Examples and tutorials

Options

Equity options: Introduction

Options on futures: Introduction

All options with a given underlying

Join options with underlying prices

US equity options volume by venue

Resample US equity options NBBO

Estimate implied volatility

Get symbols for 0DTE options

Calculate daily statistics for equity options

Historical data

Request a large number of symbols

Programmatic batch downloads

Best bid, best offer, and midprice

Custom OHLCV bars from trades

Join schemas on instrument ID

Plot a candlestick chart

Calculate VWAP and RSI

End-of-day pricing and portfolio valuation

Benchmark portfolio performance

Market halts, volatility interrupts, and price bands

Resample OHLCV from 1-minute to 5-minute

Convert DBN to other encoding formats

Algorithmic trading

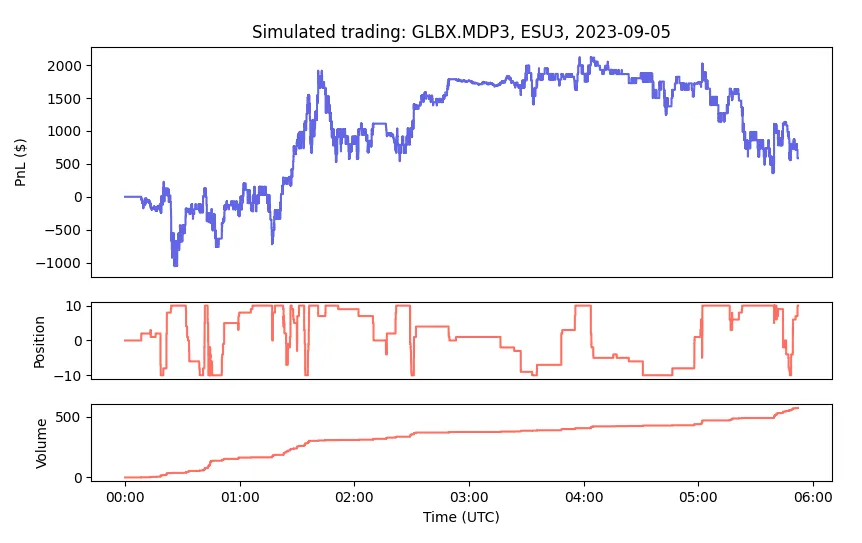

A high-frequency liquidity-taking strategy

Build prediction models with machine learning

Execution slippage and markouts

Matching engine latencies

Using messaging rates as a proxy for implied volatility

Mean reversion and portfolio optimization

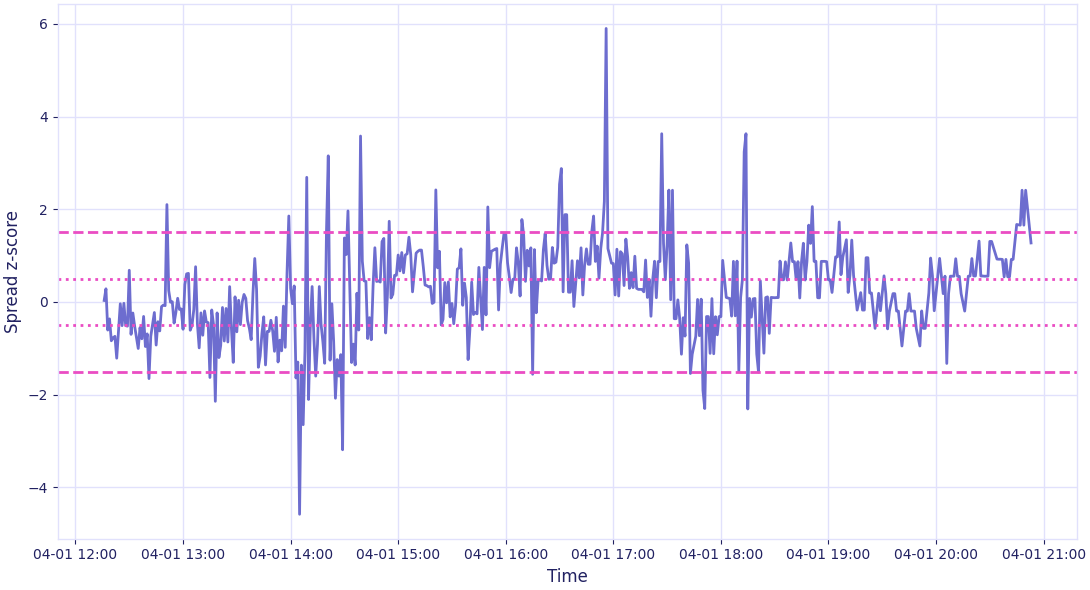

Pairs trading based on cointegration

Build a real-time stock screener

Core concepts

Venues and datasets

Cboe BYX Depth

Cboe BZX Depth

Cboe EDGA Depth

Cboe EDGX Depth

CME Globex MDP 3.0

Databento US Equities Mini

Databento US Equities Summary

Eurex

European Energy Exchange

ICE Endex

ICE Europe Commodities

ICE Europe Financials

ICE Futures US

IEX TOPS

MEMX Memoir Depth

MIAX Pearl Depth of Market

Nasdaq Basic with NLS Plus

Nasdaq TotalView-ITCH

Nasdaq BX TotalView-ITCH

Nasdaq PSX TotalView-ITCH

NYSE Integrated

NYSE American Integrated

NYSE Arca Integrated

NYSE National Trades and BBO

NYSE Texas Integrated

OPRA

Adjustment factors

Corporate actions

Security master

API Reference

Resources

Release notes

C++

0.45.0 - 2025-12-10

0.44.0 - 2025-11-18

0.43.0 - 2025-10-22

0.42.0 - 2025-08-19

0.41.0 - 2025-08-12

0.40.0 - 2025-07-29

0.39.1 - 2025-07-22

0.39.0 - 2025-07-15

