud reduced the program's data storage costs.

The program's director, Jacob Gallice, noted that students have found the API easy to implement and use. He also mentioned that the effortless setup process allowed professors to quickly determine that Databento would be a great fit.

We have many use cases and applications for the data, and the diverse schemas are extremely helpful because they cater to a multitude of projects.