This article introduces additional concepts to get started with futures data on Databento. If you're new to Databento, see the Quickstart guide.

Futures: Introduction

Futures: Introduction

Info

Overview

Overview

In this example, we'll show how to:

- Find a futures dataset

- Find the 10 futures contracts with the highest volume

- Use instrument definitions to get the tick size, expiration, and matching algorithm of an instrument

- Stream live BBO data

- Use parent symbology to fetch all contracts expirations

- Use continuous contract symbology to get the lead month contract

We'll also highlight any special conventions of futures datasets on Databento that differ from those of other asset classes.

Finding a futures dataset

Finding a futures dataset

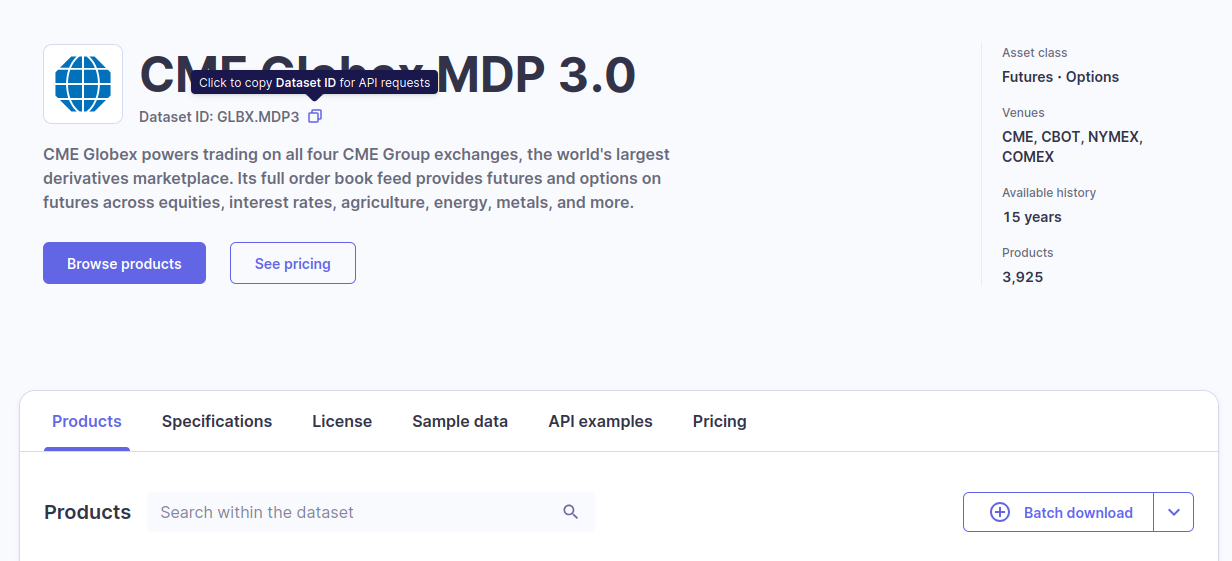

To use futures data on Databento, first identify the dataset that you want from our data catalog and go to its detail page. Here, you can find its dataset ID at the top left of the page.

For this example, we'll use the CME Globex MDP 3.0

dataset, whose dataset ID is GLBX.MDP3. You'll need to pass this in as the dataset

parameter of any API or client method.

Finding futures contracts with highest volume

Finding futures contracts with highest volume

A quick way to find the most actively-traded futures contracts, across all

expirations, is to fetch the daily volumes from the OHLCV-1d schema. (You can also

get a similar result using the statistics schema, which provides the official daily

settlement prices and trade volumes.)

import databento as db

# Create historical client

client = db.Historical("$YOUR_API_KEY")

def rank_by_volume(top=10):

# Request OHLCV-1d data

data = client.timeseries.get_range(

dataset="GLBX.MDP3",

symbols="ALL_SYMBOLS",

schema="ohlcv-1d",

start="2023-08-15"

)

# Convert to DataFrame and filter for top 10 instruments by volume

df = data.to_df()

return df.sort_values(by="volume", ascending=False)["instrument_id"].to_list()[:top]

top_instruments = rank_by_volume()

print(top_instruments)

This returns the following list of numeric instrument IDs, from the instrument_id

field.

[338574, 3445, 404144, 9235, 2922, 2130, 72156, 399495, 225833, 1562]

Using instrument definitions to get tick size, expiration, and matching algorithm

Using instrument definitions to get tick size, expiration, and matching algorithm

In the case of CME Globex MDP 3.0, these instrument IDs are sourced from tag 48-SecurityID of the original Security Definition messages.