0.38.2 - 2025-07-01

0.38.1 - 2025-06-25

0.38.0 - 2025-06-10

0.37.1 - 2025-06-03

0.37.0 - 2025-06-03

0.36.0 - 2025-05-27

0.35.1 - 2025-05-20

0.35.0 - 2025-05-13

0.34.2 - 2025-05-06

0.34.1 - 2025-04-29

0.34.0 - 2025-04-22

0.33.0 - 2025-04-15

0.32.1 - 2025-04-07

0.32.0 - 2025-04-02

0.31.0 - 2025-03-18

0.30.0 - 2025-02-11

0.29.0 - 2025-02-04

0.28.0 - 2025-01-21

0.27.0 - 2025-01-07

0.26.0 - 2024-12-17

0.25.0 - 2024-11-12

0.24.0 - 2024-10-22

0.23.0 - 2024-09-25

0.22.0 - 2024-08-27

0.21.0 - 2024-07-30

0.20.1 - 2024-07-16

0.20.0 - 2024-07-09

0.19.1 - 2024-06-25

0.19.0 - 2024-06-04

0.18.1 - 2024-05-22

0.18.0 - 2024-05-14

0.17.1 - 2024-04-08

0.17.0 - 2024-04-01

0.16.0 - 2024-03-01

0.15.0 - 2024-01-16

0.14.1 - 2023-12-18

0.14.0 - 2023-11-23

0.13.1 - 2023-10-23

0.13.0 - 2023-09-21

0.12.0 - 2023-08-24

0.11.0 - 2023-08-10

0.10.0 - 2023-07-20

0.9.1 - 2023-07-11

0.9.0 - 2023-06-13

0.8.0 - 2023-05-16

0.7.0 - 2023-04-28

0.6.1 - 2023-03-28

0.6.0 - 2023-03-24

0.5.0 - 2023-03-13

0.4.0 - 2023-03-02

0.3.0 - 2023-01-06

0.2.0 - 2022-12-01

0.1.0 - 2022-11-07

Python

0.68.2 - TBD

0.68.1 - 2025-12-16

0.68.0 - 2025-12-09

0.67.0 - 2025-12-02

0.66.0 - 2025-11-18

0.65.0 - 2025-11-11

0.64.0 - 2025-09-30

0.63.0 - 2025-09-02

0.62.0 - 2025-08-19

0.61.0 - 2025-08-12

0.60.0 - 2025-08-05

0.59.0 - 2025-07-15

0.58.0 - 2025-07-08

0.57.1 - 2025-06-17

0.57.0 - 2025-06-10

0.56.0 - 2025-06-03

0.55.1 - 2025-06-02

0.55.0 - 2025-05-29

0.54.0 - 2025-05-13

0.53.0 - 2025-04-29

0.52.0 - 2025-04-15

0.51.0 - 2025-04-08

0.50.0 - 2025-03-18

0.49.0 - 2025-03-04

0.48.0 - 2025-01-21

0.47.0 - 2024-12-17

0.46.0 - 2024-12-10

0.45.0 - 2024-11-12

0.44.1 - 2024-10-29

0.44.0 - 2024-10-22

0.43.1 - 2024-10-15

0.43.0 - 2024-10-09

0.42.0 - 2024-09-23

0.41.0 - 2024-09-03

0.40.0 - 2024-08-27

0.39.3 - 2024-08-20

0.39.2 - 2024-08-13

0.39.1 - 2024-08-13

0.39.0 - 2024-07-30

0.38.0 - 2024-07-23

0.37.0 - 2024-07-09

0.36.3 - 2024-07-02

0.36.2 - 2024-06-25

0.36.1 - 2024-06-18

0.36.0 - 2024-06-11

0.35.0 - 2024-06-04

