Expanding into futures markets with Temple Capital

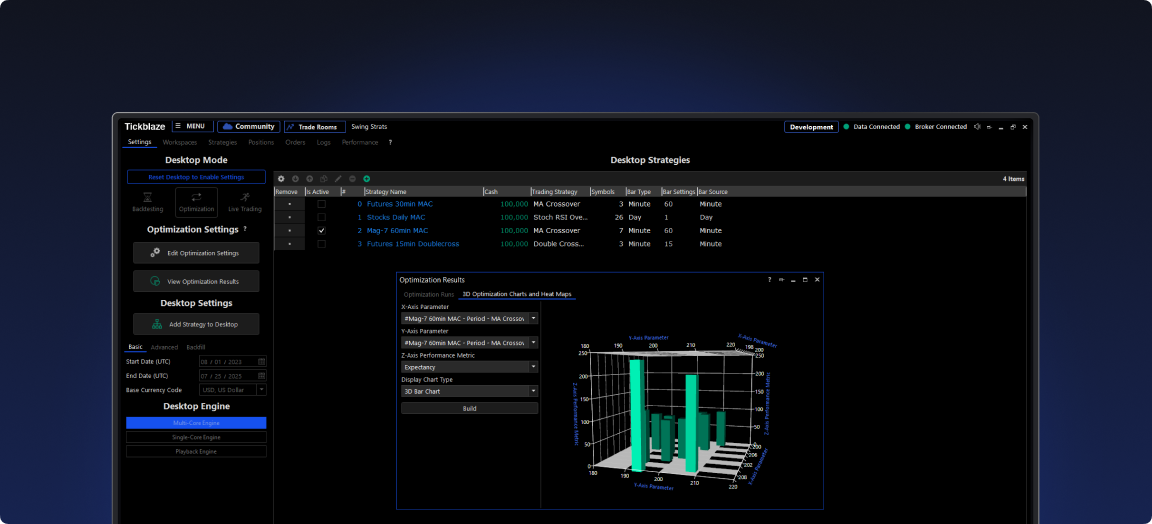

Temple Capital was founded in 2017 and represents a fusion of expertise in crypto investing, machine learning, and quantitative trading. The fund has executed nearly $50 billion in trades and employs a risk-sensitive approach to produce consistent, exceptional returns across bear and bull markets. Initially focused on digital assets, Temple Capital is applying its foundational principles of a fully systematic, beta-neutral, and quant-directional strategy across multiple asset classes—all while ensuring that their portfolio maintains zero correlation to broader indices like Bitcoin (BTC), Ethereum (ETH), and the S&P 500 (SPY).

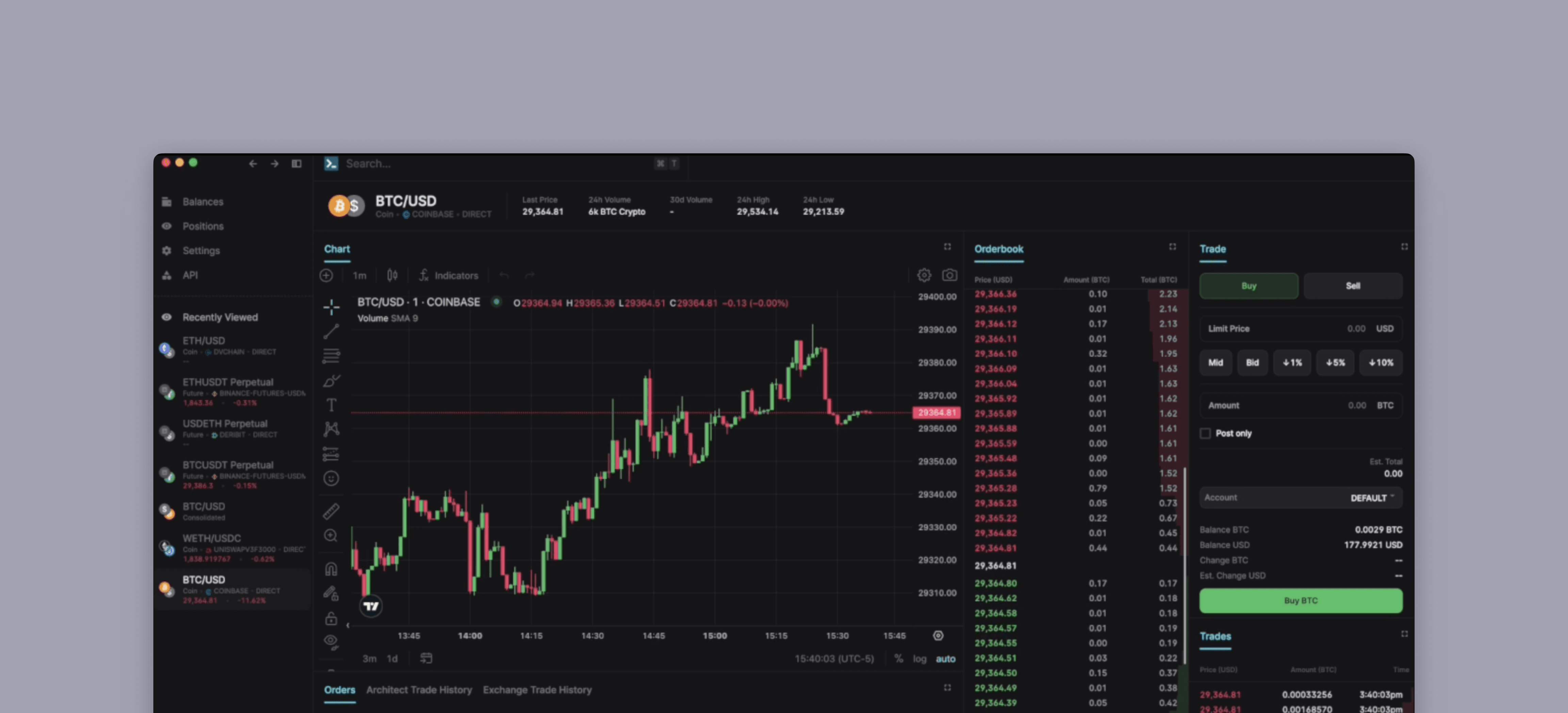

When Temple Capital sought to enter futures markets, CEO and co-founder Vasily Andreev faced considerable time constraints and needed to find a provider that'd be easy to integrate alongside their existing crypto data. Engineers pointed out that ambiguous and outdated documentation had caused integration delays in the past, and it was difficult to find vendors that offer native support for modern programming languages like Python.

Andreev noted that Databento simplified the entire process with forward pricing, reliable data quality, and incredible support. The engineering team echoed this sentiment, sharing that their experience with Databento's APIs and data formats was exceptionally straightforward: import the Python library, input credentials, and you're ready to go—no manual serialization or deserialization needed.

I seriously don’t think we’d be able to trade CME futures anytime soon without Databento. It would've probably taken us at least 6 months, whereas with Databento, it was well under a month.