Instrument IDs are necessary for many order routing and post-trade scenarios with the exchange, but can be hard to work with, so we will print their raw symbols instead. Let's extract useful properties of these instruments, like their tick sizes, expiration dates, and matching algorithms.

def get_symbol_properties(instrument_id_list):

# Request definition data

data = client.timeseries.get_range(

dataset="GLBX.MDP3",

stype_in="instrument_id",

symbols=instrument_id_list,

schema="definition",

start="2023-08-15",

)

# Convert to DataFrame

df = data.to_df()

return df[["instrument_id", "raw_symbol", "min_price_increment", "match_algorithm", "expiration"]]

print(get_symbol_properties(top_instruments))

instrument_id raw_symbol min_price_increment match_algorithm expiration

ts_recv

2023-08-15 00:00:00+00:00 225833 ZBU3 0.031250 F 2023-09-20 17:01:00+00:00

2023-08-15 00:00:00+00:00 1562 SR3Z3 0.005000 A 2024-03-19 21:00:00+00:00

2023-08-15 00:00:00+00:00 2922 MESU3 0.250000 F 2023-09-15 13:30:00+00:00

2023-08-15 00:00:00+00:00 399495 TNU3 0.015625 F 2023-09-20 17:01:00+00:00

2023-08-15 00:00:00+00:00 338574 ZNU3 0.015625 F 2023-09-20 17:01:00+00:00

2023-08-15 00:00:00+00:00 3445 ESU3 0.250000 F 2023-09-15 13:30:00+00:00

2023-08-15 00:00:00+00:00 72156 ZTU3 0.003906 K 2023-09-29 17:01:00+00:00

2023-08-15 00:00:00+00:00 9235 MNQU3 0.250000 F 2023-09-15 13:30:00+00:00

2023-08-15 00:00:00+00:00 2130 NQU3 0.250000 F 2023-09-15 13:30:00+00:00

2023-08-15 00:00:00+00:00 404144 ZFU3 0.007812 F 2023-09-29 17:01:00+00:00

Observe that the matching_algorithm values are in their raw values passed through

from the exchange. The full list of supported instrument definition fields and info

about the output can be found on the exchange's specifications page.

Streaming live BBO data

Streaming live BBO data

While highly liquid futures contracts generally maintain narrow bid-ask spreads, certain market conditions can lead to this spread widening. Stream our BBO-1s schema to monitor the current best bid and best offer, subsampled at 1-second intervals.

This example uses the BBO-1s schema for top-of-book information, but other similar schemas exist that may better suit your use case. Read more about these schemas on our MBP-1 vs. TBBO vs. BBO schemas page.

InfoThis example requires a live license to

GLBX.MDP3. Visit our live data portal to sign up.

import databento as db

# Enable basic logging

db.enable_logging("INFO")

# Create a live client

live_client = db.Live("$YOUR_API_KEY")

# Subscribe to the BBO-1s schema for the continuous NQ contract

live_client.subscribe(

dataset="GLBX.MDP3",

schema="bbo-1s",

symbols="NQ.v.0",

stype_in="continuous",

)

# Add a print callback

live_client.add_callback(print)

# Start the live client to begin streaming

live_client.start()

# Run the stream for 15 seconds before closing

live_client.block_for_close(timeout=15)

InfoIf you do not see any output, it could be because the markets are closed. See the

startparameter in Live.subscribe to utilize intraday replay.

SymbolMappingMsg { hd: RecordHeader { length: 44, rtype: SymbolMapping, publisher_id: 0, instrument_id: 42288528, ts_event: 1738586561618888067 }, stype_in: 255, stype_in_symbol: "NQ.v.0", stype_out: 255, stype_out_symbol: "NQH5", start_ts: 18446744073709551615, end_ts: 18446744073709551615 }

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586561944562749 }, price: 21181.750000000, size: 1, side: 'B', flags: LAST (130), ts_recv: 1738586562000000000, sequence: 20360097, levels: [BidAskPair { bid_px: 21180.250000000, ask_px: 21181.250000000, bid_sz: 1, ask_sz: 1, bid_ct: 1, ask_ct: 1 }] }

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586562826454327 }, price: 21180.750000000, size: 1, side: 'A', flags: LAST (130), ts_recv: 1738586563000000000, sequence: 20360523, levels: [BidAskPair { bid_px: 21180.250000000, ask_px: 21181.250000000, bid_sz: 1, ask_sz: 1, bid_ct: 1, ask_ct: 1 }] }

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586563257839295 }, price: 21182.500000000, size: 1, side: 'B', flags: LAST (130), ts_recv: 1738586564000000000, sequence: 20361382, levels: [BidAskPair { bid_px: 21182.250000000, ask_px: 21183.000000000, bid_sz: 3, ask_sz: 1, bid_ct: 1, ask_ct: 1 }] }

...