0.34.1 - 2024-05-21

0.34.0 - 2024-05-14

0.33.0 - 2024-04-16

0.32.0 - 2024-04-04

0.31.1 - 2024-03-20

0.31.0 - 2024-03-05

0.30.0 - 2024-02-22

0.29.0 - 2024-02-13

0.28.0 - 2024-02-01

0.27.0 - 2024-01-23

0.26.0 - 2024-01-16

0.25.0 - 2024-01-09

0.24.1 - 2023-12-15

0.24.0 - 2023-11-23

0.23.1 - 2023-11-10

0.23.0 - 2023-10-26

0.22.1 - 2023-10-24

0.22.0 - 2023-10-23

0.21.0 - 2023-10-11

0.20.0 - 2023-09-21

0.19.1 - 2023-09-08

0.19.0 - 2023-08-25

0.18.1 - 2023-08-16

0.18.0 - 2023-08-14

0.17.0 - 2023-08-10

0.16.1 - 2023-08-03

0.16.0 - 2023-07-25

0.15.2 - 2023-07-19

0.15.1 - 2023-07-06

0.15.0 - 2023-07-05

0.14.1 - 2023-06-16

0.14.0 - 2023-06-14

0.13.0 - 2023-06-02

0.12.0 - 2023-05-01

0.11.0 - 2023-04-13

0.10.0 - 2023-04-07

0.9.0 - 2023-03-10

0.8.1 - 2023-03-05

0.8.0 - 2023-03-03

0.7.0 - 2023-01-10

0.6.0 - 2022-12-02

0.5.0 - 2022-11-07

0.4.0 - 2022-09-14

0.3.0 - 2022-08-30

HTTP API

0.35.0 - 2025-08-19

0.34.1 - 2025-06-17

0.34.0 - 2025-06-09

0.33.0 - 2024-12-10

0.32.0 - 2024-11-26

0.31.0 - 2024-11-12

0.30.0 - 2024-09-24

0.29.0 - 2024-09-03

0.28.0 - 2024-06-25

0.27.0 - 2024-06-04

0.26.0 - 2024-05-14

0.25.0 - 2024-03-26

0.24.0 - 2024-03-06

0.23.0 - 2024-02-15

0.22.0 - 2024-02-06

0.21.0 - 2024-01-30

0.20.0 - 2024-01-18

0.19.0 - 2023-10-17

0.18.0 - 2023-10-11

0.17.0 - 2023-10-04

0.16.0 - 2023-09-26

0.15.0 - 2023-09-19

0.14.0 - 2023-08-29

0.13.0 - 2023-08-23

0.12.0 - 2023-08-10

0.11.0 - 2023-07-25

0.10.0 - 2023-07-06

0.9.0 - 2023-06-01

0.8.0 - 2023-05-01

0.7.0 - 2023-04-07

0.6.0 - 2023-03-10

0.5.0 - 2023-03-03

0.4.0 - 2022-12-02

0.3.0 - 2022-08-30

0.2.0 - 2021-12-10

0.1.0 - 2021-08-30

Raw API

0.7.2 - TBD

0.7.1 - 2025-11-09

0.7.0 - 2025-10-26

0.6.4 - 2025-09-28

0.6.3 - 2025-09-07

0.6.2 - 2025-08-02

0.6.1 - 2025-06-29

0.6.0 - 2025-05-24

0.5.6 - 2025-04-06

0.5.5 - 2024-12-01

0.5.4 - 2024-10-02

0.5.3 - 2024-10-02

0.5.1 - 2024-07-24

2024-07-20

2024-06-25

0.5.0 - 2024-05-25

0.4.6 - 2024-04-13

0.4.5 - 2024-03-25

0.4.4 - 2024-03-23

0.4.3 - 2024-02-13

0.4.2 - 2024-01-06