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586573077758761 }, price: 21181.750000000, size: 2, side: 'A', flags: LAST (130), ts_recv: 1738586574000000000, sequence: 20367086, levels: [BidAskPair { bid_px: 21182.250000000, ask_px: 21183.000000000, bid_sz: 1, ask_sz: 1, bid_ct: 1, ask_ct: 1 }] }

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586573077758761 }, price: 21181.750000000, size: 2, side: 'A', flags: LAST (130), ts_recv: 1738586575000000000, sequence: 20367373, levels: [BidAskPair { bid_px: 21182.750000000, ask_px: 21183.750000000, bid_sz: 1, ask_sz: 1, bid_ct: 1, ask_ct: 1 }] }

BboMsg { hd: RecordHeader { length: 20, rtype: Bbo1S, publisher_id: GlbxMdp3Glbx, instrument_id: 42288528, ts_event: 1738586575233261001 }, price: 21182.250000000, size: 1, side: 'A', flags: LAST (130), ts_recv: 1738586576000000000, sequence: 20367799, levels: [BidAskPair { bid_px: 21181.250000000, ask_px: 21182.250000000, bid_sz: 2, ask_sz: 1, bid_ct: 2, ask_ct: 1 }] }

Parent symbology

Parent symbology

On futures trading venues, it can be tedious to fetch every child instrument and

contract expiration (like ESU3, ESZ3, ESU3-ESZ3) for a given parent instrument

(like ES). You can use our parent symbology type

to do this, by passing in stype_in="parent".

def get_child_instruments(parents=["ZB.FUT", "SR3.FUT"]):

# Request definition data for parent symbols

data = client.timeseries.get_range(

dataset="GLBX.MDP3",

symbols=parents,

stype_in="parent",

schema="definition",

start="2023-08-15",

)

# Convert to DataFrame

df = data.to_df()

return df[["instrument_id", "raw_symbol"]]

print(get_child_instruments().head())

instrument_id raw_symbol

ts_recv

2023-08-15 00:00:00+00:00 34810 SR3:AB 01Y M8

2023-08-15 00:00:00+00:00 45040 SR3M6-SR3Z7

2023-08-15 00:00:00+00:00 51186 SR3Z4-SR3M6

2023-08-15 00:00:00+00:00 22508 SR3:DF H7Z7U8M9

2023-08-15 00:00:00+00:00 350151 SR3:SB PK M4-M5

Alternatively, you can replicate this logic by requesting definition data for all symbols and

filtering on the asset field. The asset field is populated with the root of the parent symbol.

Databento's web portal only exposes parent products, and not child instruments. When you set up a batch download through the web portal, note that you're making a parent symbology request and you'll receive interleaved data from multiple instruments. If you want to set up a batch download of individual child instruments, you must use our API instead.

Continuous contract symbology

Continuous contract symbology

Likewise, it's tedious to track the lead month contract of a futures

product over a long period of time, due to rollovers. You can use our

continuous contract symbology type

to get a single symbol that is pegged to the lead month contract, by passing

in stype_in="continuous".

For example, let's plot the two lead month ES contracts ES.n.0 and

ES.n.1.

import databento as db

import matplotlib.pyplot as plt

client = db.Historical("$YOUR_API_KEY")

dataset = "GLBX.MDP3"

symbols = ["ES.n.0", "ES.n.1"]

start = "2024"

data = client.timeseries.get_range(

dataset="GLBX.MDP3",

schema="ohlcv-1d",

stype_in="continuous",

symbols=symbols,

start=start,

)

df = data.to_df()

df.groupby("symbol")["close"].plot(

xlabel="Date",

ylabel="Price",

)

plt.legend()

plt.show()

TipIf you'd like to see the two calendar front month contracts instead, you may use

ES.c.0andES.c.1. However, in most cases these will resolve to the same symbols asES.n.0andES.n.1respectively because open interest tends to decay with increasing time to expiration.

Many futures products reflect seasonality in commodities or

term structure in fixed income, so the nearest calendar month may not be the

lead month. In such cases, you need to specify how you want to resolve the lead month,

also known as a roll rule. For example, you could use ES.v.0 to resolve

the lead month by volume instead of open interest.

Special conventions for futures on Databento

Special conventions for futures on Databento

- Weekly trading session. Unlike many venues, CME Globex has a weekly trading session. This affects how you process MBO data. We provide a synthetic snapshot of the book at the start of each UTC day to make it easier to start from any day of the week.

- User-defined instruments and spreads. CME Globex has a large number of user-defined instruments. While many vendors do not expose these and their raw symbols may be foreign to a user who's seeing these for the first time, Databento includes all of them as many are highly liquid and active.

- Asynchronous trade publication. CME Globex prints fills and order deletions

associated with the fills asynchronously, with the fills published before the

deletions. This is unlike most venues, which treat the individual fill and

corresponding order deletion as a single atomic event. You may choose to preemptively

update your book based on trades or fills, or wait until the corresponding deletes,

which we represent with action

C. - Implied book. CME Globex has implied matching. If a trade is partially filled by

contra liquidity on the implied book, we show the full quantity of the trade but only

the fill quantities on the direct book. A full implied trade will have trade side

N. - Inverted spreads. CME Globex's matching engine has various price limits and circuit breakers. The spread may be inverted during a trading halt.

- No rollover back-adjustments. Our continuous contract symbology is a notation that maps to an actual, tradable instrument on any given date. The continuous contract prices provided are the original, unadjusted prices. We don't create a synthetic time series by back-adjusting the prices to remove jumps during rollovers.

See also