0.4.0 - 2023-11-08

0.3.0 - 2023-10-20

0.2.0 - 2023-07-23

0.1.0 - 2023-05-01

Rust

0.38.0 - 2025-12-16

0.37.0 - 2025-12-09

0.36.0 - 2025-11-19

0.35.0 - 2025-10-22

0.34.1 - 2025-09-30

0.34.0 - 2025-09-23

0.33.1 - 2025-08-26

0.33.0 - 2025-08-19

0.32.0 - 2025-08-12

0.31.0 - 2025-07-30

0.30.0 - 2025-07-22

0.29.0 - 2025-07-15

0.28.0 - 2025-07-01

0.27.1 - 2025-06-25

0.27.0 - 2025-06-10

0.26.2 - 2025-06-03

0.26.1 - 2025-05-30

0.26.0 - 2025-05-28

0.25.0 - 2025-05-13

0.24.0 - 2025-04-22

0.23.0 - 2025-04-15

0.22.0 - 2025-04-01

0.21.0 - 2025-03-18

0.20.0 - 2025-02-12

0.19.0 - 2025-01-21

0.18.0 - 2025-01-08

0.17.0 - 2024-12-17

0.16.0 - 2024-11-12

0.15.0 - 2024-10-22

0.14.1 - 2024-10-08

0.14.0 - 2024-10-01

0.13.0 - 2024-09-25

0.12.1 - 2024-08-27

0.12.0 - 2024-07-30

0.11.4 - 2024-07-16

0.11.3 - 2024-07-09

0.11.2 - 2024-06-25

0.11.1 - 2024-06-11

0.11.0 - 2024-06-04

0.10.0 - 2024-05-22

0.9.1 - 2024-05-15

0.9.0 - 2024-05-14

0.8.0 - 2024-04-01

0.7.1 - 2024-03-05

0.7.0 - 2024-03-01

0.6.0 - 2024-01-16

0.5.0 - 2023-11-23

0.4.2 - 2023-10-23

0.4.1 - 2023-10-06

0.4.0 - 2023-09-21

0.3.0 - 2023-09-13

0.2.1 - 2023-08-25

0.2.0 - 2023-08-10

0.1.0 - 2023-08-02

Data

2025-11-09

2025-11-04

2025-09-23

2025-08-26

2025-08-05

2025-07-25

2025-07-06

2025-07-01

2025-06-27

2025-06-17

2025-06-10

2025-05-20

2025-05-07

2025-04-05

2025-04-01

2025-03-13

2025-02-26

2025-02-01

2025-01-15

2024-12-14

2024-12-03

2024-12-02

2024-10-22

2024-10-24

2024-07-05

2024-06-25

2024-06-18

2024-05-07

2024-01-18

2023-11-17

2023-10-04

2023-08-29

2023-07-23

2023-05-01

2023-04-28

2023-03-07

Collapse all

Examples

Examples

Basics

Most-read docs for common Python, C++, and Rust use cases.

Advanced applications

Develop systematic strategies and algorithmic trading applications.

Python

Can't find an example for your use case? Our team can help. Contact support or join our Slack community to chat with developers.

Equities

Equities Historical

Historical

Futures

Futures Options

Options Live

Live